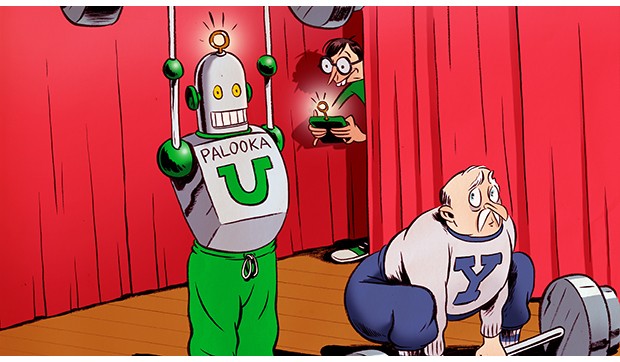

ETFs Aim To Invest Like Yale s Swensen

Post on: 5 Июнь, 2015 No Comment

Yale University’s $16 billion endowment’s enviable gains the past 20 years have catapulted its chief investment officer to Wall Street stardom. Even after losing 25% in its fiscal year ending June 2009 — suffering its first loss in 20 years — the endowment has returned an average annual 12% the past 10 years. That’s while the S&P 500 averaged -1.2% and bonds 6% in the comparable period.

David Swensen, who took the helm in 1985, developed The Yale Model that’s been widely adopted by endowments across the country. These institutional investors dive into private equity, hedge funds and other areas of the market not easily accessible to individuals.

But exchange traded funds now make that possible, says Vern Sumnicht, who manages $275 million for individual and institutional clients. Sumnicht is the CEO of Appleton, Wis.-based iSectors LLC, an asset management firm built around Yale’s investment strategy.

IBD: What is the investment strategy of endowments?

Sumnicht: Endowment portfolios are generally special funds where the principal is held for investment and the return on investment is spent as directed.

They have such an extensive time horizon that the portfolio manager can invest in long-term, illiquid investments. Thus, these portfolios are typically extremely well diversified over a large number of asset classes, including illiquid alternative investments like hedge funds, private equity and real assets.

IBD: Which endowments follow this game plan?

Sumnicht: Almost all universities and foundations have an endowment portfolio that invests at least a small percentage of their portfolio in alternative investments.

IBD: How do you invest like an endowment using ETFs?

Sumnicht: Our investors don’t have the luxury of an unlimited time horizon. Thus, iSectors uses only liquid (registered) securities to design a portfolio that includes significant allocations to alternatives.

ISectors has five models in our Endowment Allocation series, each designed for a different investor risk-return profile (from conservative through aggressive).

As an example, iSectors’ Endowment 60-40 model has approximately 60% allocated to alternative investments, with 30% allocated to equities and 10% to fixed income ETFs.

Each of the iSectors Endowment Allocation models contains over 50 — mostly index ETF — securities in the portfolio.

ISectors uses ETFs to incorporate alternative assets within the models. For instance, as a private equity investment proxy, iSectors portfolios own PowerShares Global Listed Private Equity (ARCA:PSP ).

PSP holds publicly traded private equity firms whose success is derived from profits on the private equity investments they manage. An example of a hedge fund allocation is PowerShares S&P 500 Buy-Write (ARCA:PBP ), which holds common stocks but sells options against those holdings; the option income acts as a hedge.