ETF Liquidity Tips and Trading Best Practices

Post on: 30 Апрель, 2015 No Comment

One of the biggest advantages of an ETF over a mutual fund is the ability to trade intra-day without being held hostage to a single price. This makes ETFs a flexible tool for both long-term investors and short-term traders alike. However, with that flexibility comes an additional layer of risk that involves understanding the liquidity and execution elements that are critical to a successful entry or exit.

With an ETF, liquidity is provided by the underlying securities, market makers, associated participants, and investors that are purchasing or selling these funds. The top aspect you should focus on is the liquidity of the underlying holdings which is where the ETF is ultimately priced in relation to its net asset value. A secondary consideration should be the average daily volume and current bid/ask spread of the ETF as compared to comparable alternatives.

Well-established funds such as the SPDR S&P 500 ETF (SPY ) or the PowerShares QQQ (QQQ ) trade hundreds of millions of shares per day and track some of the most liquid stocks in the world. As a result, any reasonable order size for an average investor will likely be filled with lightning-quick speed.

I once had an institutional trade desk tell me these ETFs “trade like water,” which means they are constantly creating and redeeming shares based on order flow. You are quite literally a drop in a very large bucket that will barely roil the surface in these funds.

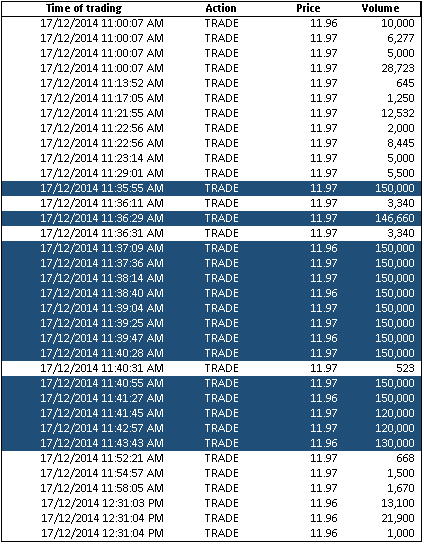

The art of successful trade execution really becomes more acute with lesser known ETFs that have smaller trading volume, illiquid underlying securities, or fewer institutions creating and redeeming shares. ETFs with fewer than 100,000 shares of average daily trading volume tend to be susceptible to wider spreads between the bid and ask price. In that instance, it becomes even more critical to understand what the constraints of the ETF are and patiently devise a plan for entry or exit.

As a professional money manager who has been block trading ETFs in size for years, I have made and seen a great deal of mistakes in this arena. I have watched large blocks of shares get scalped for 0.50%-1.00% (or more in extreme instances) on each side of the trade because the investor was too lazy to implement a limit order, break up their share block, or simply seek out other liquidity sources. That may not seem like a great deal on the surface, but over time it can erode your profits and significantly impact your total return.

For the average ETF investor, your first line of defense should be using a limit order to execute your trade at a pre-determined price. That way you are not susceptible to an opportunistic intermediary who is going to mark down the price of your trade to their benefit. It also eliminates the potential for high frequency traders to front run your orders.

If you are trading in larger quantities and finding that your limit orders are not being executed, you may want to consider breaking up the trade into smaller blocks that are easier for your broker to fill. While you will pay slightly more in commissions to execute multiple trades, it may ultimately be in your favor to average into an ETF. Often times you can achieve a better execution price than if you had just sent in a large market order.

The wider the spread between the bid and ask, the more important it is to implement these strategies to reduce trading costs. While you can’t always control the ultimate direction of the investment, you can enhance your chances for a successful trade by being alert to liquidity constraints and implementing simple measures to enhance your returns .