Equity Indexed Annuities Investment U

Post on: 27 Июнь, 2015 No Comment

Equity Indexed Annuities

The Investment U E-Letter: Issue # 387

Monday, November 15, 2004

Equity Indexed Annuities

By Dr. Steve Sjuggerud, Chairman, Investment U

You really mean I can’t lose money? I asked my good friend Jeff Winn. who’s been an investment advisor since we graduated from the University of Florida in the early 1990s.

That’s right. At the end of a year, your principal will never go down.

I know there’s no free lunch in this world. But I also know that the way to make money is to limit your downside risk (to prevent a catastrophic loss), and leave your upside potential as unlimited as possible.

In the investment Jeff was telling me about — called equity indexed annuities — limiting your downside risk and giving your upside unlimited potential are both possible. Here’s a little more from our talk

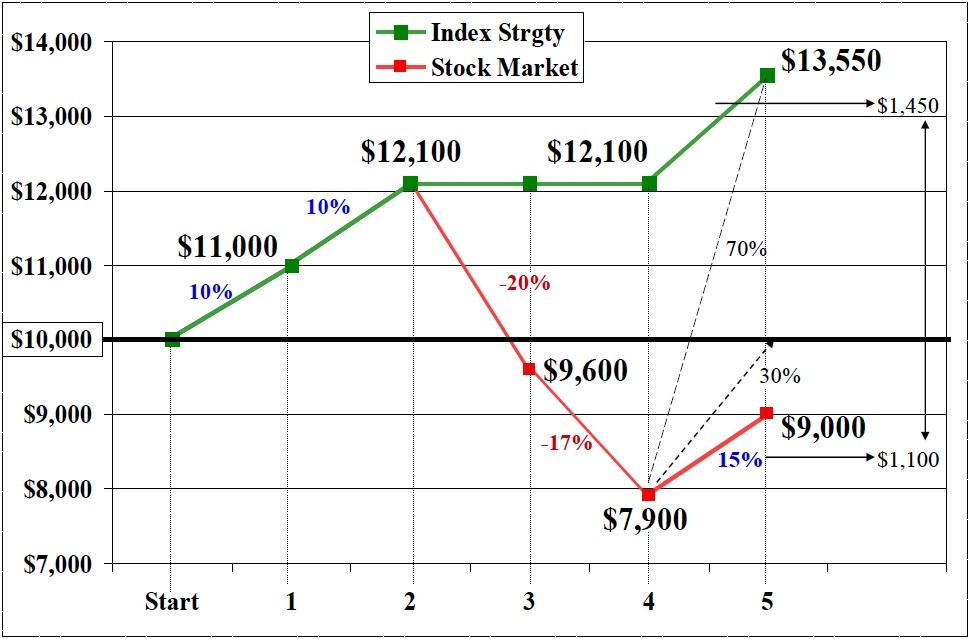

Jeff. Steve, look at it this way If you invest $100,000 in the first year, and the market falls by 20%, the value of your investment will be $100,000. And in the second year, if the market goes up by 20%, then your investment will be worth $120,000.

I find that a ridiculously good offer your portfolio never has to recover from a fall. No downside, and all the upside, that doesn’t seem right How can it be possible?

Jeff. Well, you get almost all of the upside of the stock market In the equity indexed annuities investment I’m talking about, you’re capped to a 2.7% gain in the stock market in any one month. Let me give an extreme example If the market is flat for 11 months, and then goes up 12% in December, then you’re only credited for 2.7% for the year. As another extreme example, if the market is up 2% every month for the whole year, than you never bumped into the cap and get to keep all those gains.

So, how have equity indexed annuities actually performed?

Jeff. Some specific history here might be helpful This indexed annuity investment returned over 17% last year. And, as of the beginning of the year, $100,000 invested at the beginning of 1999 was worth over $135,000, while the S&P 500 was still well under water. Also, all these gains are tax-deferred, similar to an IRA.

So these things are called equity indexed annuities, huh? I don’t know a lot about annuities. But I used to hear that fees were high. What’s the story with annuities?

Jeff. There is generally a ‘surrender charge’ that usually declines every year and eventually disappears in seven years’ time, in the equity indexed annuity I’ve been recommending. If you can hold for seven years, then you will have gotten most of the upside and none of the downside of the stock market, with the only ‘cost’ being the fact that your upside was limited to 2.7% in any month. That’s a fair trade-off to me. For the full story, you might want to check out Jack Marrion’s website

www.indexannuity.org. Here are a few recent points from Jack:

So what’s the REAL risk? Jack Marrion says: The biggest risk an index annuity owner faces is that they might have earned a higher return in another vehicle (but then again, hindsight’s always 20-20).

The idea with equity indexed annuities is that, over time, they’d beat your fixed investments like CDs and bonds, but may underperform the stock market. It’s quite possible that these equity index annuities could beat both fixed investments and the stock market over the next few years. And they would do so with less risk — as neither stocks nor bonds guarantee that you’ll make money.

Understanding Equity Indexed Annuities: Three Steps to Get You Started

Indexed annuities are not right for everyone. But if you’re over 50, and not particularly optimistic about the stock market these may be something of interest to you. If the idea of guaranteed minimum returns with a stock-like upside is interesting to you, I recommend you do three things:

www.indexannuity.org. where equity indexed annuities are explained inside and out with both a beginner and expert investor perspective.

www.ins.state.il.us/Life_Annuities/equityindex.htm Once you’ve done that, to determine which indexed annuity might be appropriate for you, then

Lastly, be aware that I don’t consider myself any kind of expert in this area, and I don’t own nor have never bought an equity indexed annuity (but I’m not in my 50s yet). Please make sure you do plenty of your own homework to determine if this is right for you

Today’s IU Cribsheet