ETF V Funds

Post on: 11 Май, 2015 No Comment

Background

A mutual fund is a company that uses money from many investors to buy stocks or other securities. Management of a mutual fund can be active, where managers buy and sell securities attempting to get a high return, or passive, where securities are mostly bought and held.

ETFs

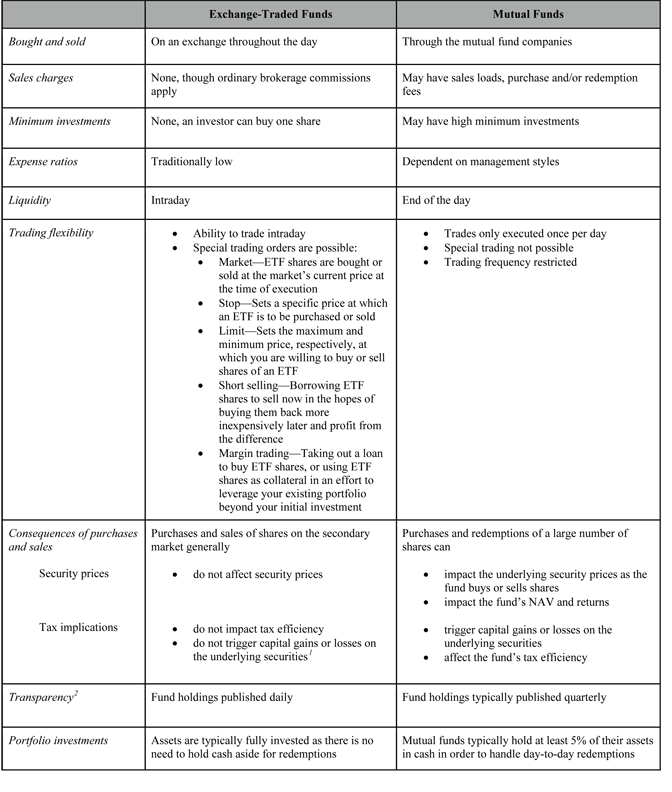

Although like an index fund in which ETF buys securities to track a market index, ETFs are not mutual funds. Rather ETFs trade in the same way that company stocks trade on a stock exchange. While the net-asset value (NAV) of a mutual fund is calculated at the end of each trading day, the price of an ETF changes throughout the day, just as a company stock price changes.

Trading

Index funds are a passive investment, where you buy shares and then sell them when ready. In comparison, you can trade ETF shares the same way that you would trade stocks.

Expert Insight

References

More Like This

The Tax Advantages of Investing in Index Funds

You May Also Like

Index mutual funds and exchange traded funds (ETFs) both provide investors with low cost, pooled investment products. The two fund types are.

Since the early 1970s, investment products have been introduced to simplify the process of investing. Index mutual funds were presented in 1971.

If a resistance level is breached, you may wish to buy an index fund or index exchange-traded fund (ETF) that provides broad.

Exchange Traded Funds Vs. Mutual Funds. Mutual funds and exchange-traded funds (ETFs). Exchange-traded funds (ETFs) are index funds that trade like.

Growth of ETFs Vs. Mutual Funds. Exchange traded funds. Exchange traded funds can provide a convenient and cost-effective alternative to both.

Mutual Funds; Index Funds; The Best Utility ETFs; X. Must See: Slide Shows. Exchange traded funds, or ETFs, are securities that.

An index mutual fund values the individual investor's shares at the close of a market day at the net asset value (NAV.

Exchange traded funds, or ETFs, are index portfolios that trade just like stocks. ETFs offer individual investors a number of advantages relative.

ETF Vs. Index Funds. Active vs. Passive Investment Strategy. Indexing vs. Active Mutual Fund Management. Value Vs. Growth Index Funds. What Are.

ETF MERs are almost always lower than mutual fund MERs because ETFs use an investment process called index tracking. ETFs vs.

Mutual Funds vs. Index Funds. Mutual funds provide a great many advantages to investors. ETF Vs. Index Funds. Index mutual funds.

An ETF is constrained by the index in tracks to hold certain securities and does not deviate. Closed End Funds Vs.

Mutual funds and exchange traded funds (ETFs) have gained explosive popularity among individual investors. While there are similarities between them, their origins.