ETF Benefits and Risks of investing

Post on: 8 Апрель, 2015 No Comment

The benefits and risks of exchange traded funds (ETF’s) are many and varied.

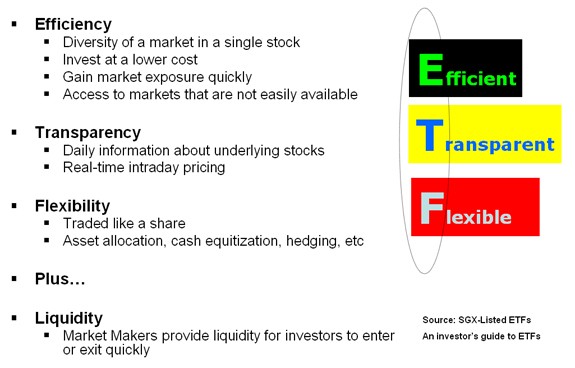

ETF Benefits

ETF’s can be bought and sold like ordinary stocks making the management of investors portfolios a snap and giving investors a great deal of control.

ETF’s offer investors the benefits of diversification

ETF’s often have very low costs and costs historically have been a key predictor of investors returns. The lower the cost of a fund the higher its predicted return

ETF’s can be purchased using margin lending facilities

ETF’s can be short sold, offering investors protection from other parts of the portfolio falling in value

ETF’s can provide easy exposure to specific market sectors/segments

The transaction cost of buying ETF’s can be significantly lower than the entry fees of up to 4% charged by some managed funds

ETF’s are tax efficient, because they normally follow an index the turnover within the ETF’s investment portfolio is relatively low and realised taxable gains are minimised

Transparency ETF’s publish their investment holdings usually every day

ETF Risks

The transactions costs associated with buying ETF’s can be far more than managed funds, it is often possible for investors to obtain a rebate of some or all of the entry fees. For investors making small frequent transactions a managed fund with a slightly higher management fee might be a better option

ETF’s have a bid and an ask price and a spread in between the two. In time of market stress or ETFs where the underlying portfolio is illquid the spread can grow and the market price may not reflect the net asset value of the underlying securities.

Not all ETF’s have low management fees. As the number of ETF’s increase the competition for funding is forcing the product spruikers to spend money on marketing

All ETF’s have some level of tracking error, which is the degree to which they do not track the underlying index. ETF’s mission to track an index is not as easy as it first appears. ETF’s do hold some cash. ETF’s often don’t hold all the shares or underlying assets of the index they are trying to track, because sometimes it is simply not practical. Many smaller stocks and some larger ones may not have the liquidity (e.g. there are not a sufficient number of buyers or sellers) which would allow large institutional ETF investors to buy and sell the underlying shares as required.

It is estimated more than 20% of ETFs listed in the US face closure due to an asset level of <$15m, investors do not always fare well when ETFs are wound up.

They are a bit complicated the actual mechanics and risks behind ETF’s are not that easy for the average or even the highly professional investor to understand there are a lot of middle men. For example in the US in early August 2012 a software foul-up nearly bankrupted Knight Capital (a US market making stockbroking firm responsible for maintaining certain ETF prices), with $440 million in losses in a single morning. As a result of the software glitch part of their ETF team was forced to withdraw its bids on dozens of ETFs. The prices/spreads on small ETFs where Knight was the lead marketmaker blew out by 200%.

Counterparty party risk which is the risk that the other side of a contract will default. Synthetically replicated ETFs are exposed to a higher degree of counterparty risk relative to physical replication funds. Synthetically replicated funds mimic the return of their benchmark by entering a total return swap. Under the terms of the swap, the funds counterparty is obligated to deliver the return of the funds reference index in exchange for the performance of a basket of securities held as collateral, which the fund delivers to the counterparty. This arrangement exposes shareholders to the risk that the swap counterparty will fail to deliver the benchmark return.

Stock lending many ETFs lend out the underlying stocks to earn extra revenue, this also exposes them to counterparty risk