ETFs and the Rise of the Tactical Allocator 5 Questions

Post on: 12 Август, 2015 No Comment

ETF managed portfolios are among the fastest growing segments of the investment marketplace, reaching $100 billion of assets after growth of 40% in 2013. The category, as defined by Morningstar, includes more than 600 strategies managed by 150 firms. Morningstar divides the ETF managed portfolio universe into three distinct sub-categories based on investment approach:

- Strategic asset allocators that establish a long term asset allocation and allow for limited deviation from that asset allocation.

- Tactical asset allocators that rotate asset classes more frequently and to a larger degree.

- Hybrid asset allocators that combine strategic and tactical elements.

The focus of this column is on tactical asset allocators, as they have had the most success gathering assets and offer a compelling but controversial value proposition.

The leading tactical asset allocators offer the potential for upside participation while protecting against downside risk, a tempting offer for advisors and retail investors scarred by two brutal bear markets since 2000.

Windhaven Investments (formerly Windward Investment Management), purchased by Schwab in 2010, is one of the biggest success stories with $18 billion under management. Good Harbor Financial, which manages approximately $10 billion, originated as a part time venture to manage the founders retirement account. Another category leader is F squared, which manages approximately $15 billion.

Quantitative techniques are at the core of their investment process for most tactical asset allocators, driving decisions to rotate between different investments, and in many cases into or out of the market. As is so often the case, the most successful firms have gathered assets by delivering strong returns during a critical period for the markets. Windhaven delivered outstanding relative returns by preserving capital in the aftermath of the tech bubble in 2002, as well as during the heart of the financial crisis in 2008. Good Harbor also made its reputation in weathering the market downturn, providing significant outperformance in 2008, then calling the market turnaround correctly in 2009. F squared has a slightly different story, demonstrating strong simulated performance in marketing materials before having to make changes to their materials in response to ongoing scrutiny from SEC examiners.

Selecting an ETF Strategist

We encourage advisors to go beyond flashy short-term performance results when thinking about investing with an ETF Strategist that offers a tactical asset allocation strategy. There are critical questions to ask before investing:

1. What role will the strategy play in your clients portfolio?

Will it be used for return enhancement, diversification or risk management? Some advisors use tactical asset allocators to supplement a core portfolio, while others use them as a core holding. Having a clear purpose simplifies the decision-making process and informs the evaluation process post-purchase.

2. What is the strategists investment edge and is that edge sustainable?

The most successful ETF strategists make extensive use of quantitative metrics, leveraging technology in their investment process. Windhavens approach relies on a proprietary model of key economic, fundamental and behavioral relationships; Good Harbor focuses on momentum, economic data and yield curve analysis; and F squared has a sector-centric focus driven by volatility and trends in total returns. The strategist should be able to articulate their advantage and explain why that advantage is sustainable over time.

3. How does the firm utilize the technical inputs?

Does the strategist follow the model inputs without intervention, or is there a judgmental overlay applied by an individual or committee? If there is a judgmental overlay, under what circumstances does the judgment apply? How successful has the judgmental component of the process been relative to the quantitative component.

4. How is the strategy implemented?

What investment instruments are used, and how much does the portfolio change over time? For example, can the portfolio go from being fully invested to all cash or are moves more measured in approach? Portfolio turnover is also an important strategy question, particularly for taxable investors. One of the strategies we examined had turnover of more than 400%, potentially an unpleasant surprise for the taxable investor.

5. How did the strategist perform in different market environments?

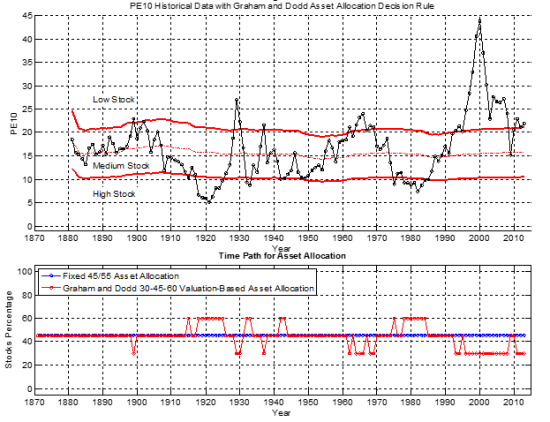

Looking beyond flashy three- or five-year performance numbers is a must. Some asset allocators built their track record on the basis of one or two great years of performance around the financial crisis, but have delivered less inspiring returns since. (See chart below.) Also, size is often the enemy of investment performance, and many stellar track records were built on a small asset base. We think that its tougher to sustain success when assets under management grow rapidly. We also caution advisors about the use of simulated, back-tested performance results. Although back-tested results can provide useful insight into how a strategy will work over long periods of time, there is a big difference between simulated and actual results.

Chart: Sustainable Strategies?

ETF strategists that performed well in 2008 or 2009 have under-performed recently

(Actual annual returns for three popular ETF strategists compared to the S&P 500)

(Source: Morningstar data)

Closing Thoughts

History is filled with investors who became famous on the basis of one or two high-profile market calls that went right; there are far fewer investors who have been able to sustain that kind of success over a long period of time.

In his book The Success Equation, which discusses the role of luck in success, Michael Mauboussin writes about the tendency of people to derive more meaning from small samples than is warranted by the data. Assuming that a manager who performed well during the last financial crisis will also perform well during the next crisis may not be justified by the data. Investors expecting asset allocators to anticipate all market downturns may have been disappointed during last years taper tantrum, as most of the leading strategies followed the market downward during that brief but painful correction.

So its important to do the homework to distinguish whether a tactical asset allocator is a one-hit wonder or has the right stuff necessary to sustain success over time.

As Mauboussin also points out, the markets are a marvelously adaptive environment with market participants adjusting their behavior in response to market activity and other trends. The adaptive environment can include traders that try to trade ahead in anticipation of repositioning by large asset allocators, or copycats who crowd into positions held by the large asset allocators.

The quant quake of 2007 illustrated how too much of a good thing can end up being a bad thing! Many bright quantitative investors used similar models drawing upon similar investment factors to crowd into many of the same stocks.

When the models indicated that it might be time to sell, the resulting deluge of selling reversed several years of excellent performance by quantitatively oriented strategies. So even the best of asset allocators may have their advantage eroded by such adaptive markets.