Emerging Market ETF Battle Vanguard v

Post on: 1 Октябрь, 2015 No Comment

Feature Stories News:

Vanguard MSCI Emerging Markets (NYSEArca: VWO) is the best-selling ETF this year by a wide margin but Vanguard is hoping an index change at the fund won’t diminish its popularity.

The emerging market ETF has gathered inflows of $11.5 billion year to date, according to IndexUniverse data.

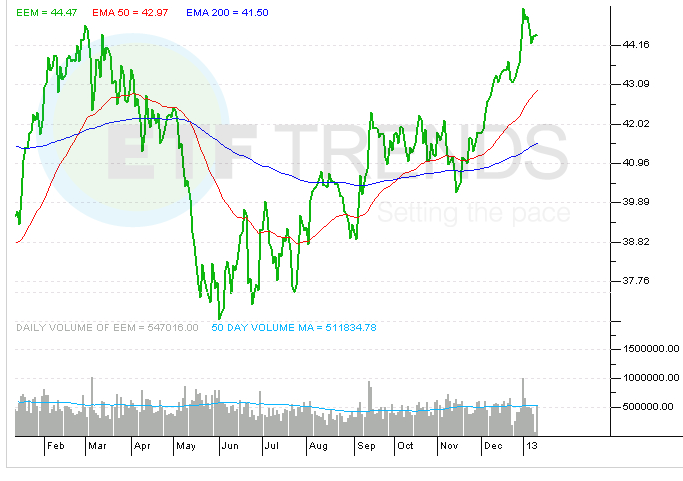

Its main competitor, iShares MSCI Emerging Markets (NYSEArca: EEM). has seen $2.9 billion move in and is also among the top 10 for ETF inflows.

BlackRock, the ETF’s manager, has also made a bold move recently. The firm recently introduced iShares Core MSCI Emerging Markets ETF (NYSEArca: IEMG). [BlackRock Lists Four ‘Core’ iShares ETFs]

There are a lot of moving parts in this emerging market ETF showdown featuring Vanguard and BlackRock.

Battle for assets

First, VWO and EEM currently track the same MSCI index. However, Vanguard plans to fully transition to a FTSE index sometime next year. [iShares Emerging Market ETF Sees Inflow After Vanguard Index Swap]

VWO is cheaper than its iShares rival with an expense ratio of 0.2% compared with 0.67% for EEM.

Yet the recently launched iShares Core MSCI Emerging Markets ETF (IEMG) charges fees of 0.18%.

“With an expense ratio of 0.67%, EEM lost a battle for assets to its Vanguard equivalent, but EEM is still popular with institutions that use the ETF for tactical strategies. In other words, there was no good reason for iShares to tinker with the $38.1 billion EEM, but there certainly is a good reason (investor assets) to introduce a cheaper rival to the Vanguard MSCI Emerging Markets ETF (VWO),” Benzinga reports.

“Cost is not the only noticeable difference between EEM and IEMG. The former is home to 832 stocks. The new fund is home to nearly 1,600,” it adds.

IEMG is part of BlackRock’s new iShares Core Series, which features 10 ETFs. The company cut fees on six existing funds and rebranded them, and launched four new ETFs, including IEMG.

Strengthening the core

“Because investors that seek core portfolio products to buy and hold for the long term value price over other attributes, we have created a suite of products tailored just for them,” said BlackRock President Robert Kapito.

Morningstar’s director of ETF research in North America, Paul Justice, points out that IEMG is “extremely similar” to EEM although the new emerging market fund will hold more securities.

“While these are real differences, the performance of the new funds will likely be extremely similar to that of the existing funds, except for periods when there is a large divide between the performance of small and large-cap stocks. We would expect these events to be fairly rare,” Justice wrote in a recent commentary.

“A simpler solution, from an investor standpoint, would have been for iShares to simply cut the fees on their existing funds to match the competitive landscape, so many people are asking why the firm didn’t take this route. The answer, in our view, is profits,” he added, noting that BlackRock is a publicly traded company.

Vanguard index change

For Vanguard, moving to a FTSE index for its emerging market ETF could cause some institutional investors benchmarked to MSCI indices to drop the fund.

Also, MSCI considers South Korea an emerging market country, while FTSE considers it a developed market, reports Allan Roth at CBS MoneyWatch.

“The $72 billion Vanguard Emerging Market Index Fund owns over $10 billion of Korean stocks. Those must be sold, as the FTSE does not include Korea,” according to the story.

Although making the change may result in some initial costs for investors, Vanguard says moving to FTSE benchmarks will allow it to cut fees in its ETFs.

“We negotiated licensing agreements for these [FTSE] benchmarks that we expect will enable us to deliver significant value to our index fund and ETF shareholders and lower expense ratios over time,” Gus Sauter, chief investment officer at Vanguard, said in a Reuters report.

In a report on the Vanguard emerging market ETF, VWO, Morningstar analyst Patricia Oey writes that South Korea accounts for about 15% of the MSCI index while the country isn’t included in the FTSE benchmark.

“The most significant change will be the removal of South Korean securities from the fund. While some of these holdings have appreciated significantly, Vanguard says that the fund has a large capital loss account to offset capital gains from this index change,” Oey said.

Full disclosure: Tom Lydons clients own EEM.

The opinions and forecasts expressed herein are solely those of John Spence, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.