ETF Investors Find Value in Russia Bonner Partners

Post on: 2 Июнь, 2015 No Comment

A chart that we picked up on our radar recently shows that, over the last three months, investors have put more money into the 23 Russia-exposed equity ETFs than theyve taken out.

Source: Markit

As you can see, despite increasingly ugly headlines about the Russian economy, since the start of August, net inflows have passed the $1 billion mark.

Most of that money has gone into the big daddy of Russian equity ETFs, the Market Vectors Russia ETF (NYSE:RSX). It accounts for about half of the total invested assets of the 23 ETFs.

That anyone would invest in Russia right now is a mystery to a lot of folks.

And we regularly take flak at Bonner & Partners for writing positively about such a deeply hated market.

But you dont have to like Russia or its economy to recognize it as a great long-term buy (with the emphasis on long term) .

As legendary distressed debt investor Howard Marks of Oaktree Capital Management – a guy who knows a lot about investing in the unpopular – puts it:

Investment success doesnt come from buying good things, but rather comes from buying things well.

What Marks means is that successful investing is about understanding the relationship between value and price.

Theres no such thing as an investment thats so good that it cant become a bad idea at too high a price. Likewise, there are few investments that arent a good idea at a low enough price. (I saw few because some cheap stocks are cheap because the product or service they sell has become obsolete or is becoming obsolete.)

Russia faces some well-understood problems. Its been hit by economic sanctions from Europe and the US. The ruble has lost close to 30% against the US dollar so far this year. Annual inflation is running at about 8%. And the slump in commodity prices is putting the squeeze on its commodity-dependent economy.

But these are well-known problems. That means they are already reflected in Russian stock market prices and then some.

The Russian stock market sells for 6.2 times the recorded earnings over the last 12 months. Thats more than two-thirds off the price recorded earnings for the MSCI USA Index are selling for.

And the Russian market yields 5.3% – more than double the 2% yield available on its US counterpart.

Its easy to fall into the trap of believing everything stinks in Russia right now. But thats not the case. Look under the hood of the Market Vectors Russia ETF, and some interesting counter-narratives emerge.

For instance, Russias biggest food retailer, Magnit – which makes up about 8% of the ETFs holdings – saw an expectations-beating 40% rise in earnings for the third quarter, despite a ban on food imports.

And its shares were up 23% over the quarter.

And Russian oil and gas company Lukoil – which makes up another 7.6% of RSXs holdings – recently announced it would target a 15% growth rate for its annual dividend payments.

That will take its dividend yield up to 5.5% next year.

Over the short term, its anyones guess where the Russian market is headed. But as the chart above shows, some folks out there are starting to see value in this deeply unloved market.

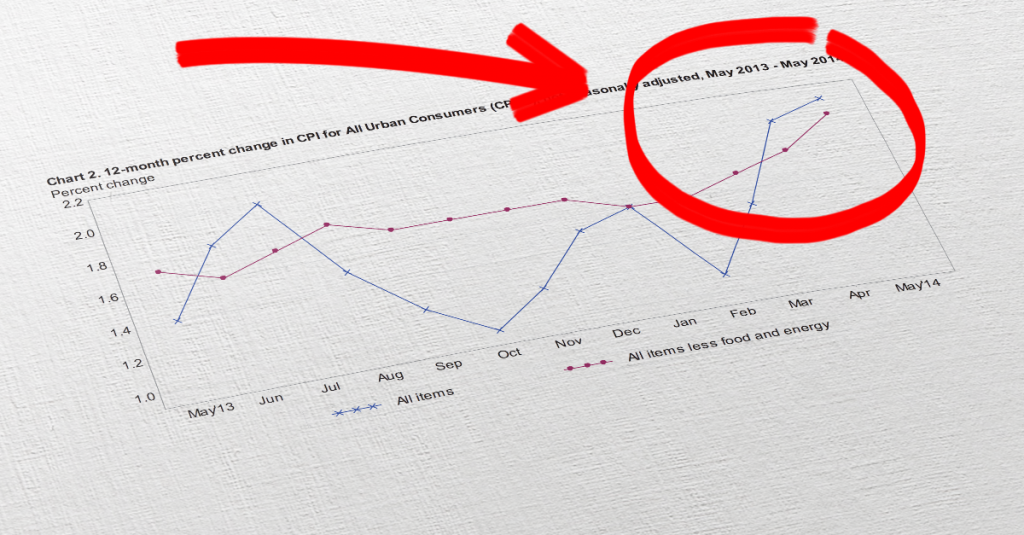

P.S. The popular trade right now is US stocks. But as readers of Hormegeddon know, markets pumped up by QE and ultra-low interest rates are vulnerable to collapse. Heres the link again to pick up your copy and become an early subscriber to The Bill Bonner Letter .