Equal weight approach more popular than ever ten years after S&P 500 Equal Weight Index (EWI) and

Post on: 21 Июль, 2015 No Comment

Equal weight approach more popular than ever, ten years after S&P 500 EWI and ETF debut

The pioneering S&P 500 Equal Weight Index (EWI) marked its tenth anniversary in January. Prior to its launch, the overwhelming majority of indices were weighted by market capitalisation. And while market capitalisation weightings still dominate today, alternatively weighted approaches are becoming increasingly popular.

David M. Blitzer, Managing Director and Chairman of the Index Committee at S&P Dow Jones Indices.

Although the S&P 500 EWI was certainly not the first non-market cap weighted index (the MSCI GDP Weighted Indices. for example, were published in the 1990s), it represented the first major equity index to use an alternative weighting methodology and the first such index to be widely used for investable index-linked products.

Since the introduction of the S&P 500 EWI, several indices using alternative weighting schemes have been developed and the area has become a fertile ground for index research and product development. This is epitomised by the huge interest in so-called ‘smart beta’ products, which are fundamentally simply alternatively weighted products.

Hot on the heels of the S&P 500 EWI launch back in 2003 was an exchange-traded fund (ETF) linked to it – the Guggenheim S&P 500 Equal Weight ETF (RSP). This was the industry’s first alternatively weighted ETF and is still going strong today with more than $3.7 billion in assets under management.

So what exactly does the S&P 500 EWI do? Essentially, it provides equal exposure to each of the 500 stocks within the S&P 500 Index. ensuring that smaller cap names are weighted as heavily as market giants, therefore eliminating the large-cap bias of traditional capitalisation weighted indices.

Due mostly to the nature of the equal weighted scheme, an equal weighted index has several different properties from its corresponding parent index. For instance, the S&P 500 EWI tends to have a lower stock concentration than the S&P 500, a higher turnover due to the quarterly rebalancing of weights back to equal weights, and higher liquidity constraints since all stocks in the index are given the same weight regardless of market cap.

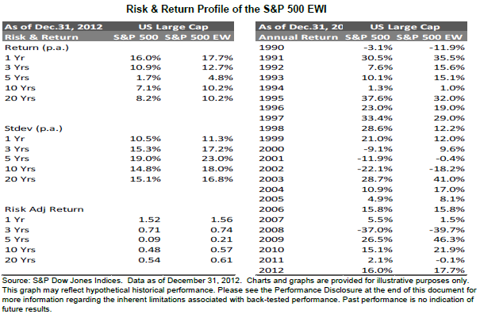

David M. Blitzer, Managing Director and Chairman of the Index Committee at S&P Dow Jones Indices. said: “Over the past decade or two, the market has learned a great deal about the important role that weights play in index design – a lesson clearly on display when one looks at the characteristics of equal vs. market capitalisation weighting. Equal weighting over-weights small cap and value stocks to take advantage of the most successful anomalies in stock selection. The best demonstration of this is the weighted performance margin was 161 basis points annually.”

William Belden, Managing Director for Guggenheim Investments. added: “Broad diversification across market segments may help reduce concentration risk, providing more balanced exposure across market capitalisations, sectors and other risk factors. Like its benchmark index, RSP rebalances quarterly to its original equal weights, which may result in unbiased exposure to market risk factors, enhanced risk controls and opportunity to capture long-term equity market performance.”

Based on the performance of the Guggenheim ETF, the index has performed very strongly. Since its launch on 24 April, 2003, the fund has outperformed the conventional market cap weighted S&P 500 Index, delivering a 10.36% average annual total return against the S&P 500’s 7.71% average annual total return (through 22 April, 2013). For 2013, the fund is up 11.15%, versus the S&P 500’s performance of 7.71%.

The Guggenheim fund is listed on the NYSE Arca and is primarily aimed at US-based investors. UK and Continental European investors keen to explore this approach have a couple of options. For access to the S&P 500 EWI itself, Deutsche Asset & Wealth Management. a subsidiary of Deutsche Bank, offers the db X-trackers S&P 500 Equal Weight UCITS ETF (XSEW) listed on the London, Luxembourg and Deutsche Börse exchanges. Alternatively, for equal weight exposure to European equities, Paris-based Ossiam offers ETFs on the Stoxx Europe 600 and Euro Stoxx 50 indices cross-listed on a number of European exchanges (including London Stock Exchange).

An evolution of the equal weight approach – and a demonstration of fertility of the alternative index space – is reflected in the Euro iStoxx 50 Equal Risk Index. This innovative index applies an equal risk contribution (ERC) concept to the Euro Stoxx 50. The ERC concept spreads the overall risk of the portfolio equally between the 50 index components to achieve maximum risk diversification. Investors can access this index via the Euronext-listed Lyxor ETF Euro Smartix iStoxx 50 Equal Risk (ERC) .

You may also be interested in: