EMini Trading Channel Trading Bollinger Bands and Reversion to the Mean Theory The Fractal

Post on: 29 Август, 2015 No Comment

As I mentioned in earlier articles, I am an enthusiastic channel trader, which flies in the face of what most e-mini traders consider prudent trading. Most e-mini traders avoid trading in channels because they can be unpredictable and unprofitable. Reversion to the Mean Theory has certainly had its abuse over the years by purveyors of stocks and bonds. It is not uncommon for unscrupulous stockbrokers to tell a potential client that a stock is overpriced because it is trading over its yearly mean price. There is no correlation between eminent price movement in a stock and its distance from the mean price. This use of the Reversion to the Mean Theory is a misrepresentation of how stock prices fluctuate.

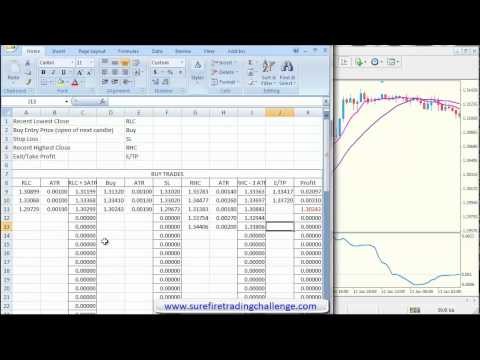

On the other hand, the theory holds great value for trading in the short term, especially when used in conjunction with Bollinger bands. I generally set by Bollinger bands at 2 standard deviations from the mean and use a setting of 10 time periods. There are other settings, which may be 14 or 18, that give satisfactory results under unusual market conditions; but I find 10 to be the most dependable setting for my personal e-mini trading.

John Bollinger, in his article, “Bollinger Bands-The Basic Rules,” states that closes outside the Bollinger bands are continuation signals not reversal signals. In nearly all cases, closes outside the Bollinger bands tend to be continuation patterns, with certain exceptions.

In reasonably symmetrical continuation channels the Bollinger bands tend to define the highs and lows of the channel. As a quick aside, symmetrical continuation channels refer to channels where the price action is ricocheting off the top line of the Bollinger band and moving in a direct line, with little retracement, to the mean line or the bottom Bollinger band line. These channels are a delight to trade as they are usually very low volume formations and occur during the stand down period (from 11 AM CST to 12:30 PM CST with some daily variations). During the stand down period the market is often dominated by smaller traders. This is especially true on the YM e-mini contract. In a typical trade, the smaller traders will try to push the price action outside the Bollinger band and typically fail. It is at this time that I fade the failed breakout back into the channel.

With very few exceptions, the price action in the above-described scenario will revert to the mean average at the center of the Bollinger bands. I have used this technique for several years and can assure you that continuation channels seldom breakout or breakdown. A more likely scenario for this price action is a reversion to the mean centerline of the Bollinger bands or a move to the lower Bollinger band. (Or an exactly the opposite, depending on the direction of your trade.) The tendency for continuation patterns to revert to the mean defies many investment theorists judgment, but it is true, just the same.

It is important to understand that this principle I have outlined works only in continuation channels and is a disastrous principle to implement in a trending market, or even a choppy market. Its sole use is in a flat continuation channel. Its also important to use a fairly tight stop should the market action choose to actually breakout or breakdown.

In summary, I have described a unique scenario in e-mini trading where Bollinger bands and Reversion to the Mean Theory can be utilized to initiate frequent and profitable trades. It takes some time and experience to learn as technique, but continuation channels tend to revert to the mean.

Real Live Trading Doesnt Lie. Spend several days in my trading room and see if you can benefit from a fresh and unique view on trading e-mini contracts. Sign up for your free trading experience by clicking here.