Enhanced ETFs A Different Approach to Passive Investing US News

Post on: 16 Март, 2015 No Comment

Enhanced ETFs use formulas to whittle down traditional indices to the best of the best.

Kelly Campbell

Exchange-traded funds haven’t been around for very long and many investors still don’t understand them. While many are a plain-vanilla type investment, some offer an allocation that could significantly enhance a portfolio.

Many ETFs are based on an index and are passively managed. They have gained popularity because they are diversified, easy-to-trade, tax efficient and cover many hard-to-access asset classes. While many investors use mainstream ETFs, there is a different classification of ETFs some investors do not know about called an enhanced index ETF.

An enhanced index takes one of the typical indices and reduces the securities down to the best of the best using a formula.

A standard ETF may be based on the S&P 500 index, a weighted average of 500 stocks said to represent the largest companies traded on the stock exchanges. It is a representation of the market, but because it is weighted, a majority of the index value is contained in a small number of stocks.

An enhanced ETF could begin with the same index, but possess several formulas that potentially change the number of stocks and the value contained in each. For example, the first formula that enhances the index could change from one that is weighted to one that is evenly distributed. A second formula could rank the 500 companies according to sales, book value, net profits or even dividends. From that formula, the fund may limit the investment to the top 50 stocks of the ranking. Securities could be rescreened several times throughout the year to ensure they still fit the formula criteria.

[For more investing and money advice, visit U.S. News Money. or find us on Facebook or Twitter .]

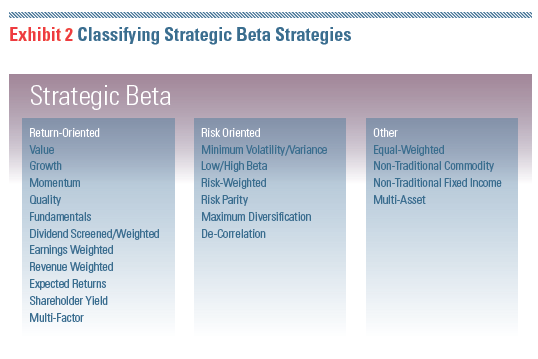

There are many types of enhanced ETFs and the formulas they use come in many shapes and sizes. Here are a few of the screening strategies that whittle a broader index down to stocks you actually want to own:

It takes a little extra work to find the perfect enhanced index ETF for you, but it could definitely be worth the effort. Now that you know about enhanced indexing, you have a leg up on all those passive ETF investors.

Good luck and happy investing.

Kelly Campbell , Certified Financial Planner and Accredited Investment Fiduciary, is founder of Campbell Wealth Management. a Registered Investment Advisor in Fairfax, Va. Campbell is also the author of Fire Your Broker. a controversial look at the broker industry written as an empathetic response to the trials and tribulations many investors have faced as the stock market cratered and their advisers abandoned their responsibilities to help them weather the storm.