End Of QE How Will It Affect Our Stock Market

Post on: 28 Май, 2015 No Comment

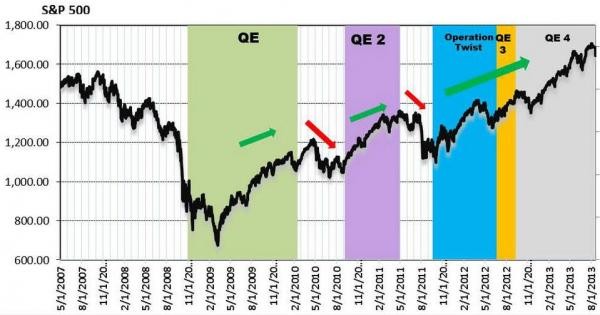

While concerns of the tapering of quantitative easing (QE) by the Fed remains in the backdrop in the recent couple of weeks, markets have been turning bad news into good news; relating any poor data to more central bank assistance. However, with signs of an economic revival in the US, the “bad news” of the Fed ending stimulus measures could possibly come true in time.

Significantly, tapering off the QE measures would bring about the end of the low interest rate environment. When low interest rates become a thing of the past, increasing cost of capital would almost certainly hamper growth for many firms. So, delving into our local market, which are some of the sectors that would be affected?

The Cash Rich Versus The Highly Leveraged

When there is an interest rate spike, companies sitting on huge cash piles would not be as affected as those which are highly leveraged. Highly-geared companies would be most at risk as they could see the increased cost of debt become a drag on their earnings. This is especially so if their debt is pegged to floating rates.

Also, the higher cost of capital would become an important consideration on companies’ expansion plans and the number of projects that can be taken up. Notably, Olam International is one company having to balance between its expansion plans and generating positive cash flow as the acquisition spree it went on previously made it one of the highest leveraged commodity player.

The Capital Providers Versus The Capital Intensive

Banks would be able to benefit from the rising interest rates from pricing up business loans gradually as raising money in the bond market gets more costly. Additionally, existing loans, which are pegged to a floating rate, would also improve banks’ asset position. Coupled with deposit rates sticky downwards, CIMB Research notes that the net interest margins of banks would improve in the medium term with profit from the wider spread between its assets and liabilities.

On the contrary, capital intensive sectors would be negatively affected due to high capital outlays required for their business developments. As such, some of these capital intensive companies, such as those in the real estate investment trusts (REITs) or oil and gas sectors, are also highly leveraged. Depending on the company’s credit standing and potential opportunity costs, it may consider raising more funds from equity markets instead of bearing higher costs from banks.

REITs: Darlings To Duds?

As an effective bond substitute, REITs have taken the centre stage in the low interest rate environment as investors pursue high yielding plays. However, the recent rate shocks have toppled the REITs off their recent peaks. CIMB Research noted in its report that REITs have become more expensive after Singapore’s 10-year bond yields rose from 1.4 percent to 1.8 percent and the yield gap between the REITs’ yield and the risk-free rate compressed further to 400 basis points.

With the sector coming under pressure, this narrowing yield gap (as bond yields go up) will prompt investors to re-look into their risk-return benefits from investing in REITs. Also noteworthy is that an increase in interest rates would further impact these large users of capital as it affects their ability to grow inorganically through acquisitions.

Indeed, the changing sentiment that interest rates will not always stay low is not unfounded and would continue to have an impact on the REITs. But, does that mean that REITs will be darlings no more? CIMB noted that there is also differentiation within the REIT space. While REITs with higher asset leverage and those with higher proportion of floating-rate debt would be negatively affected, quality asset plays with strong fundamentals and organic growth opportunities could mitigate those effects through active leasing efforts, asset enhancement initiatives and yield accretive investments to lift distribution.

Risk-On Versus Defensive

Finally, if the economy is deemed well enough by the Fed to turn off the liquidity tap, it may not necessarily keep markets down for long as the recovery in the US would create a supportive environment for equities, especially cyclical stocks. This could finally spark a bond-to-equity rotation as investors could take a more “risk-on” approach to ride on the recovery of the US economy. Perhaps, when risk appetite returns, defensive stocks may also retreat to the back seat as high growth plays take the spotlight.

Meanwhile, for investors who wish to switch out of the rate-sensitive sectors, MayBank Kim Eng favours stocks with high liquidity, sufficient trading volumes to absorb large positions and pointed out undervalued property developers and defensive stocks amongst its favourites.