ETF Outlook Guggenheim S P Equal Weight Health Care ETF (RYH)

Post on: 21 Июль, 2015 No Comment

Share | Subscribe

Every week, Marc Chaikin applies his groundbreaking analysis to an ETF or a sector. Today, he looks at the Guggenheim S&P Equal Weight Health Care ETF (RYH ).

As indicated below by the Chaikin Power Bar stock rankings of the 9 SPDR Select Sector ETFs, the SPDR Health Care ETF (XLV ) continues to show the most bullish differential between bullish and bearish Chaikin Power Gauge stock ratings. However, there is an ETF with the same constituents which weights them equally, as opposed to the XLV which is capitalization-weighted. That ETF is the Guggenheim S&P Equal Weight Health Care ETF (RYH ). The RYH has 20 stocks with bullish Chaikin Power Gauge stock ratings vs. only 4 with bearish ratings.

The RYH has less of a bias to the large cap Health Care stocks; and as small and mid cap companies have reversed their underperformance in the past 6 weeks, the RYH has been a better performer than the XLV. The RYH has the same bullish Power Gauge bias but puts more emphasis on the smaller cap names in the Index. This is important in the current environment as the larger Biotech stocks have been more volatile as they have been buffeted by concerns about pricing pressure from the large managed drug plan providers like Express Scripts (ESRX ) and CVS Health (CVS ).

When we look at all Health Care ETFs through the lens of the Power Gauge rating, ranked in strongest to weakest order, we see The RYH at the top of the list.

The current pullback in the broad market has seen many stocks in the RYH pull back to support levels, yet the RYH itself continues to outperform the market.

The market is digesting the effects of the plunging price of crude oil on the U.S. economy and has found support at the 2,000 level on the S&P 500 Index. With the Health Care Sector likely to continue to outperform the broad market and the Biotech stocks regrouping, the RYH is an excellent way to participate in a renewed market advance. Biotech stocks are the most volatile component of the RYH but have very exciting new drugs in the pipelines. As such, they will provide a tailwind for the RYH which should push this ETF to new highs.

Use any short-term dips to buy the RYH in anticipation of renewed strength in this strong sector in the weeks ahead.

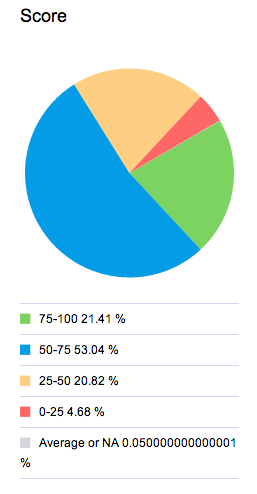

The Guggenheim S&P Equal Weight Health Care ETF (RYH) has 20 Bullish-rated Chaikin Power Gauge stocks vs. 4 with Bearish ratings, as indicated by the Chaikin Power Bar for the RYH below. This indicates positive potential for the RYH over the next 3 – 6 months. When combined with strong relative strength to the market, this is a powerful one-two punch for investors.

The Chaikin Portfolio Health Check is an excellent tool to help zero in on the strongest stocks in any ETF; in the RYH there are 20 bullish-rated stocks.

By looking at the individual component stocks through the lens of the 20 factor, Chaikin Power Gauge stock rating model, you can easily find the stocks in the RYH ETF with the strongest price potential over the next 3-6 months. These are individual stocks to buy, as they are likely to outperform the RYH, as well as the overall market.

The Chaikin Power Grid in Portfolio Health Check (see below) maps stocks and industry groups from strong to weak so you can easily determine the best and worst stocks in any ETF. To find the strongest stocks in the RYH, we look to the upper right quadrant of the Power Grid (strong Power Gauge stocks in strong industry groups) where we find stocks with the best potential for price gains over the next 3-6 months. There we see stocks like Edwards Lifesciences (EW ), C.R. Bard (BCR ) and Boston Scientific (BSX ) in the strong Medical Products Group. that has recently received a P/E takeover bid.

Stocks in the upper left quadrant, (weak Power Gauge stocks in strong Industry Groups), like Baxter International (BAX ), Tenet Health (THC ) and AbbVie (ABBV ) can be swapped for strong stocks in those same industry groups like BSX and Celgene (CELG ).

Over time, strong stocks in strong industry groups will outperform the market.