ETFs for Falling Emerging Markets Emerging Markets Daily

Post on: 6 Апрель, 2015 No Comment

By Ben Levisohn

Last week, BlackRocks Russ Koesterich urged investors to stay long emerging market stocks but said they should consider looking beyond a straight allocation to basic emerging market stock funds. He also offered investors possible solutionsall from BlackRocks iShares family of exchange-traded funds, so please be aware that theres more than a little bit of marketing going on here.

Associated Press

His choices:

1.) Minimum volatility funds. which are designed to help smooth out volatility, such as the iShares MSCI Emerging Markets Minimum Volatility Index Fund (EEMV ).

2.) Funds representing regions or countries (I still like China ).

3.) Interpreting “emerging markets” to also include frontier markets . While a traditional emerging market benchmark is down year-to-date, frontier, or “pre-emerging” markets, have been performing well. Frontier markets are accessible through the iShares MSCI Frontier 100 ETF (FM ).

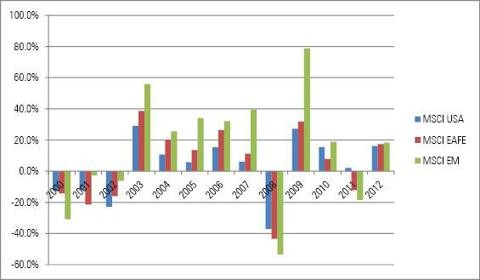

Lets take them one at a time. Im a big fan of low volatility. and a look at the iShares MSCI Emerging Markets Minimum Volatility Index ETF will demonstrate why. While the iShares MSCI Emerging Markets ETF (EEM ) has lost 9.5% this year including reinvested dividends through June 10, the minimum volatility ETF has dropped just 3.3%. And in 2012, the Minimum Volatility ETF gained 23%, to the iShares MSCI Emerging Markets ETFs 19% gain. Minimum volatility wont always outperform, but for those who are willing to forsake some upside when emerging markets are booming, it could be a nice choice.

Frontier markets have had a great year so far and are holding up decently, even as other emerging markets have fallen hard. The iShares MSCI Frontier 100 ETF, for instance, has gained 16% this year, and just 1.2% during the past week when the iShares MSCI Emerging Markets ETF dropped 4%. My biggest quibble: Frontier markets are generally small and illiquid so investors shouldnt make the mistake of thinking they can have a huge stake. And if the money flows reverse, the downside could be substantial.

Im not a huge fan of country specific funds for most investors because its very easy to get the call wrong. Consider someone who jumped into the iShares MSCI Turkey Investable Market Index ETF (TUR ) because of its relatively strong economy and its growing stability. That was all upended last week, when protests erupted against Prime Minister Recep Tayyip Erdogan. TUR has dropped 12% since May 31, giving back all of this years 3.8% gain and then some. Still, if youre going to gamble on an individual country, Chinas might not be the worst bet .

The iShares FTSE China 25 Index (FXI ) has dropped 12.6% this year.

Himax Falls 4% as Large Investor Sells Shares Next

LDK Plunges 10% on Earnings, Takes Chinese Solar Stocks With It