Equity Valuation Class Country Equity Risk Premiums and Betas Fat Pitch Financials

Post on: 8 Май, 2015 No Comment

Sorry about the delay in getting to lesson four of Professor Damodarans Equity Valuation class. I was just having too much fun reading all about the Berkshire Hathaway Annual Shareholders Meeting last week and I ran out of time to squeeze in a class lecture.

Country Equity Risk Premiums

This weeks class started on the topic of country equity risk premiums on slide 32 of the Discounted Cashflow Valuation presentation (pdf). Professor Damodaran started out by noting that India just received an investment grade rating for the first time. One typically expects as country risk goes down that usually expect equity values go up. This wasnt really clear for Indias stock prices after the rating increase earlier this year.

I had a few issues with the discussion of country equity risk premiums, so Ill keep this short. Damodaran presents three way country equity risk premium can be estimated:

- Assume that every company in the country is equally exposed to country risk.

- Assume that a companys exposure to country risk is similar to its exposure to other market risk (i.e., Beta).

- Treat country risk as a separate risk factor and allow firms to have different exposures to country risk (perhaps based upon the proportion of their revenues come from non-domestic sales)

I think the third approach made the most sense. In this approach, Damodaran creates a term he labels λ. This lambda measures a companys risk exposure to a country

based upon the proportion of its revenues that come from non-domestic sales, location of its production facilities, and use of risk management products. The thought here is that a companys country risk exposure is determined by where it does business, not necesarily by where it is located. Really, the only practical component of country risk that can be easily measured is the proportion of revenues generated by a company in each country.

Damodaran looks at how sensitive a company is to country risk by regressing it its earnings to the countrys bond rate. There is also a cross market risk factor. If the Russian stock market collapse, it still causes impacts in far away Singapore. Damodaran believes there is a joint risk factor among emerging markets. I think this is a reasonable assumption given how global markets have become and also based on my experience at seeing how a market shock in China can ripple throughout all the world markets.

Damodaran notes that equity research analysts may be assigning too much risk to some emerging market companies that generate most of their revenues in developed stable countries such as the US. He then lays out a strategy for taking advantage of this potential miscalculation. He recommends identifying a few companies in each country that generate most of their revenues in stable countries. Then under this strategy we should wait for a crisis in an emerging market before investing. I like the concept of waiting for a crisis, but I think two other things need to be factored in. First, I think in addition to selecting emerging market companies that generate most of their revenues in stable countries, we should also give preference to those companies that have global competitive advantages. Second, we should be cautious in investing after a crisis in an emerging market if critical infrastructure utilized by a selected company has been severely damaged or if property rights are in danger of collapsing.

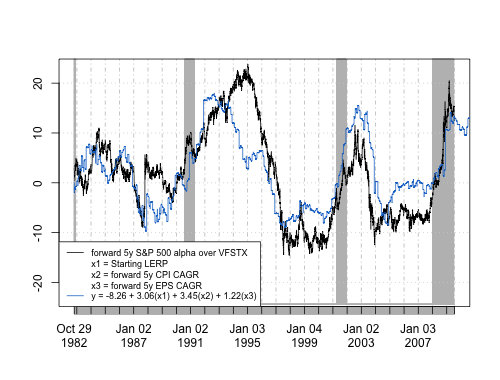

Lower and more stable interest rates are good for equity risk. Shifting equity risk premiums comes from investors stomachs. Each morning we wake up with a different gut sense of how risky the world is and this collective gut sense impacts the mood of Mr. Market. Most daily fluctuations in stock prices come from changes in our perceived risk.

I found it interesting that Damodaran notes that historical risk premiums (probably the most commonly used) are too high and will result in you finding stocks to be overvalued. Using the current implied equity risk premium is more market neutral. The average implied equity risk premium between 1960-2003 in the United States is about 4%. When using the historical implied equity risk premium, you are assuming that the market is correct on average but not necessarily at any given point in time.

Beta

Beta is probably the least useful topic in this course, but it is still good to know what it is. The standard procedure for estimating betas is to regress stock returns against market returns. The slope of the regression is Beta. In reality, regression beta calculations are a waste of time because they depend highly on the index chosen.

There are a few non-regression based methods for estimating Beta. You could look at the standard deviation in stock prices instead of regressing against an index. You could also regress accounting earnings or revenues against those of an index. This seems somewhat more attractive but still probably not worth the effort.

I recommend looking at slide 54, which has a diagram of beta of equity. I think this slide does a good job at breaking down the sources of potential risk faced by companies. The diagram breaks risk down into risks that come from the nature of the products and/or services provided by a company, the amount of fixed costs in proportion to total costs, and obviously financial leverage. I would add a category for the risks associated with bad management and the risks associated with loosing any competitive advantages a company may have due to increasing competition or potential technological change.

This lecture ended on the topic of bottom up beta. This is Damodarans preferred method and what he will discuss in the next lecture.

Here is this weeks discussion question:

How should value investors utilize the concepts of country equity risk premium and betas?