ETFs pose growing flash crash risk report

Post on: 1 Май, 2015 No Comment

Analysis & Opinion

BOSTON (Reuters) — So far a single mutual fund firm, Waddell & Reed Financial Inc, has borne much of the scrutiny that followed the May 6 flash crash.

But several new reports point to a different part of the mutual fund industry — the soaring exchange-traded funds sector — as needing more review after its role in the gut-churning drop of nearly 700 points in the Dow Jones industrial average in a matter of minutes.

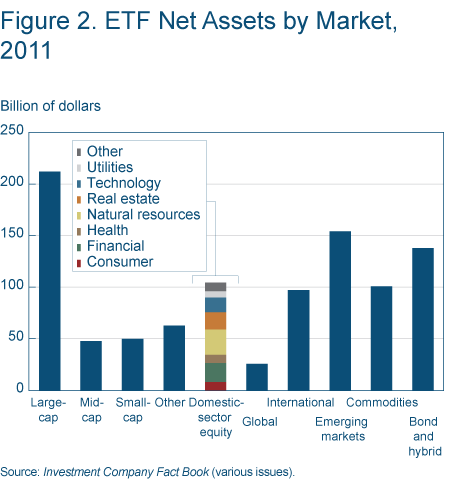

The latest shot to the $925 billion sector came on Monday from two prominent financial specialists who argued in a new paper that the rise of ETFs pose systemic risks of the kind seen on May 6.

Regulators last month said that of trades that had to be canceled because of the day’s volatility, 70 percent were ETFs and that in one 20-minute period some 3 million ETF trades came at losses of 90 to 100 percent. They have already put in place circuit breakers on some ETFs to limit their volatility.

But these steps so far are not enough to reign in the risks of ETFs, say the authors of the paper. They worry both about the temporary risks of another flash crash and that ETF growth might interfere with the normal trading of small company stocks and make it harder for them to raise capital.

The ETF machine is out of control, said co-author Robert Litan, an economist at the Kauffman Foundation in Kansas City who is also affiliated with the Brookings Institution. We need at least to throw some sand in the gears to keep it from running amok, like Frankenstein, Litan said.

REVIEW LEADS TO MORE DEBATE

While Litan’s rhetoric seems hot for a technical financial discussion, the findings of the paper he co-authored with Kauffman chief investment officer Harold Bradley will feed a continuing debate over the flash crash’s causes and lessons.

In an October 1 report regulators described how a trade by a Kansas City mutual fund firm — identified by Reuters and others as Waddell & Reed — set off unintended consequences.

Many responses from market participants were split between those who said regulators pointed too much at the fund firm and those who say it raised too many questions about the role of high-frequency traders.

The questions for ETFs have emerged more gradually. The paper by Litan and Bradley quotes recent research by Bogan Associates, a family-run Boston money management firm. In a blog post on September 15 managing member Andrew Bogan, and others say many ETFs have shockingly large short interest positions made possible by their complicated structure.

In a forthcoming research paper the Bogans and co-author Brendan Connor of Hillview Capital Advisors in New York argue further that the structure could drive ETF prices near zero if the supply of ETFs to sell short were unlimited.

Interestingly, this is precisely what investors saw during the ‘Flash Crash’ on May 6, they wrote. For some ETFs, the circuit breakers since put in place likely would not withstand a sustained equity market crash, they wrote.

DEFENDING THE ETFS

Led by firms like Vanguard Group Inc and the iShares unit of New York asset manager BlackRock Inc, the ETF industry had already embraced some changes like the circuit breakers. But the Bogans’ September 15 report has triggered a response from some who say the concerns are overwrought.

For one thing, most ETF registration statements allow their manager to reject requests to redeem shares when too many investors want to sell, wrote a note sent around by Susquehanna Financial Group on September 30 titled Can ETF Collapse? We think not. The memo also noted that if an ETF is forced to liquidate all of its holdings, those with short positions are required to pay back what they owe in cash. No one is left ‘holding the bag’, the firm wrote.

In an interview, Vanguard chief investment officer Gus Sauter said the short-selling concerns were no more than theoretical. He said his own fund firm and others will only lend out about a third of all shares of an equity they might own, making it hard to use ETFs to take disruptively large short positions in companies they own.

But even if a single broker were to try to redeem all the shares that had been lent out for short positions, they would not likely be able to locate all the shares in circulation, Sauter said. True, the broker could then ask the ETF to create more of its own shares, but would have to deliver stock back to the ETF to do so — and thus prop up the value of the fund.

To the notion of a general ETF collapse, Sauter said, From a practical standpoint, I don’t think it’s possible.

(Reporting by Ross Kerber, editing by Christian Plumb, Bernard Orr )