ETF Investing Guide The 4 Criteria for Picking a Brokerage

Post on: 5 Апрель, 2015 No Comment

Now that youve determined your asset allocation and picked a basket of ETFs for your portfolio, you need to find a brokerage to execute the trades and hold your portfolio for you. How do you pick the brokerage? The criteria are relatively straightforward.

- Low-cost trades. You cant control the performance of your portfolio, but you can control the taxes and fees you pay. So heres your opportunity to further minimize the fees. Youve already chosen ETFs with the lowest possible annual fund fees, now youre going to crush the fees you pay to buy and sell the ETFs. If you pay too much for trades, index mutual funds quickly become more attractive than ETFs, and then you have to manage multiple separate mutual fund accounts. So keeping trading fees very low is a critical element of your investment strategy. Go for an online brokerage firm with per-trade fees below $25.

- Easy tax management. Ill discuss taxes in more detail in How to Turn Taxes to Your Advantage. But for selecting a brokerage (if you are investing in a taxable account), it’s crucial to find an online broker that allows you to identify and sell specific tax lots with ease. If the broker also provides a summary of unrealized gains and losses by purchase lot, even better.

- Portfolio allocation tools. Its easy to track your ETF portfolio and asset allocation using a spreadsheet. But its even easier if your brokerage does that for you. And sure enough, the best online brokerages do show you your asset allocation.

- Maximum interest on your cash. Most investors pick their brokerage on the cost of trading alone. Mistake! There are a number of reasons you may be holding cash in your account, and the interest you earn on the cash could easily be material. First, it may take you time to allocate your assets as you choose which ETFs to put your cash into. Second, many ETFs earn dividends (the S&P 500, for example, pays a couple of percent a year in dividends). Until you re-invest those dividends in ETFs in line with your asset allocation targets, theyll be sitting in cash. And finally, if you think the risk-reward ratio on buying bonds (or any other asset class) is currently unattractive (as I do), youll want to leave the assets you allocated to bonds in cash until interest rates rise and bond prices fall. This means you may be keeping a fair chunk of your assets in cash; and probably the older you are, the greater your bond allocation and thus the more cash youll have waiting on the sidelines. (I discuss this issue later on in When to Get Started: The Getting Started Problem).

Lest you underestimate how much most investors are currently holding in cash, consider this: Ameritrade reported that in the second quarter of 2003, 27% of its customer’s assets at the firm were in cash and money market accounts, totaling about $10 billion. So the interest you earn on your cash matters, and can outweigh the fees youll pay to buy and sell the ETFs in your portfolio.

But heres the problem: most brokerages sweep the cash in brokerage accounts into money market accounts that pay relatively low interest, and in some instances they pay no interest at all. Ameritrade, for example, proudly reported to investors in its stock that the average interest it paid on the $10 billion of clients money in cash in Q2 2003 was just 0.3%.

The solution to this problem is to keep your cash in a bank account paying higher interest, and youll also get FDIC insurance. When its time to move into bonds, move the cash from the bank account to your brokerage account. But if you can find a brokerage offering high-interest paying money market accounts linked to brokerage accounts, youll get the best of both worlds: the convenience of managing your entire portfolio in one place, and higher interest.

Now the criteria that don’t matter to you:

- You dont need real-time or streaming quotes. You can buy ETFs using limit orders, setting the price slightly below where the ETF currently trades. If you want real-time quotes when you enter your order, you can get real time ECN quotes from Yahoo for free. Streaming quotes, or NASDAQ Level II quotes? Youre not a day trader. You dont need to check your portfolio every day, let alone every second.

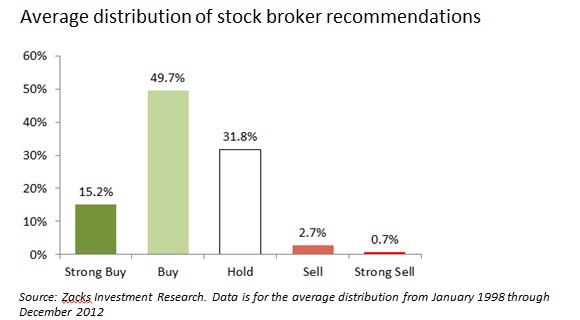

- You dont need stock research. Since youre not buying individual stocks, you dont care whether your brokerage provides stock research. (It may be fun to read as entertainment, but it shouldnt affect your portfolio).

- You dont need a choice of mutual funds. Why? Because mutual funds are generally a lousy deal, and youll be buying ultra-low-cost, index-tracking ETFs instead.

- You dont need cheap margin interest. Your goal is to allocate the assets you have, not to borrow money from your brokerage to buy stock. Since you wont be borrowing, you dont care what your brokerages margin interest rates are.

Is size an important factor in choosing an online brokerage? My gut feeling is it is. Heres why. The larger online brokerages will have the resources to develop better and better products at lower and lower cost. Look for them to offer automated tools to make it easier for customers to allocate assets and manage their portfolios. A company called Financial Engines currently provides companies and some brokerages with a wizard that spits out a suggested asset allocation in response to questions about the customers financial goals and resources. But the software then suggests mutual funds, instead of ETFs. As the larger online brokerages begin to focus on investors rather than traders, expect their asset allocation and portfolio management tools to improve markedly.

Next, look for the larger brokerages to roll out ever more sophisticated banking products. E*Trade, Merrill Lynch and Schwab already emphasize banking products, including mortgages and loans, in an effort to become a one stop shop for their customers financial needs. This is a win-win for both the firms and their customers. Its far more convenient to use a single firm for all your financial needs; the ability to move funds between accounts in real time online is only one example of this.

As firms get to see their customers total financial pictures, theyll also be able to offer better interest and lending rates. The perceived risk of loan default on a mortgage is far less if the bank knows how much you have in your brokerage account and knows from direct experience your current account balance and credit card payment histories. That will allow bank/brokerages to offer lower mortgage interest rates.

Smaller brokerage firms without banking capabilities will find it increasingly difficult to keep up with the functionality and cost competitiveness offered by the leaders. At the same time, the Internet will allow easy comparisons of brokerage fees and interest rates (both on account balances and loans). Those firms saddled with large branch networks, I believe, will not be able to compete with primarily Internet-based banks/brokerages. If you doubt this, check out the highest interest rates offered on money market accounts at BankRate.com. Most of the top rates are offered by Internet-based banks.

Some financial firms may also find their development hampered by conflicts of interest. Will Fidelity invest in tools to make buying and managing ETFs easier, when ETFs could cannibalize Fidelitys mutual fund business? I dont think so. Will Brown & Co. which offers among the lowest per trade commissions of all online brokers, invest in high interest online banking, when that could cannibalize the business of JP Morgan Chase, its parent? I dont think so.

In sum, when selecting an online brokerage, think also about consolidating your assets with that firm in the future. Look for a firm that will be a low-cost-leader in the future; that will offer sophisticated Internet-based bank and brokerage products; and will focus on its online platform and ATM network, rather than an expensive branch network and personal relationships with brokers.

Previous: What to Buy in Which Account

Next: Summary: How to Assemble a Core ETF Portfolio