ETFs For Dividend Growth Investors

Post on: 10 Май, 2015 No Comment

I recently read an SA article by Bob Wells where he discussed a problem he has regarding who would take over management of his portfolio when he is no longer able to do so. He looked at ETFs as a possible solution, without complete satisfaction. David Van Knapp has also written in SA concerned with the same problem. I, and possibly most of us, have the same successor problem. Both David and I (with Bob and probably others) have analyzed using ETFs as a potential solution, without success. I believe a reason for this is that we all were looking at individual ETFs with the hope of finding one (at least) that satisfies the dividend growth criteria. This article takes another, broader, look.

The reason for these concerns is that we don’t know how much maintenance is needed to keep our portfolios within its objectives. If we have chosen our holdings well, little or nothing need be done. For long time periods where an increasing cash flow is required, certainly some intervention will be required. In my case, we are looking at 40 years (44 to be precise), the maximum life expectancy of my heirs. The hope in using ETFs is that their passive managers will cull out undesirable holdings in a timely fashion, saving the retirement portfolio manager the trouble.

My portfolio has had several ETFs for many years, nearly as long as they have been available. Among other things, they are a good hassle-free way to hold foreign stocks. In taxable accounts, the 1099 lists qualified and non-qualified dividends as well as foreign tax are withheld. In the past couple of years, I have been scrubbing my portfolio with the goal of highlighting dividend growth as a prime objective. The portfolio is separated into segments, the reasons for which I have discussed in several previous articles. Even after scrubbing this segment, results were initially disappointing with respect to dividend growth, requiring some shifting around as well as new buys.

Let’s back up a little and discuss why ETFs might solve the problem. They are a passively managed collection of equities designed to track a pre-determined index. Portfolio Turnover is (should be) limited to that minimum required to maintain portfolio objectives. Unfortunately, currently, dividend growth does not appear to be on the ETF manager’s list of metrics to monitor. However, it appears that, while not (overtly) planned, a form of dividend growth is a fallout with some ETFs. If a selection of ETFs could be made having some semblance of dividend growth, the question is How could we live with it?

Cutting to the chase. Currently, my portfolio has 19 ETFs. I normally analyze individual portfolio holdings and segments using regression analysis (described in my SA articles) using 8 years of data. Unfortunately, 10 of my ETFs have a shorter life span. However, using the 9 remaining, some useful information may be gleaned.

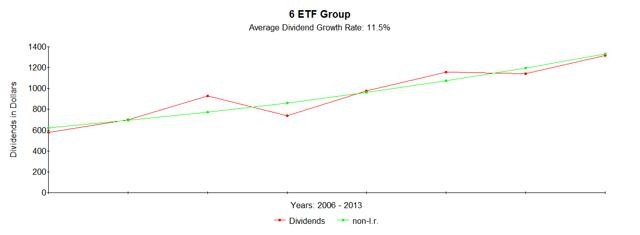

The red curve represents dividends from 9 ETFs for the years 2005-2012. Quite obviously, 2008 and 2009 were bummers. The ETFs depicted (not equally weighted) are: Vanguard Small Cap Value (NYSEARCA:VBR ); Vanguard Consumer Staples (NYSEARCA:VDC ); iShares MSCI Pacific ex-Japan (NYSEARCA:EPP ); iShares S&P Latin America 40 (NYSEARCA:ILF ); iShares MSCI Canada (NYSEARCA:EWC ); Vanguard Industrials (NYSEARCA:VIS ); Vanguard Small Cap (NYSEARCA:VB ); Vanguard FTSE Emerging Markets (NYSEARCA:VWO ); and iShares S&P Global Energy (NYSEARCA:IXC ). The green curve represents the non-linear regression ‘best fit’ to an exponential curve of 7.6% (dividend growth). Year-to year dividend growths are: 43.0%, 33.1%, -29.9%, 3.1%, 18.3%, 14.6%, 14.2%.

These data show that in years with a robust economy, dividend growth is abundant. This is one of the key metrics for selecting ETFs for inclusion in dividend growth portfolios. A question remains, what about years with a down economy? An answer could be to save out a portion of dividends paid during years with an up economy to be used to augment income during down years. From the figure, if dividends above the green line were saved and used to fill in for lower (below the line) dividends, available dividend flow would be close to the green line, a smooth payout.

Instead of performing all these calculations, one could assume an 8-year business cycle having 5 up years and 3 down years, the amount of saving/year required is a reasonable pre-determined shortfall divided by 5. Yearly contributions could be invested in a bond fund since at the time when money is needed, interest rates are low meaning bond values are high. My online brokerage account has some commission-free ETFs, I selected Vanguard Intermediate-Term Gov’t Bond Idx (NASDAQ:VGIT ). Since these are odd-lot transactions, I use limit orders at/near the ask end of the spread. For this cycle, I used 2010 as the start, so now (2013) we are 4 years into the cycle. An example of these calculations is given later.

In the 9 ETF sample shown here I am over-weighted in EPP. It is interesting to separate that from the sample, as shown in the figure below.

Here the red curve is EPP and the green curve the remaining 8 ETFs. This set of curves clearly show the advantages of dividend growth diversification. In 2008, EPP dropped by a large amount while the other ETFs were still increasing. The reverse happened in 2009. It also shows that EPP hasn’t fully recovered from the financial crisis. Emerging Market ETFs have a similar pattern, indicating that full global recovery is yet to come.

It is clear from the figures above that the year 2007 was a high point in terms of dividends. Fifteen of my nineteen ETFs have dividend history back to that point. The figure below depicts the dividend history for this group.

