Equity Mutual Fund Portfolio Comparison Tool

Post on: 3 Июль, 2015 No Comment

Use this excel tool to compare mutual fund stock holdings and determine the extent of portfolio overlap among your mutual fund holdings. The tool can help you build a well-diversified equity portfolio. An investment portfolio should be diversified in two ways

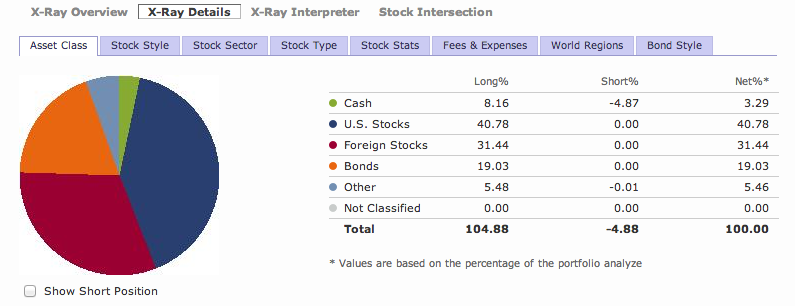

- Across asset classes like equity/stocks, bonds, gold, cash etc. The allocation to each asset class depends on the duration available for investment and to a certain extent the risk profile of the individual. For effective allocation, we should have a realistic net rate of post-tax rate of return in mind .

- Within each asset class. The equity component of a portfolio should ideally consist of a basket of stocks that differ in market capitalization and countries. Similarly, the debt component should consist of bonds of differing risk.

The main aim of diversifying within an asset class is to reduce the volatility (fluctuating returns) of the portfolio. Here is an example of how diversification across asset classe s works. A portfolio of 25% stocks, 25% long term bonds, 25% gold and 25% cash/liquid(short-term) debt is known as the permanent portfolio . I had earlier reviewed its suitability as a low-volatility option by considering Sensex, fixed deposits, gold and a savings bank account returns. Here is the plot of the historical returns of the individual assets: Sensex (left axes), FD/Gold/SB account (right axes), along with a portfolio (green) which consists of 25% of each asset class rebalanced each year.

An example of diversification across asset classes

Notice that although the individual asset classes (stocks and gold and FDs) are volatile to varying extents, the volatility of the portfolio is much lower. Observe also the consistency of the (pre-tax) returns. Diversification within an asset class also works on the same idea but perhaps a little less dramatic. Adding small-cap and mid-cap stocks to an equity basket of large-cap stocks will decrease the volatility of the portfolio! This may seem counter-intuitive, as we are adding stocks of higher risk. However, it should be kept in mind that large-cap stocks and mid-cap/small-cap stocks are not well correlated. That is, mid-cap/small-cap stock prices do not depend heavily on large-cap stock prices. Therefore adding riskier stocks (or bonds) poorly correlated with existing stocks (or bonds) reduces the volatility of the portfolio. As an example, imagine two investors A and B. Investor A has an equity portfolio consisting only of Indian stocks. The equity portfolio of investor B has US, Indian, European, and Asian stocks. Who do you think made more returns in the last 5-6 years? If you would like to understand this concept better, I recommend you read, Think, Act and Invest like Warren Buffet by Larry E. Swedroe (affiliate link) Mutual Funds The best and easiest way to diversify within and across asset classes is via mutual funds. While diversifying within an asset class it is important to buy mutual funds with very little overlap in their portfolios. The number of mutual funds held does not matter. Holding 2-3 large-cap mutual funds alone is not diversification at all, as the portfolio of the funds would be largely identical. Therefore, the idea is to hold 2-3 mutual funds with little or no overall in portfolio holdings. The simplest way to do this would be invest in funds with different objectives. For example, a large-cap fund and a mid-/ small-cap fund will have little or no portfolio overlap For example, IDFC Premier Equity and Franklin India Blue Chip have only 8% overlap between their stock holdings. Unfortunately, very few investors have mutual funds with little or no portfolio overlap. If there is an easy way to check the overlap in mutual fund stock holdings, we can all build ourselves a well diversified equity portfolio.

Equity Mutual Fund Portfolio Comparison Tool

Use this stock comparison tool to check the overlap in portfolios of three equity mutual funds. The excel file extracts the portfolio holdings from Value Research Online’s fund portfolio page and

- determines the percentage of stock portfolio overlap. This will indicate how diversified an investors equity portfolio is. Investors can then make suitable changes to improve diversification.

- lists common stocks among three equity mutual funds.

- displays the sector-wise allocation. This also an indication of diversification.

Here are some random results using this tool

Update:

Mutual Fund Portfolio Comparison Tool (May 2014)

All opened-ended funds have now been included for comparing portfolio composition. Equity oriented balanced funds are also included.

Download the Equity Mutual Fund Portfolio Comparison Tool (Nov 2013) If you have tested this tool, please spare a moment to let me know your comments and suggestions.