ETF Investors Why The Stock Market Is Flashing Warning Signs (NYSE GLD NYSE SLV NYSE SPY NYSE

Post on: 29 Март, 2015 No Comment

Have you ever wondered how billionaires continue to get RICHER, while the rest of the world is struggling?

I study billionaires for a living. To be more specific, I study how these investors generate such huge and consistent profits in the stock markets — year-in and year-out.

CLICK HERE to get your Free E-Book, “The Little Black Book Of Billionaires Secrets”

On average the stock market suffers a major correction about every four years. In a secular bear market that cyclical trough arrives as the economy sinks into recession and a stock market bear bottoms out.

The last four year cycle bottom formed in March of 09. That just happened to be the longest four year cycle in history. Ive noted before that long cycles are often followed by a short cycle that compensates for the extended nature or the prior cycle. If thats the case then the next four year cycle low is due sometime in 2012. (My best guess is in the fall.)

As we are still in a secular bear market then the move down into the four year cycle trough should correspond to another economic recession and cyclical bear market for stocks. Bear markets tend to last about a year and a half to two and a half years. If the next four year cycle bottoms in the implied timing band then the current cyclical bull should be topping soon.

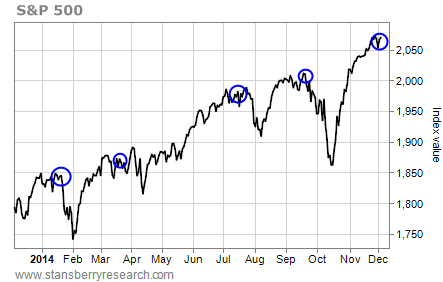

As a matter of fact the stock market is already flashing warning signs. Three of the largest and most important sectors in the S&P 500 (NYSE:SPY) have not confirmed new highs.

Another warning sign; Despite record earnings the market has only been able to move to marginal new highs and is now in jeopardy of reversing the recent breakout.

Ive noted in the past that this is how major tops and bottoms are often established. Smart money sells into the breakout, or buys the break down in the case of a bottom. The trend then reverses and a major turning point is formed. Both the `02 bottom and the `07 top were put in this way.

The market is now at risk of a similar event as weve experienced a marginal breakout to new highs that is threatening to fail. Dont forget this is happening against a back drop of record earnings.

When a market cant move higher on good news something is wrong. And dont forget bull markets dont top on bad news they top on good.

If the market can recover and move to new highs the cyclical bull will be confirmed but if the market continues to fade and drops back below the Japan bottom it will constitute a failed intermediate cycle and if both the Dow (NYSE:DIA) and the Transports close back below the Japan bottom we would have a Dow Theory sell signal and that would confirm the next leg down in the secular bear has begun.

It would also be a signal that the economy was unable to handle the spiking food and energy costs that were the direct result of Bernanke trying to prop up the financial system with his printing press.

Like I said, printing money has never been the answer. Every empire in history has tried this approach and not one of has ever succeeded with it. We wont either.

Related Tickers: SPDR Gold ETF (NYSE:GLD), iShares Silver ETF (NYSE:SLV), SPDR S&P 500 ETF (NYSE:SPY), SPDR Dow Jones Industrial Average ETF (NYSE:DIA), Oil Services HOLDRs ETF (NYSE:OIH), ProShares UltraShort S&P500 ETF (NYSE:SDS), Direxion Daily Financial Bull 3X Shares (NYSE:FAS), Direxion Daily Financial Bear 3X Shares (NYSE:FAZ), Direxion Daily Small Cap Bull 3X Shares (NYSE:TNA), Direxion Daily Small Cap Bear 3X Shares (NYSE:TZA).

Written By Toby Connor From Gold Scents

Toby Connor is the author of Gold Scents, a financial blog with a special emphasis on the gold secular bull market. Mr. Connor’s analysis skill of the markets is largely self-taught, though he admits to being an avid reader of Richard Russell and Jim Rogers, among several others.