Environmental Industries Industry Facts

Post on: 16 Март, 2015 No Comment

The Office of Energy and Environmental Industries (OEEI) is part of the Manufacturing section of the Manufacturing and Services Division of the International Trade Administration of the U.S. Department of Commerce. Its primary mission is to promote U.S. commercial and economic interests related to international trade and investment in energy and environmental technologies (goods and services).

The office:

- analyzes international market trends; identifies export opportunities for American companies; disseminates trade leads to industry; counsels companies on export strategies; conducts a range of trade promotion activities; develops trade policy positions aimed at increasing free and fair trade; participates in trade negotiations and consultations; and advocates on behalf of U.S. exporters in particular transactions.

This web site focuses on the environmental industries and is maintained by the environmental industries team of the office. Here is a link to our site focused on energy industries.

Industry Background and Definition :

In general and as well as for the purpose of this report, the environmental technologies (ET) industry is defined as all goods and services that generate revenue associated with environmental protection, assessment, compliance with environmental regulations, pollution control and prevention, waste management, renewable energy, remediation of contaminated property, design and operation of environmental infrastructure, and the provision and delivery of environmental resources. According to Environmental Business International (EBI), employment for the U.S. ET industry is approximately 1.6 million for all segments, producing revenues of $290 billion. The U.S. ET industry revenue is broken down into the various industry segments as follows: services (47%), equipment (21%), and resources (32%).

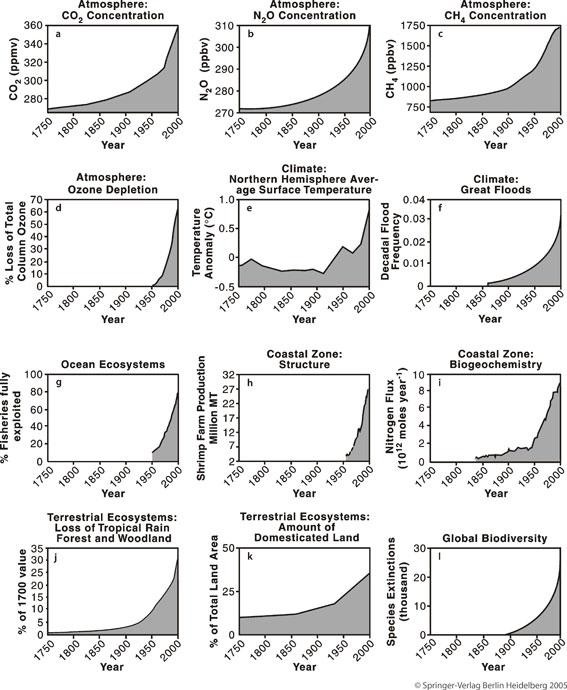

Key subsectors for products and services of the ET industry include: air, water, and soil pollution control; solid and toxic waste management; recycling; renewable energy; pollution prevention and resource recovery; site remediation; environmental monitoring; and water treatment for industrial and municipal water use. This sector is extremely broad and includes a wide variety of products and services that cut across many different industry sectors. The ET industry evolved in response to concerns about the risks and costs of pollution and the enactment of pollution control legislation and regulations in the United States and around the world. It is now increasingly driven by sustainability concerns.

Importance of the Sector :

The global ET market is approximately $782 billion.

The U.S. is the worlds largest producer and consumer of environmental technologies worldwide.

In the United States, approximately 119,000 enterprises are engaged in the ET business.

The U.S. ET industry generates approximately $300 billion in revenues, $43.8 billion in exports. and supports close to 1.7 million jobs.

(2008 Environmental Business International)

Global Competitiveness Factors :

The United States is regarded as a world leader in many ET categories, including: engineering, design, construction, and consulting services; pollution prevention and resource recovery; water and wastewater handling and treatment equipment; stationary and mobile source air pollution monitoring and control equipment; solid and hazardous waste management; contaminated site remediation; automation for treatment systems and monitoring equipment; and information systems/software for environmental management and analysis.

While 99 percent of U.S. ET private sector companies fall under the small and medium-sized enterprises (SMEs) category, they generate only 20 percent of the total U.S. ET revenue. Large ET companies, which represent only one percent of all private sector activity, account for 49 percent of total U.S. ET revenue. Public-sector municipalities and similar entities account the remaining 31 percent of revenue and dominate water utilities, wastewater treatment works, and solid waste management.

The ET industry continues to experience consolidation as larger ET companies typically arise through mergers and acquisitions, not internal growth. More change of ownership and structure is likely to continue.

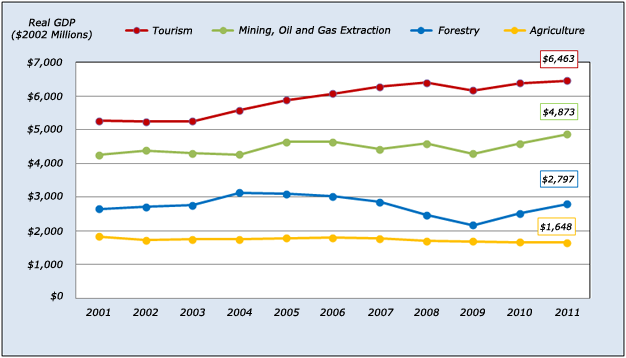

U.S. Environmental Export Competitiveness 2004-2008