EmergingMarket Stocks How Much Is Too Much

Post on: 29 Май, 2015 No Comment

As U.S. investors put more and more money into developing economies such as China and Brazil, they are getting widely differing advice on what kind of role emerging-market stocks should play in their portfolios.

The flow of individual investor dollars to these fast-growing countries has sped up in 2010, as emerging-market stocks have outperformed those in the U.S. and other developed nations. Since its 2010 low on May 25, the MSCI Emerging Markets index is up 29.3 percent. In that same period, the MSCI World index, which includes only developed markets, has risen 16.8 percent and the U.S.-only Standard & Poor’s 500 index is up 9.9 percent.

An Oct. 19 report from JPMorgan states that retail investors have put $60 billion in emerging-market equity funds so far this year while pulling $74 billion from developed-market stock funds.

According to TrimTabs Investment Research, $20.9 billion has flowed into diversified emerging-market exchange-traded funds so far this year, compared with $14.4 billion in all of 2009.

A Bank of America Merrill Lynch survey of fund managers, released Oct. 20, found that 49 percent have a higher-than-usual, or overweight, exposure to emerging markets, up 17 points from last month. A Russell Investments survey of 350 financial advisers in September found 59 percent plan to boost their emerging-market exposure in the next year, up 11 points from a June survey.

Contrarian View

Yet on Oct. 18, brokerage Morgan Stanley contradicted much of the rest of Wall Street with a recommendation to scale back emerging-market stocks. Morgan Stanley’s chief Asia and emerging-market strategist, Jonathan Garner, told investors to reduce their holdings gradually, rather than precipitately from an overweight exposure of 6 percent more than usual to 4 percent.

The rapid rebound in the benchmark MSCI index since the May 2010 low was one reason cited for Morgan Stanley’s downgrade of emerging-market stocks.

By contrast, from the third to fourth quarter of 2010, Barclays Wealth raised its recommended emerging-market stock portion from 8 percent to 9.5 percent. In its fourth quarter Global Asset Allocation report issued Oct. 1, Bank of America Merrill Lynch gives developing-market stocks a favorable overweight rating, at a recommended 11 percent portfolio weighting.

The Currency Angle

We don’t actually think emerging markets look cheap, says Barclays Wealth investment strategist Brian Nick. There are other reasons, however, to invest outside the developed world—especially to gain exposure to currencies that have a good chance of rising, he says. It’s important, we think, to have that emerging-market currency exposure, especially because the U.S. seems to be doing everything it can to weaken the dollar.

India’s currency, the rupee, has risen 5 percent so far this year against the U.S. dollar, while the Brazilian real has increased 2.25 percent and the Chinese renminbi has gained 2.5 percent.

Standard & Poor’s equity market strategist Alec Young says flows of investor assets into emerging markets accelerated when, on Oct. 15, Federal Reserve Chairman Ben S. Bernanke said additional monetary stimulus via the central bank’s purchase of U.S. Treasury issues—known as quantitative easing—may be needed to revive the U.S. economy. Quantitative easing in developed countries is pushing this flood of liquidity into emerging markets, says Young, who recommends that 7 percent of a total portfolio go into emerging-market equities.

Americans Still Leery

Data indicate that most U.S. investors still send a relatively small portion of their portfolios to emerging markets. According to the International Monetary Fund, emerging-market stocks have grown as a portion of total U.S. holdings from 1.63 percent in 2004 to 2.41 percent in 2009. That increase, however, lagged the growth during that time in emerging-market stocks’ proportion of total world market capitalization, from 8.7 percent to 15.9 percent.

Americans tend to be underweight emerging [market stocks] relative to where they should be, Young says.

Charles Schwab senior market analyst Michelle Gibley says many Americans should be conservative about putting their nest eggs into emerging markets. She suggests 5 percent or less of portfolios should be in emerging-market stocks, a recommendation that hasn’t changed despite others’ growing enthusiasm for the category.

Going through the crisis, we saw people pull back their risk tolerance, Gibley says. So it’s somewhat surprising to see U.S. investors embracing an investment that is often quite volatile, she says.

Diminishing Risk?

Financial advisers say the past year has made it clear that emerging-market stocks are actually much less risky than once feared. Keith Amburgey, chief investment officer at Rutherford Asset Planning in Cresskill, N.J. says he has doubled his typical portfolio’s emerging-market exposure in the past year, from 5 percent to 10 percent.

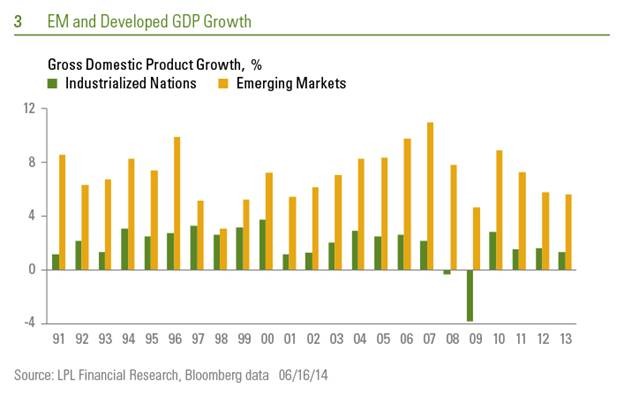

A lot of the emerging markets have emerged, he says. Amburgey notes that many emerging economies have better economic fundamentals—especially lower debt levels and faster economic growth—than developed economies.

Emerging markets are much more stable than they used to be, says Terry J. Siman, president of Vantage Point Advisors in Lower Gwynedd, Pa. He finds it reassuring that large, established companies, such as South Korea’s Samsung Electronics, dominate many emerging-market stock indexes.

The right mix of emerging-market stocks in a portfolio depends on the particular circumstances and risk tolerance of an investor, says George Iwanicki Jr. global macrostrategist for J.P. Morgan Asset Management’s emerging-market equity team. That percentage, however, has been an upwardly moving target for the past five years.

Rising Corporate Profits

The reason is that corporate profits from emerging-market companies continue to take a larger and larger share of the world’s total. For emerging-market corporations, there has been an improvement in corporate focus on profitability, Iwanicki says. Also, there are more investable names, he says. By various measures, he calculates that the number of public companies with substantial trading volume has roughly tripled since 2005.

S&P’s Young says emerging-market stocks still look reasonably priced, judged by price-earnings, or p-e, ratios, which are a common valuation measure. According to Bloomberg data, the p-e for the MSCI Emerging Markets index based on earnings for the past 12 months is 14.8, compared with 15.2 for the S&P 500. With corporate profits in developing nations expected to increase, the emerging markets index’s p-e based on estimated earnings is 12.9 for 2010 and 11.1 for 2011.

For now, the biggest risk for emerging markets may not be local worries but the flood of liquidity and investor enthusiasm from the developed world. If the quantitative easing persists too long in the developed world, Young says, that could create bubbles and problems in emerging markets.

With developed-world economies chugging along at subpar growth rates, investors searching for higher returns are willing to take that chance.

Steverman is a reporter for Bloomberg News in New York.