Equal Weight ETFdb Portfolio

Post on: 21 Июль, 2015 No Comment

Published on by Stoyan Bojinov on July 14, 2011 | Updated February 14, 2013

Portfolio Strategy

The Equal Weight ETFdb Portfolio is designed for investors who are seeking to build a broad-based portfolio but wish to avoid holding traditional market cap-weighted funds. The investment thesis behind equal weighting has been gaining popularity as this strategy avoids the many pitfalls of market cap-weighted funds while also offering several distinguishing benefits often overlooked by novice investors. In a traditional market cap-weighted index, such as the S&P 500, each component stock is weighted according to its market capitalization (trading price multiplied by shares outstanding). Because cap-weighted indexes determine the allocation given to each security based on the company’s market capitalization–and therefore the price of the stock–there is a tendency to overweight overvalued companies and underweight undervalued stocks.

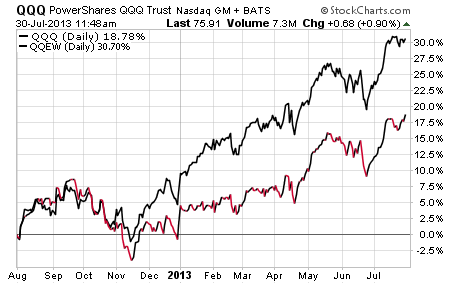

Historical performance suggests that bottom line returns are in fact impacted by the choice of weighting methodology employed. In 2010 for example, SPY. which tracks the S&P 500 Index, lagged behind the the Rydex S&P 500 Equal Weight ETF (RSP ) by about 600 basis points. Those two ETFs maintain the exact same holdings, but use different methodologies to assign weightings to the 500 component stocks. The significant difference in performance reveals valuable insights about the inefficiency of traditional cap-weighted funds. Most notably, cap weighting has a tendency to overweight overvalued stocks and underweight undervalued ETFs. Because equal-weighted funds break the link between stock price and weighting, they steer clear of some of these potentially undesirable tendencies.

Equal weighting can also enhance the diversification offered relative to cap-weighted funds. For example, the Russell 1000 Index Fund (IWB ) offers exposure to a broad basket of securities, but its cap-weighted construction results in top-heavy characteristics; the top 10% of holdings account for more than 50% of assets. In an equal-weighted index, such as EWRI. the top 10% of companies would account for about 10% of total assets.

Pro Membership Required to Continue Reading

To continue reading this article, you must be an ETFdb Pro member. Please login or begin your 14-day free trial to continue reading. There are several benefits to becoming an ETFdb Pro member today:

- Access to 50+ All-ETF model portfolios . Whether you’re a long-term, buy-and-hold investor or a more active trader looking to establish a tactical position, our collection of ETFdb Portfolios has something for everyone.

- ETFdb Realtime Ratings show you exactly where each fund stacks up next to the competition. Get objective, in-depth, custom research on every ETF.

- Pro members have Unlimited Excel Download capabilities across the entire database; users can easily download more than 200 data filled paged and also export results to Microsoft Excel from every tool.

- Get ETF Picks of the Month . For active investors seeking ETF investment ideas, our team analyzes technical and fundamental price drivers of more than 1,400 ETFs to identify both short and longer-term opportunities with a focus on absolute returns. Recommendations are actionable investment ideas that are poised for outperformance over the next week to 90 days.