ETF Investors Dollar Cost Averaging Through Down Markets (NYSE SPY NYSE DIA NYSE IWM NYSE SDS

Post on: 5 Май, 2015 No Comment

Have you ever wondered how billionaires continue to get RICHER, while the rest of the world is struggling?

I study billionaires for a living. To be more specific, I study how these investors generate such huge and consistent profits in the stock markets — year-in and year-out.

CLICK HERE to get your Free E-Book, “The Little Black Book Of Billionaires Secrets”

That’s why I want to spend a little time revisiting that strategy of dollar-cost averaging — to see if we can still safely call it one of the most boringly profitable investment approaches available … one that puts the passage of time to work for us rather than against us.

Dollar-Cost Averaging: Cruise Control for Your Portfolio

The idea with dollar-cost averaging is relatively simple: You buy equal dollar amounts of the same investment on a predetermined schedule.

Please note the italics in that last sentence. Dollar-cost averaging IS NOT buying a fixed number of shares on a regular basis. In fact, it is quite the opposite. Here’s why …

Let’s say you’ve decided to invest $10,000 in XYZ Corp. Rather than deploying the entire amount at one time, you might instead opt to purchase $1,000 of XYZ stock on the first day of each of the next 10 months.

What’s the logic behind this approach? Well, you can expect just about any stock’s price to vary substantially over a ten-month period. So, when the price is higher, your $1,000 will buy fewer shares; when the price dips, your $1,000 will buy more shares.

In other words, buying equal dollar amounts over time allows you to reduce your risk to a stock’s short-term price movements, automatically encouraging you to buy more when prices are lower and less when prices are higher.

It also removes much of the emotion from the investing process. You’ve already committed to buying the stock at regular intervals, regardless of market conditions.

And because you’re doing this automatically, it doesn’t require more than a few minutes of your time (if any at all!).

Okay, But How Does This Strategy Fare When the Road Gets Bumpy?

Obviously, buying bits of stock as the market continually rises would work just fine … even if it meant you missed out on some additional upside by not putting as much in as quickly as possible.

But what about the other scenario — the one where the market really zigs and zags, moves sideways, or even goes lower over a long period of time?

Well, again, there is perhaps no better example of this kind of action than the last few years!

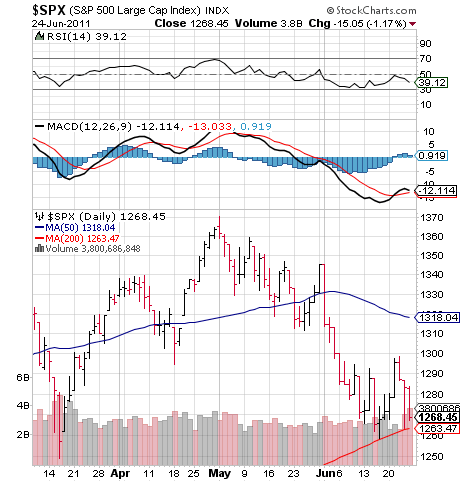

Just take a look at a chart of the S&P 500 since June 12, 2007 — the day my daughter was born …

As you can see, despite the huge declines and rallies, the broad U.S. stock market index is still lower than it was four years ago.

And yes, if you’d had very good timing, you could have clearly been making a fortune during every one of those major moves … but what if you didn’t have perfect timing? Or if you had BAD timing?

That’s where dollar-cost averaging comes in. Let’s look at what would have happened if you simply followed this approach over the last four years — investing an equal amount of money in the S&P 500 ETF (NYSE:SPY) at the beginning of every single month.

It’s a long table, but I want to show you exactly how this works …

As you can see, by putting $1,000 into a broad-based ETF each and every month over the last four years, you would have spent $49,000 to buy a total of 441 shares.

Based on the SPY’s recent price of 131.73, that total stake would currently be worth $58,144 — a total profit of $9,144!

That’s an 18.66 percent return over the four years … even though the market actually FELL over the same time period!

The reason, as I mentioned earlier, is simple: While you would have bought some shares when the market was at its peak, you also would have forced yourself to buy a bunch of shares when the market was much lower than it is today.

Now, does this mean that careful timing or superior stock selection couldn’t have given you even BETTER returns?

No way!

But in the case of buying individual stocks, it’s worth noting that you can apply dollar-cost averaging there just as easily as you can with broad-based ETFs.

In addition, you are also using this same general concept whenever you reinvest your dividend payments or make regular contributions to the same funds in a retirement plan such as a 401(k).

Of course, whether or not you decide to put dollar-cost averaging to work in your portfolio, the important part is remembering that while time often passes more quickly than we might like, the key to success — in both investing and life — is finding a way to capture those key moments that happen along the way.

Best wishes,

Written By Nilus Mattive From Money And Markets

Money and Markets (MaM) is published by Weiss Research, Inc. and written by Martin D. Weiss along with Nilus Mattive, Claus Vogt, Ron Rowland, Michael Larson and Bryan Rich. To avoid conflicts of interest, Weiss Research and its staff do not hold positions in companies recommended in MaM. nor do we accept any compensation for such recommendations. The comments, graphs, forecasts, and indices published in MaM are based upon data whose accuracy is deemed reliable but not guaranteed. Performance returns cited are derived from our best estimates but must be considered hypothetical in as much as we do not track the actual prices investors pay or receive. Regular contributors and staff include Andrea Baumwald, John Burke, Marci Campbell, Selene Ceballo, Amber Dakar, Maryellen Murphy, Jennifer Newman-Amos, Adam Shafer, Julie Trudeau, Jill Umiker, Leslie Underwood and Michelle Zausnig.