Estimation of expected return CAPM v and French

Post on: 15 Июнь, 2015 No Comment

Page 1

________________________________________________________________________________________________________________________________________

email: ppe@asb.dk

Abstract

Most practitioners favour a one factor model (CAPM) when estimating expected

return for an individual stock. For estimation of portfolio returns academics

recommend the Fama and French three factor model. The main objective of this

paper is to compare the performance of these two models for individual stocks.

First, estimates for individual stock returns based on CAPM are obtained using

different time frames, data frequencies, and indexes. It is found that five years of

monthly data and an equal-weighted index, as opposed to the commonly

JEL Classifications: G11, G12, G31

12. november 2003

Page 3

“A commercial provider of betas once told the authors that his firm, and others, did not know

what the right period was, but they all decided to use five years in order to reduce the apparent

differences between various services’ betas, because large differences reduced everyone’s

credibility!”

(Brigham and Gapenski [1997], p354, footnote 9.)

Introduction

Estimation of expected return or cost of equity for individual stocks is central to many financial

decisions such as those relating to portfolio management, capital budgeting, and performance

evaluation. The two main alternatives available for this purpose are a single factor model (or

Capital Asset Pricing Model (CAPM)) and the three factor model suggested by Fama and French

[1992, for example]1. Despite a large body of evidence in the academic literature in favour of the

Fama and French model, for estimation of portfolio returns, practitioners seem to prefer CAPM

for estimating cost of equity (see, for example, Bruner et al [1998] and Graham and Harvey

[2001]). The main objective of this paper is, therefore, to compare the performance of the Fama

French model with that of CAPM, for individual stocks.

The view taken in this paper, therefore, is that of a firm estimating its cost of equity. It is

assumed that if estimation is based on CAPM then an estimate for beta is obtained using a simple

OLS regression and this estimate is multiplied by an estimate for the risk premium on the market

to obtain an estimate for excess return on equity2. If estimation is based on Fama French then an

estimate for the beta for each factor is obtained, also using a simple OLS regression, and these

estimates are multiplied by the risk premium for the relevant factor to obtain an estimate for cost

of equity. That is, for both CAPM and Fama French, it is assumed that an estimate for cost of

equity is obtained using a simple estimation technique, in particular in relation to the amount of

data required for estimation. For the method described here the only data requirements are the

return on a market index and the return on the stock, over the estimation period, if CAPM is

used. If Fama French is used then data for the additional two factors is also required. There are a

variety of different methods available to improve the estimates of beta and for implementing the

2From Bartholdy and Peare [2003] this procedure results in a biased estimate for cost of equity. This, however, is

not the focus of this paper. The focus here is on the “quality” of the beta estimate(s) obtained from CAPM and Fama

French, for estimation of cost of equity, when a very simple estimation technique is used. Of course, in this paper

the unbiased method recommended in Peare and Bartholdy [2003] is used for evaluation of beta estimates. Further,

this technique, however, does not involve additional costs in terms of econometric sophistication or data required.

1We are aware that it is not possible to estimate CAPM since the world market portfolio is not observable; that what

is in fact estimated is a single factor model. This is, however, referred to as “estimation based on CAPM”

throughout the paper as this is consistent with common usage.

Page 4

two models, however, all of these methods require returns on a large sample of stocks, to form

portfolios for example. This amount of data is only available at significant expense. This paper,

therefore, compares the performance of the CAPM with the Fama French model under the

assumption that a simple estimation technique, in particular in relation to the amount if data

required, is used. That is, comparison is made from the point of view of the practitioner3.

To compare the performance of CAPM and the Fama and French model, in this context, we

need to obtain estimates for expected return based on each of these models. To make a fair

comparison we need the “best” possible estimate for expected return in each case. What do we

mean by “best”? Since the view taken here is that of the practitioner who needs an estimate for

cost of equity, a financial manager making a capital budgeting decision for example, the

objective here is to find the model and data that provides the “best” estimate for next year’s

return, using a simple estimation approach. Now the R2 from a cross section regression using

individual one year stock returns as the dependent variable and estimated factor(s) based on past

returns as the explanatory variable(s) measures how much of the differences in individual stock

returns is explained by the estimation procedure. By “best”, therefore, we mean the model and

data that results in the highest R2, when a simple estimation procedure is used.

Despite the existence of a large academic literature which discusses implementation of CAPM,

in particular in relation to estimation of the key parameter beta, there is no consensus in relation

to how a best estimate should be obtained. There is no consensus with respect to the index, time

frame, and data frequency that should be used for estimation. Previous research has focused on

reasons for differences in estimated betas between periods and the ability of historical betas to

predict future betas. See for example, Blume [1975], Carleton and Lakonishok [1985],

Klemkosky [1975], and Reilly and Wright [1988]. As illustrated by the quote at the beginning of

this paper the situation is no better among professional beta providers4. This lack of consensus

manifests itself in different beta estimates for the same company by different beta providers.

