Emerging Market Funds How I Tripled My Investment

Post on: 26 Май, 2015 No Comment

Y ouve probably heard of the expression, its better to be lucky than good. That sums up a lot of my success as an investor. And there is no better example of this than my investments in emerging markets.

I first invested in an emerging market fund at the end of 2002. And the timing couldnt have been better. The fund tripled in five years. But since then it has had its ups and down, with the performance of the fund ranging from a high of 76% in 2009 to a low of -53% in 2008! Emerging markets are not for the faint of heart. But because they can add much needed diversity to a portfolio and present the opportunity for excellent returns, emerging markets are worth serious consideration.

What are Emerging Markets

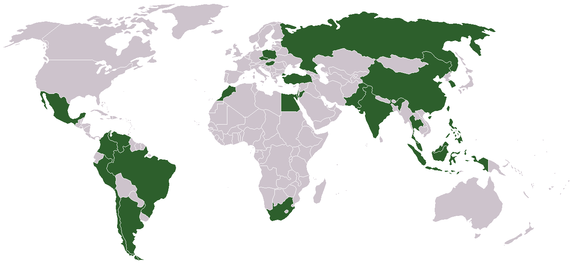

Emerging markets are those countries in transition from politically-oriented markets to financially-oriented markets. These countries often have large populations, significant influence within their region of the world, and very high growth potential. Emerging markets include Brazil, Russia, India and China (known as the BRIC economies). Other large emerging markets include Pakistan, Turkey, Indonesia and Mexico.

Emerging market funds are a significant asset class in a diversified portfolio. In fact, in determining an appropriate asset allocation, you should distinguish between mutual funds that invest in developed countries and funds that invest in emerging markets. Why? Emerging market funds present considerable risk for a host of reasons, including the potential for political unrest. Along with that risk, however, comes the potential for substantial returns.

My Investment Experience with Emerging Markets

At the end of 2002, I invested $15,000 in the Vanguard Emerging Markets Stock Index Fund (VEIEX). Now a confession. I didnt really know what emerging markets were. I knew the fund invested in countries other than the U.S. but that was about it. I also didnt know that in the six previous years, the fund had lost money in five of them. (My research since 2002 has come a long way.)

But since 2002, the fund has performed beautifully. Just to give you an idea, in 2004 I sold $12,000 worth of shares to buy a van, leaving a net investment of just $3,000. Through the ups and downs of the fund, our current balance is just over $42,000.

Here are the funds returns from 2002 through 2010: -7%, 57%, 26%, 32%, 29%, 39%, -52%, 76%, and 19%. Needless to say, Ive been very happy with this investment.

But the truth is, I got lucky. Emerging market funds have been on a tear in seven of the last eight years. They will lose money, and lots of it, just as they did in 2008. And in the six years from 1997 to 2002, VEIEX lost money in every year but one (the one good year returned 61%, which should underscore just how volatile emerging market mutual funds can be).

Here is a snapshot of the funds performance from 2001 to the present. The big dip in 2008 takes some willpower to stomach:

How much should you invest in emerging markets?

Asset allocation deals with how much of your investment is placed in different asset classes. In the context of stocks, asset classes include U.S. companies versus foreign companies, large companies versus small companies, and emerging markets versus developed countries. Because of the volatility of emerging markets, most experts recommend that a relatively small amount of your portfolio go to emerging markets. Most sample portfolios Ive seen put the amount between 5% and 10%.

An excellent resource to better understand asset allocation and to help yo develop an investment strategy is All About Asset Allocation by Rick Ferri. I interviewed Rick some time ago, and you can check out the interview here .

You can also check out the articles in my Beginners Guide to Asset Allocation series. You should also check out this article about frontier markets. the cutting edge of emerging market investing.