Equity Option Strategies Protective Puts

Post on: 20 Июль, 2015 No Comment

The Equity Strategy Workshop is a collection of discussion pieces followed by interactive worksheets. The workshop is designed to assist individuals in learning how options work and in understanding various options strategies. These discussions and materials are for educational purposes only and are not intended to provide investment advice.

Access to, or delivery of a copy of, the Options Disclosure Document must accompany this worksheet.

Who Should Consider Using Protective Puts?

- A stock-owning investor who doesn’t want to sell the shares because they may increase in value, but wants to protect his unrealized profits (if any).

- An investor who is considering a stock purchase but at the same time is concerned with downside risk.

Today’s investors are often confronted with uncertainties about the stock market. During bull markets they might be worried about market corrections, and during bear markets that their stocks could fall further. This uncertainty can lead to reluctance to invest, and strong up moves might be missed. Just like insuring other valuable assets like homes and automobiles, stock positions can also be insured, and this is exactly what a protective put accomplishes. Although not suitable for all investors, buying puts to protect an existing stock position, or simultaneously purchasing stock and puts, can supply the insurance needed for those shares to overcome doubts about the marketplace. Typically, by paying a put premium that is relatively small compared to the market value of the stock, an investor knows that no matter how far the stock drops he has a guaranteed selling price. By exercising the put, underlying shares can be sold at the strike price at anytime until the option expires.

Definition

Buying a protective put involves buying one put contract for every 100 shares of underlying stock already owned or simultaneously purchased. This put guarantees the owner the right, but not the obligation, to sell the shares at the strike price at any time until the option expires, no matter how low the stock declines in value. And just as with other forms of insurance the investor pays a premium for this protection — the premium paid for the put.

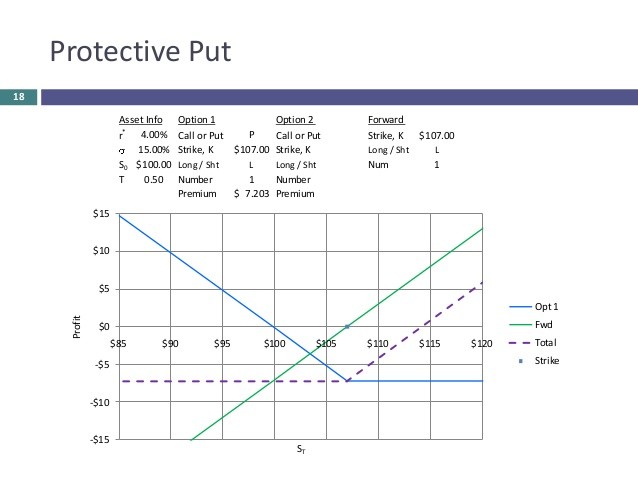

The protective put’s upside profit potential is unlimited as long as the price of the underlying stock continues to rise. However, purchasing a protective put in effect increases the purchase price of the stock by the premium paid for the option contract. When the underlying shares are ultimately sold, whether by exercising the put after a stock price decline or by simply selling the shares after a stock increase, the net price received will be the sale price less the put premium paid. The break-even point for this strategy at expiration can be calculated in advance as the stock’s purchase price plus the put premium paid.

Another benefit of the protective put is that the investor is in total control of the sale of the protected shares. Since the protection provided is a long option position, whether or not the put is exercised, and the underlying shares sold, is entirely up to the investor. If the underlying stock has declined below the put’s strike price before it expires, and the put is in-the-money with intrinsic value, the put may be sold instead of exercised and the shares retained. Regardless of the investor’s decision at option expiration, during the lifetime of the put contract the investor continues to receive any dividends paid to stockholders as long as the underlying shares are owned.