ETF s price matters

Post on: 9 Май, 2015 No Comment

Your e-mail has been sent.

What you pay for buying and selling any security matters. ETF investors have much to cheer about the availability of commission-free ETF trades—Fidelity is now offering 70 iShares ETFs and 10 Fidelity sector ETFs for purchase commission-free.

Commissions aren’t the only cost to consider when buying an ETF. Most investors compare expense ratios, but a less appreciated—yet important factor—is the bid-ask spread, which is the difference between the highest price a buyer is willing to pay for an asset (bid) and the lowest price at which a seller is willing to sell (ask). While investors should consider the Net Asset Value (NAV) of an ETF, the price you pay is a seller’s ask price, which can be at a discount or premium to the NAV.

“It’s important to remember that not all ETFs are created equal,” says Ram Subramanium, president of Fidelity brokerage services. “So, investors may want to look for ETFs with established track records and low bid-ask spreads relative to their peers.”

Behind the bid-ask spread

Purchase commission-free details

Free commission offer applies to online purchases of Fidelity ETFs and select iShares ETFs in a Fidelity brokerage account. Fidelity accounts may require minimum balances. The sale of ETFs is subject to an activity assessment fee (of between $0.01 to $0.03 per $1,000 of principal). iShares ETFs and Fidelity ETFs are subject to a short-term trading fee by Fidelity if held less than 30 days.

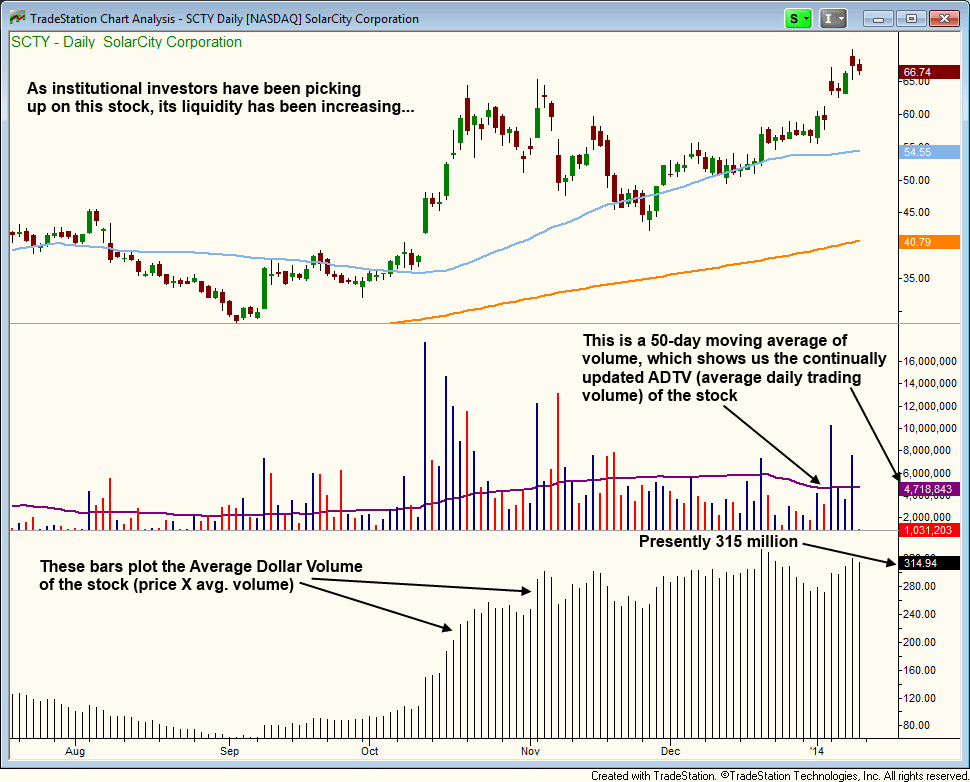

Bid-ask spread is largely a function of liquidity, or the volume of buyers and sellers for an asset during a particular moment in time. Highly liquid assets are heavily traded and can be bought and sold quickly and relatively inexpensively. Think Bank of America ( BAC ), the most heavily traded stock on October 11, 2013, with 63 million shares changing hands at a miniscule average bid-ask spread of 0.01% (this is calculated as the ask price less the bid price, divided by the ask price).

Alternatively, it may be more difficult to trade certain assets that are less liquid, where bid-ask spreads can be higher. Think some penny stocks.

Liquidity is also an important factor to consider when buying and selling ETFs. The most heavily traded ETF on October 11, 2013 was the SPDR ® S&P 500 ® ETF ( SPY ), with a bid-ask spread of 0.01%. 1 A similar ETF, the iShares Core S&P 500 ETF ( IVV ), also had a bid-ask spread of 0.01%. But some newer ETFs, or ones that target more obscure asset classes, can be very illiquid and can have much wider bid-ask spreads.

All things being equal, it makes sense to seek more liquid ETFs with narrower bid-ask spreads, because the narrower the spread, the lower price.

Understanding liquidity

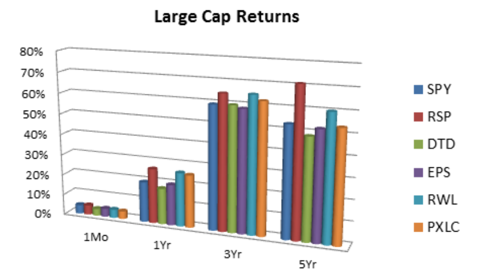

The composition of the underlying securities of an ETF is one of the more important factors in determining its liquidity. In general, ETFs whose underlying assets are broad market indexes, large-cap stocks, or government bonds tend to be the most liquid and heavily traded.

If you are investing in these types of ETFs, you have many highly liquid choices with relatively low bid-ask spreads. Still, there can be discrepancies, which is one reason why we picked many highly liquid ETFs for our online commission-free iShares offer.

Now, let’s compare bid-ask spreads on a similar set of ETFs. Let’s say you want to invest in the broad market, but are looking for a range of choices. In addition to SPY and IVV, we found several alternatives using Fidelity’s research tools. 2

There are options for investors looking for ETFs similar to the SPY ETF

Source: Fidelity.com as of March 13, 2013. Screenshot is for illustrative purposes only.

Although each of these ETFs attempts to track the S&P 500, their volumes and bid-ask spreads vary (see screenshot above). The average bid-ask spread for iShares Core S&P 500 ETF (IVV) was 0.01%—the same as SPY, but lower than VOO (0.02%), RSP (0.02%), and EQL (0.09%). IVV also has the added benefit of trading commission-free at Fidelity.

It’s all relative

When it comes to more thinly traded ETFs, the bid-ask spreads can vary even more widely than with broad market-based ETFs. So, picking the ETF with the lower bid-ask can be even more impactful.

Suppose a U.S.-based investor wants to invest in the Japanese stock market. When the Asian markets are closed, the underlying Japanese securities can’t be traded. As a result, Japan ETFs can be relatively illiquid for U.S. investors.

However, the results of the screen below show some broad-based Japanese equity ETFs can have a much wider bid-ask spread than others. For example, iShares MSCI Japan Index ETF ( EWJ ) had a bid-ask spread of 0.1%, versus DBX ETF Trust ( DBJP ) of 1.04% and SPDR Russell Nomura PRIME Japan ETF ( JPP ) 1.09%.