Employment Cost Index Economic Indicators

Post on: 16 Март, 2015 No Comment

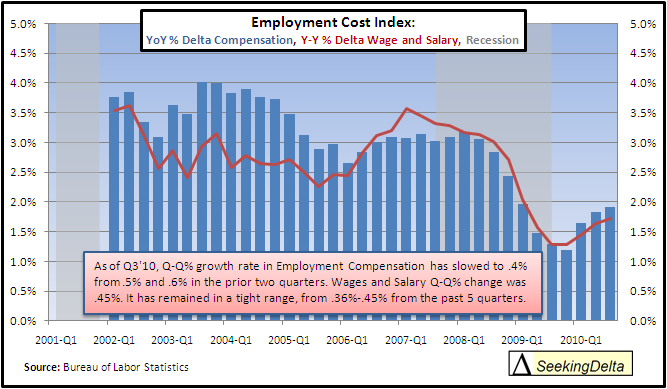

The Employment Cost Index is a report released every quarterly by the U.S. Department of Labor, as an index that measures the growth of wages and benefits paid to employees in the United States. The index is calculated based on a survey of employer payrolls in the last month of each quarter. The Employment Cost Index tracks the movement in labor costs such as salaries, fringe benefits and employee bonuses at all levels in a company.

The reasoning behind the measurement of the movements of wages and benefits is that as wage pressures go up, the tendency for inflation to occur is usually high. In addition, because employee compensation usually increases prior to increase in prices of goods and services in a country, it is necessary to measure what impact any salary increases would have on the inflation rate in a country.

Thus, an increasing employment cost index, or a jump in its value higher than is expected for a given period is considered inflationary. In addition, increase in inflation would also push up bond yields and interest rates, leading in a decrease in bond prices.

Time of Release

The Employment Cost Index report usually comes out in the US on a quarterly basis in the 3rd or last week of the month. The time of release is 9.30am US Eastern Time. The data is released on the website of the US Bureau of Labor Statistics and also on independent news feeds from Bloomberg and Thomas Reuters.

Interpreting the Data

The Employment Cost Index is a moderate impact news release. While it is not advisable to trade it directly as a news item, it is however very important as a leading indicator of consumer inflation as well as bond yields/prices. Higher ECI readings would suggest that there will be an increase in the Consumer Price Index, and this would be seen as being USD positive. A reduction in ECI readings would mean that it is less likely for inflation to occur, and this would theoretically be interpreted as being USD negative.

Conclusion

The Employment Cost Index is a very important indicator usually considered by the FOMC when planning interest rate decisions. It was also given a measure of acceptability by former US Fed Reserve Chairman Alan Greenspan who called it an indicator that ensures the accuracy of the statistics on employers’ compensation costs, and one which is relied for economic policy making and for successful business planning.