ETF Liquidity_1

Post on: 9 Май, 2015 No Comment

For individual stocks, liquidity is all about trading volume and its regularity—more is better. For exchange-traded funds (ETFs), however, there’s more to consider.

An ETF isn’t a stock

ETFs are often lauded for their liquidity and single-stock trading characteristics. Truth is, while they are similar, ETFs are also different.

If an ETF doesn’t trade a certain number of shares per day (e.g. 50,000), the fund is illiquid and should be avoided, right? Wrong. It’s a plausible assumption from a single-stock perspective, but with ETFs, we need to go a level deeper. The key is to understand the difference between the primary and secondary liquidity of an ETF.

Primary market vs. secondary market

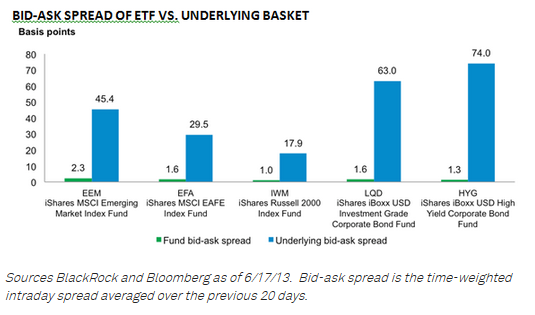

Most non-institutional investors transact in the secondary market—which means investors are trading the ETF shares that currently exist. Secondary liquidity is the “on screen” liquidity you see from your brokerage (i.e. volume and spreads), and it’s determined primarily by the volume of ETF shares traded.

However, one of the key features of ETFs is that the supply of shares is flexible—shares can be “created” or “redeemed” to offset changes in demand. Primary liquidity is concerned with how efficient it is to create or redeem shares. Liquidity in one market—primary or secondary—is not indicative of liquidity in the other market.

Another way to make the distinction between the primary market and the secondary market is to understand the participants in each. In the secondary market, investors bargain with each other or with a market maker to trade the existing supply of ETF shares. In contrast, investors in the primary market use an “authorized participant” (AP) to change the supply of ETF shares available—either to offload a large basket of shares (“redeem” shares) or to acquire a large basket of shares (“create” shares).

The determinants of primary market liquidity are different than the determinants of secondary market liquidity. In the secondary market, liquidity is generally a function of the value of ETF shares traded; in the primary market, liquidity is more a function of the value of the underlying shares that back the ETF.

When placing a large trade—on the scale of tens of thousands of shares—investors are sometimes able to circumvent an illiquid secondary market by using an AP to reach through to the primary market to “create” new ETF shares.

Unfortunately, most of us aren’t trading tens of thousands of shares at a time, so we’re stuck trading in the secondary market. Remember, to assess secondary market liquidity, you should be looking at statistics such as average spreads, average trading volume, and premiums or discounts (does the ETF trade close to its net asset value?).