The red curve shows dividend history for 15 ETFs from 2007 to 2012. The green line is a 6.8% dividend growth non-linear regression ‘best fit’. The six added ETFs (to the 9 listed above) are: WisdomTree Int SmallCap Div (NYSEARCA:DLS ), WisdomTree DEFA (NYSEARCA:DWM ), WisdomTree Commodity Country Equity (NYSEARCA:CCXE ), Vanguard Dividend Appreciation (NYSEARCA:VIG ), Vanguard FTSE All-world ex-US (NYSEARCA:VEU ), Vanguard High Dividend Yield (NYSEARCA:VYM ).

It is informative to calculate the relative size of the dividend ‘hole’ caused by the recent financial crisis for each of the curves shown. This is done by determining the ratio of the actual dividend values for the 4 years starting in 2007 divided by 4 times the 2007 value. This ratio, subtracted from one (unity), provides a measure of the hole, i.e. the portion lost from reduced dividends from the peak 2007 amount. For EPP (red line — graph 2) the 4-year hole is 37% and it still has not fully recovered. For the 8 ETF sample (red line — graph 1), the hole is 18%. The corresponding value for the 15 ETF part on my 19 ETF segment (red line — graph 3) is 1.6%. The amount needed in graph 3 to maintain a payout equal to the 2007 level for 3 years (until recovery) is $259. Accumulating that amount over 5 years (in an up economy) is $259/5=51.80/year, which is 1.7% of $3018 (2007 level).

The 7% average dividend growth rate may seem low, but consider this. If inflation averages 3.6% (which is about the long-term average), then the income amount needed to maintain parity doubles every 20 years (Rule of 72). With a 7.2% average return from a portfolio with exponential dividend growth (which equity ETFs should supply), the amount doubles every 10 years. I can live with that for a portion of my dividend growth portfolio that I don’t have to worry about becoming stale. Neither does my DS (designated successor).

An additional concern expressed with reference to ETFs is a lower yield than what may be available from individual stocks. Granted that many ETFs are in the 2-3% range, which is below the cutoff point for some investors. An answer to this concern could be: if you want the total portfolio to yield, say 4.5%, you can balance a 2% holding with one yielding 7%. Equally funded, the average is 4.5%. Granted the 7% entry may be more risky, but the 2% ETF may also be more rewarding. Besides, the only yield that is important is the one at the time of purchase. It merely determines your cost of dividends. After purchase, the metric to track is dividend growth.

As a Figure of Merit, I use the product of Yield and Dividend Growth (Y*DG) for holdings with exponential dividend growth, which should include ETFs, since they hold normal equity companies. Normally, I make this calculation at the end of every year using current values for both metrics. Since dividend growth is more erratic with ETFs, a more meaningful value can be gained by using segment averages. I don’t have strict, solid cut-off points with metrics, but for Figure of Merit, a value below 16 gets my attention. For a long-term dividend growth average of 7% for a group of ETFs, as we have seen above, this would put the minimum yield at 16/7=2.3%. I try to stay above 2%, but would not hesitate (too long) if a candidate was a little shy if it fit nicely with others in the segment.

So, what metrics are useful in selecting ETFs? Obviously, it should have stellar dividend growth, when the economy is booming to compensate for cuts during a period of economic decline. Currently, the US economy is recovering, but most of the rest of the world is lagging. As we will see, some of the ETFs listed here had dividend declines in 2012 even after better values in 2011. These may be the ones to buy now, if their prices are below their 200-day moving averages. A key point here is the ‘fact’ that ETFs (properly chosen) will recover to a satisfactory dividend payout stream while an individual company may not. The whole consideration here is little to no portfolio maintenance. Metric#1 — high dividend growth in up economies with (ideally) good recoveries after down economies. Candidate ETFs will need some track record to satisfy this requirement — at least a good multi-year record in up economies.

It should not be too difficult to select a small combination of ETFs that provide sufficient diversity to minimize the ‘hole’ in the dividend stream during depressions while at the same time provide an adequate increasing average dividend flow. That coupled with an amount to be saved annually to help smooth future payouts should get one started with a portion of their portfolios invested in ETFs.

The tables below depict several important metrics I use in selecting ETFs, over and above the vital considerations discussed above. I don’t have cut-off points, I believe you need to look at all (in context) and choose those that best fit your criteria.

That said, here are some thoughts on the subject. Turnover Ratio. TO — this should be low. The passive manager should select the best equities that fit their objectives, then leave the portfolio alone. High TO’s to me smell like chasing price performance and/or they didn’t do a proper job to start with. Net Assets — a high value is nice, it means it’s popular. Low values run the risk of the ETF being discontinued. My feeling, if it fits a niche in my segment, I’ll take that on. Number of Holdings — here a large number should mean some dividend stability although they all swing with the economy. Percent of holdings in the top 10% — if this is high and the number of holding is low, you are over-exposed to a few companies (this may be OK as long as you are aware). Yield and dividend growth — both are (equally?) important.

The three tables below lists these metrics for each ETF in my ‘Core’ portfolio segment, segregated by managing company. The four ETF not previously mentioned (due to a shorter track record) are: Vanguard Total World Stock Index (NYSEARCA:VT ), iShares S&P Global Infrastructure (NYSEARCA:IGF ), WisdomTree Emerging Markets Equity (NYSEARCA:DEM ), Market Vectors RVE Hard Assets Prod (NYSEARCA:HAP ). The latter is included with the WisdomTree table.