Emerging Markets Boom Bust Repeat Yawn

Post on: 26 Май, 2015 No Comment

February 6, 2014 By Rick Ferri

Emerging market stocks had a difficult year in 2013. They’re having a rougher year in 2014. The usual suspects are being blamed: rising interest rates, fears of a global economic slowdown, bubbling real estate prices in parts of the world coupled with a looming bank crisis, political turmoil in some countries, and the list goes on. In the words of Yogi Berra, It’s déjà vu all over again.

Here is a rundown on the current crisis. Tapering by the US Federal Reserve has led to fears of an economic slowdown in Asia along with the increased threat of a bursting Chinese real estate market and bank crisis. Currency outflows from Argentina, India, Turkey and South Africa have forced their Central banks to defend their currencies by raising rates, thereby stifling growth. Uncertainty in Brazil and other nations that have upcoming elections, in addition to political turmoil in Thailand and the Ukraine, slows the implementation of economic reforms. It all adds up to lower stock prices.

What’s an investor to do? First, don’t panic. Second, recognize that there’s a systematic boom, bust, and recovery cycle that has happened in emerging markets since the dawn of civilization. This time it’s not different.

Emerging markets suffer deep bear markets regularly. A major contraction occurs every 5 to 15 years on average. This one is happening right on cue. The last big hit occurred in 1997 after Russia defaulted on its external debt. The tremors were felt around the world, but order was restored within a few years.

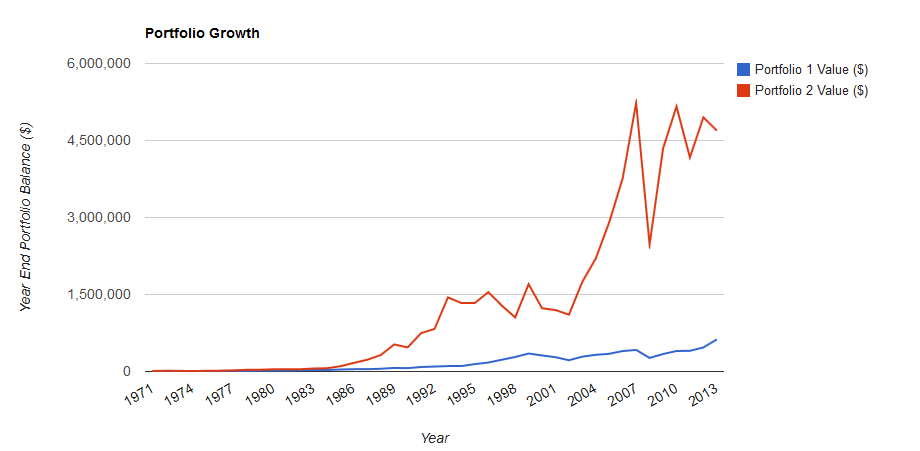

Figure 1 highlights the difference in rolling 3-year annualized excess return from two MSCI indexes. Emerging Markets (gross dividend) and All Country World (gross dividend). The data used in Figure 1 goes back to 1991, however MSCI started calculating emerging markets equity returns in 1988.

Figure 1: Relative Rolling 3-Year Annualized Performance of EM to the World

Source: MSCI Emerging Markets Gross Dividend and MSCI All Country World Index Gross Dividend derived from Dimensional Fund Advisers.

Emerging market crises are common and they all have one thing in common — leverage. They are created by excessive borrowing and overspending due to inflated growth expectations.

Unfortunately, when high expectations are not substantiated by results, a change in expectations reduces enthusiasm and disappointment ensues. This leads to deleveraging and an economic bust. Over time, there is restructuring, stabilization and recovery, and it starts again. It’s a vicious circle.

If you are concerned that the current bust may not end, I highly recommend reading This Time Is Different: Eight Centuries of Financial Folly by Carmen M. Reinhart and Kenneth Rogoff. The book looks back at hundreds of country defaults, bursting bubbles, banking failures, hyper-inflation, currency collapses, and anything else a paranoid emerging markets investor can think of. You will be cured of emerging markets jitters after reading a few chapters.

This brings us to the question: what should you do about emerging markets now? My answer is simple; do the same thing you should have been doing in the past.

Your portfolio should have a fixed allocation to stocks and bonds. There should be a fixed allocation to emerging markets within the stock allocation. Let’s say that allocation is 10% for illustrative purposes. Every time you rebalance your portfolio to realign it with your target allocation, or when you’re adding or withdrawing cash, ensure that your emerging markets allocation is on target. If it’s below or above 10% of equity, put it back to 10%.

Rebalance it’s that simple. This time is not different.