ETFs Characteristics for ShortTerm Trading_2

Post on: 10 Май, 2015 No Comment

According to our etf trader, Exchange Traded Funds (ETFs) are the most popular, reliable and useful offering introduced to the market in years. Most ETFs have many characteristics in common with both open-ended mutual funds and regular stocks – including the diversity and stability of a mutual fund and the liquidity and flexibility of a regular stock.

Mutual funds have rules and regulations that can discourage short-term trading or incur unwanted short term redemption fees if you decide to sell your shares too early. These fees and regulations can force an investor to stay in a given market even if the ideal strategy would be to exit.

ETFs provide the opportunity to gain precise strategic and tactical market exposure. ETFs are flexible enough for short-term trading, intermediate-term sector rotation, tactical asset allocation and even long-term buy and hold strategies. ETFs allow us to go right where we want to and get into very specific sectors. Unlike traditional mutual funds, they provide us with the freedom to follow our quantitative models with exactness.

ETF Benefits

Cost Effective

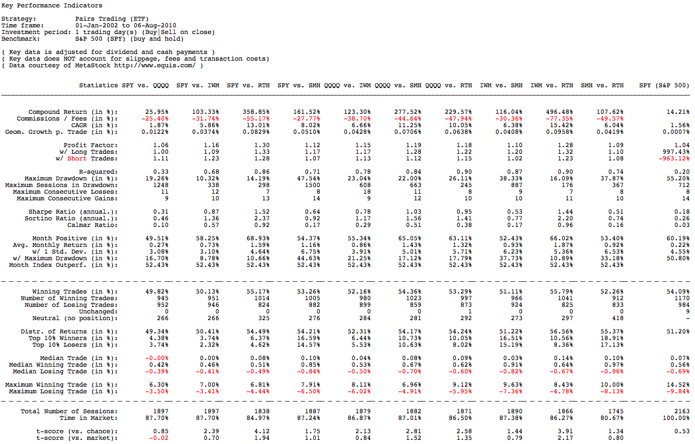

The fees for ETFs are much less than those for actively managed mutual funds. The expense ratios for mutual funds can range between 1.0% and 3.0%, while ETF fees are usually between 0.2% and 0.6%.

ETFs have no redemption fees, holding requirements or minimum investment requirements. Due to those benefits, ETFs can allow price specificity and hedging capabilities that you just can’t get in traditional mutual funds, including limit orders, stop orders, and selling short – even on a downtick.

With an ETF you can take advantage of the same intraday liquidity as other securities traded on the open market. An ETF is re-priced throughout the day, allowing us to implement asset allocation strategies at any time, not just at the end of the day, which was the practice with mutual funds.

Tax Efficient

Traditional mutual funds are subject to unexpected and unwanted capital gains tax distributions. When one shareholder in a fund decides to sell some shares, it creates a capital gain, which is taxable, and which is then spread out to the rest of the shareholders.

An ETF, however, is sold on an exchange just like other stocks. That means ETF investors are not impacted by other shareholders’ purchases and redemptions.

Diverse Investments

ETFs are an ideal tool for asset allocation and money management. They are inexpensive, liquid and reliable, and they represent just about every asset class available. With an ETF, we have precise control and access to almost every available asset class or index.

The modular nature of ETFs means they can complete a portfolio that might be missing a valuable asset class or be used as the foundation for domestic and international asset allocation.

ETFs are specific, complete and economical. By taking advantage of the various ETF benefits, we can offer wealth management strategies that are focused and proactive. This next generation trading vehicle is a powerful tool for progressive money management strategies.