ETFs Holding Alibaba Shares (FPX IPO KWEB EMQQ)

Post on: 9 Апрель, 2015 No Comment

China’s e-commerce giant Alibaba Group’s (BABA ) initial public offering earlier this year was the largest in history. The Hangzhou-based company raised $25 billion on the New York Stock Exchange .

The IPO was priced at $68 per share and opened at $92.70. Since it went public in September the price of Alibaba’s shares has ranged between $82.81 – 120.

IPOs can be tough for the average individual investor to get in on initially, as investment firms typically allocate shares to their best costumers — institutions and high-net-worth investors. (For more, see: 5 Things to Know About the Alibaba IPO .)

If you’re looking to gain exposure to Alibaba consider the following exchange-traded funds (ETFs), which have added the stock to their holdings.

First Trust US IPO Index Fund

The First Trust US IPO Index Fund ETF (FPX ) added Alibaba to its holdings on Sept. 19, the day shares starting trading. Typically this ETF only adds stocks that have traded at least seven days after an IPO launch. Alibaba’s IPO, however, took place on the same day as the fund’s quarterly rebalancing so it was fast-tracked.

Stocks added to the First Trust US IPO Index Fund ETF remain in its index for 1,000 days. Launched in 2006, the ETF tracks the IPOX-100 U.S. Index, which includes the 100 largest and most liquid U.S. public offerings in the IPOX Global Composite Index.

Alibaba accounts for 3.27% of the ETF’s holdings. Other holdings include Facebook Inc. (FB ) and General Motors Co. (GM ), which account for 9.67% and 5.09%, respectively. You can see a full list of holdings here .

The top sectors in the fund are consumer cyclicals (25.51%), technology (19.56%), healthcare (18.64%) energy (12.70%) and industrials (8.61%). The First Trust US IPO Index Fund has $526 million in assets and year-to-date has returned 12.23%. It has traded between $42.55 – 50.81 in the last year.

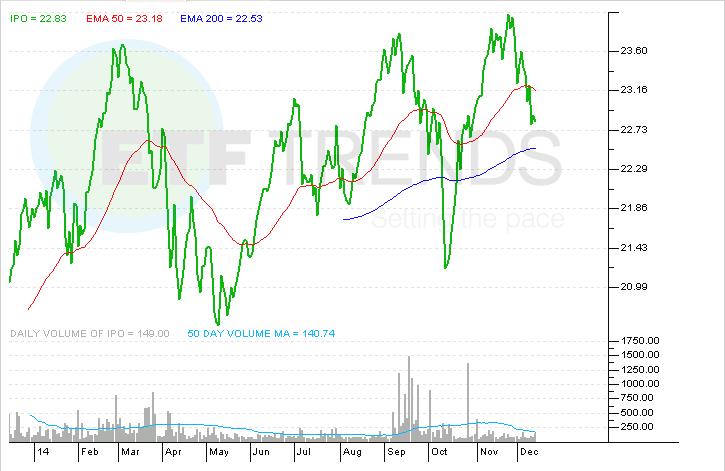

Renaissance IPO ETF (IPO)

The Renaissance IPO ETF (IPO ) added Alibaba to its holdings five days after it began trading. New companies are added to this ETF via fast tracking – five days after they begin trading – or quarterly. IPO stocks are removed from the fund after two years when they become seasoned.

The Renaissance IPO Fund is smaller than the First Trust US IPO Index Fund with $30 million in assets. It’s also much younger, having launched just over a year ago in October 2013. It was launched by Greenwich, Conn.-based Renaissance Capital. an investment and research firm whose expertise is IPOs.

The fund tracks the Renaissance IPO Index. Its largest holding is Alibaba, which accounts for 11.05% of assets. Other holdings include Twitter Inc. (TWTR ) (7.03%) and Hilton Worldwide Holdings, Inc. (HLT ) (5.02%). You can see a full list of its 76 holdings here .

Sectors included in the fund are consumer cyclicals (25.28%), technology (23.45%), healthcare (14.25%), financial services (9.32%) and energy (9.16%). The Renaissance IPO ETF has returned about 8.91% year-to-date. Its price has ranged between $20.39 – 24.14 in the last year.

KraneShares CSI China Internet ETF

The KraneShares CSI China Internet ETF (KWEB ) added Alibaba to its holdings on Oct. 3. The fund includes publicly traded Chinese companies whose primary business is the internet and internet-related sectors.

Alibaba is its top holding representing 11.75% of the fund. This ETF is dominated by the technology sector (72.45%) followed by consumer cyclical (25.95%) and industrials (1.6%). Here’s a link listing all of its 44 holdings .

The KraneShares CSI China Internet ETF has $201 million in assets and has returned about 10.49% year-to-date. Its share price has ranged between $30.82 – 42.24 in the last year. (For related reading, see: The Top Five Alibaba Shareholders .)

Emerging Markets Internet and E-commerce ETF

The latest ETF to include Alibaba in its holdings is the Emerging Markets Internet and E-commerce ETF (EMQQ ) which launched on Nov. 13. The aim of the fund is to give investors exposure to internet and e-commerce sectors in emerging markets. This ETF tracks the EMQQ Emerging Markets Internet and Ecommerce Index, which was created by investment firm Big Tree Capital .

Alibaba is its largest holding representing 8.875% of the fund’s assets. You can see a full list of its 42 holdings here. The fledgling fund has $2.4 million in assets and has traded in the $25 range since inception.

The Bottom Line

If you’re looking to gain exposure to Alibaba through an ETF there are several to choose from so far — and that roster is likely to grow. (For more about Alibaba’s business model, see: What is Alibaba? )