Bruner et al. [1998], for example, found the average beta for a small sample of stocks to be 1.03

4See Reilly and Wright [1988] for a discussion of Merill Lynch’s betas. A discussion of Ibbotson Associates’ Beta

Book can be found at the following address: www.ibbotson.com/Products/BetaBook/beta_sam.htm.

3The problems associated with this approach, such as measurement errors in the various explanatory variables, are

well documented. We know that this simple technique is not the most efficient from an econometric point of view,

although it may be from an economic point. The results in this paper should be interpreted as a test of CAPM and

Fama and French, given the simple estimation techniques available to companies, and not as a formal econometric

test of CAPM against the Fama French model.

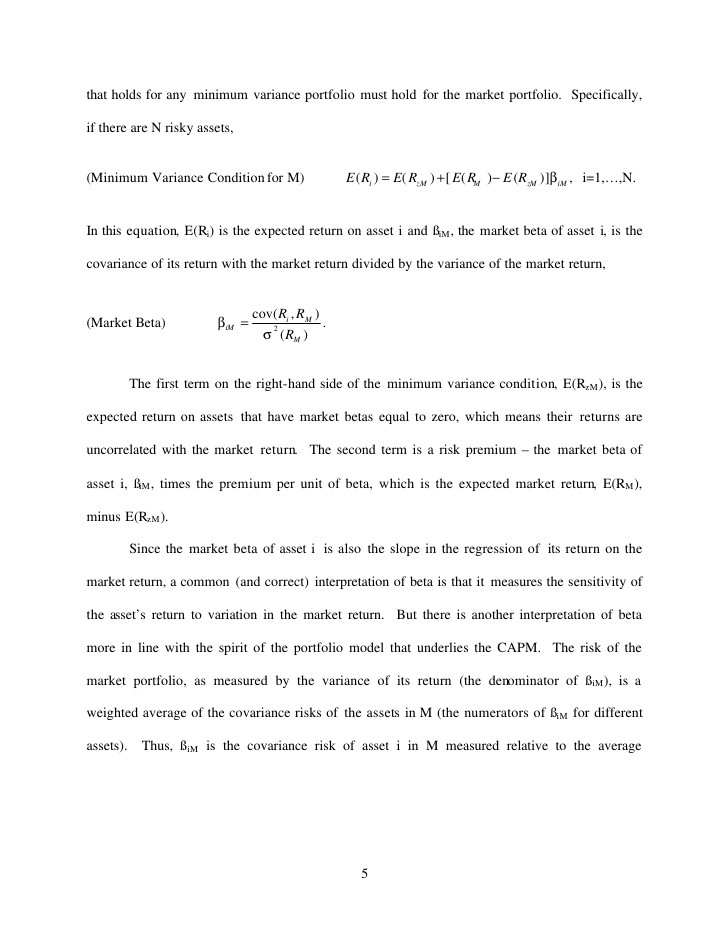

Page 5

using betas provided by Bloomberg whereas using Value Line betas it was 1.24. A difference of

this magnitude results in significantly different expected returns (costs of equity) for individual

companies leading potentially to conflicting financial decisions, in capital budgeting for

example. The second objective of this paper is, therefore, to find the best index, time frame, and

data frequency for estimating beta, and therefore expected return, based on CAPM. Two other

issues are also examined; whether or not dividends should be included in the returns and whether

raw returns or excess returns should be used when estimating beta.

The results obtained suggest that, for estimation of beta, five years of monthly data are in fact the

appropriate time period and data frequency. However, it is also found that an equal-weighted

index, as opposed to the commonly recommended value-weighted index, provides a better

estimate. It does not appear to matter whether dividends are included in the index or not or

whether raw returns or excess returns are used in the regression equation. Richard Roll pointed

out in his presidential address to the American Finance Association (Roll [1988]) the general

performance of “beta” in explaining portfolio returns is not great. As discussed above for many

practical applications it is individual returns that are relevant so it is pertinent to ask how well

(or poorly!) CAPM explains returns on individual stocks. From the results obtained here the

answer is once again, not great. The “best” estimates, namely those obtained using five years of

monthly data and an equal-weighted index are, on average, only able to explain about three

percent of differences in returns on individual stocks. It is therefore surprising that CAPM is

used at all by practitioners.

The main alternative to CAPM and the one academics recommend, at least for estimation of

portfolio returns, is the three factor model suggested by Fama and French [1992 and 1993]. In

this model size and book to market factors are included, in addition to a market index, as

explanatory variables. As discussed above, this model is not popular among practitioners. The

question is, why? In an attempt to answer this question the performance of the three factor model

is compared with that of CAPM. Using five years of monthly data it is found that the Fama

French model is at best able to explain, on average, five percent of differences in returns on

individual stocks, independent of the index used. Such a small gain in explanatory power

probably does not justify the extra work involved in including two more factors.

The remainder of the paper is organised as follows. In Section 1 various issues associated with

estimation of expected return based on CAPM, are discussed. The Fama and French three factor

Page 6

model is presented in Section 2. A description of the data used for analysis is provided in Section