ETF Sector Strategies

Post on: 10 Май, 2015 No Comment

Sector ETFs enable equity investment approaches that invest by industry, or sector.

Often, companies in the same sector have similar characteristics and risk profiles, which can cause their stock prices to move together in response to prevailing economic conditions. At the same time, in the same conditions, companies in other sectors may be affected quite differently.

Sector ETF Use

Sector ETFs enable portfolios to achieve target exposure levels to economic trends in an efficient manner. Sector ETFs also provide flexibility to adjust risk during different phases of the market cycle. For example, during the 2008 economic crisis, the financial sector declined at a far greater rate than the consumer goods sector. During the decline phase, a sector ETF strategy could have increased exposure to the consumer goods sector and reduced exposure to the financial sector. During the recovery phase, since the financial sector exhibited the best value, this strategy could have been reversed with greater exposure placed to financial sector ETFs and less exposure placed to consumer goods. The advantage of Sector ETFs is that they provide diversification within a sector but also enable strategic and tactical access to the most promising growth areas.

When to Use Sector ETFs

Sector strategies are dynamic approaches which require ongoing portfolio adjustments as economic conditions change and may be successfully implemented at any time during the economic cycle. The goal is to anticipate where the economy is headed and which sectors are most likely to benefit or struggle given expected business conditions. Sectors that are expected to outperform are overweighted while those expected to underperform are underweighted or avoided.

The Economic Cycle

Generally speaking, economic expansion is accompanied by low to rising interest rates, growing consumer optimism and strong employment numbers. During contraction, interest rates have peaked or are falling, consumers have slowed spending, and unemployment is on the rise.

Looking more closely, consumer demand for goods and services typically increases during economic expansion due to supportive monetary policy, positive sentiment and strong employment numbers.

Rather than buy just the basic necessities, consumers spend their extra income on more discretionary items. This discretionary spending drives revenue and generally increases stock prices for companies that sell discretionary goods and services. In comparison, companies selling basic consumer goods tend not to perform as well. In an economic slowdown, or contraction, the reverse occurs as consumers cut back on their discretionary purchases, yet continue to buy the necessities. In this type of environment, consumer staple companies tend to outperform their consumer discretionary counterparts.

Potential Benefits

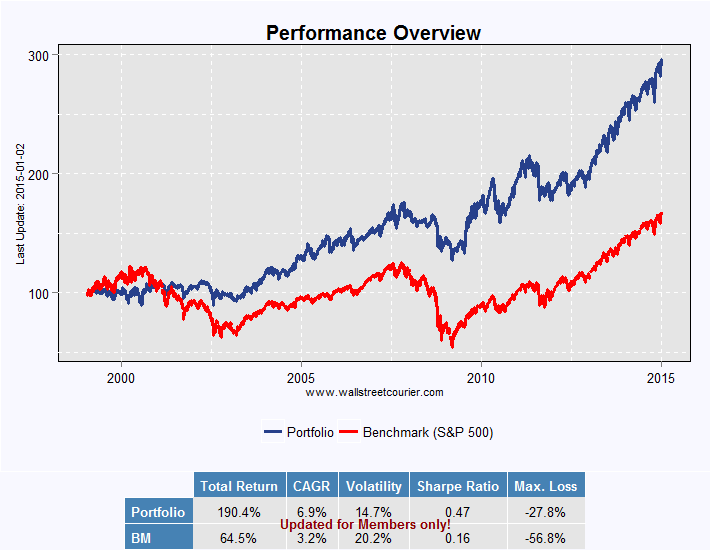

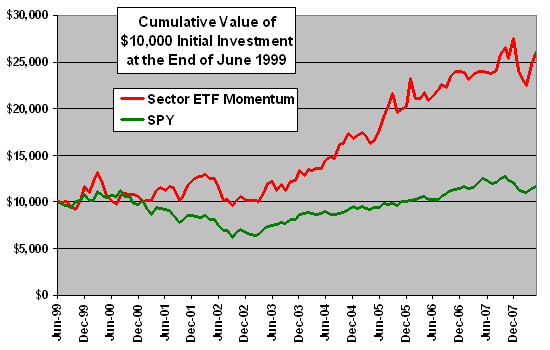

Sector strategies are attractive because of their potential to add alpha 1 and outperform the market. Tactically changing portfolio weights to capitalize on sector return differences can be a method of seeking better performance versus staying invested across the whole market during the same time period.

Sector investing provides attractive portfolio diversification when compared to investments in single stocks. The stocks with the largest weights in an index typically have a high correlation to the index itself, meaning a tendency to move together in the same direction. Using the sector, or subsector, rather than single stocks provides greater index diversification and reduces stock specific risk.

Sector strategies can offer enhanced portfolio risk management versus single stocks. When viewed individually, the majority of benchmark constituents generally tend to have higher levels of risk than the benchmark itself.

1 Alpha is the level of outperformance of a portfolio over and above its benchmark.