Emerging Market Equities How Much Should You Allocate

Post on: 29 Май, 2015 No Comment

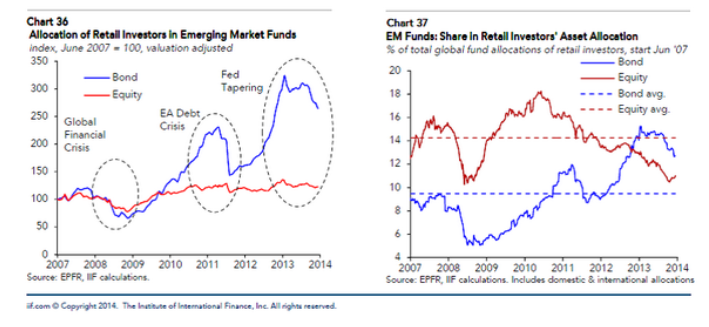

With emerging market economies like India and China growing at nearly 10%, you may be feeling pain from all the criticism from pundits and advisers that you are a myopic, short-sighted American for not allocating enough to emerging market equities. According to Vanguard, the average allocation to emerging market equities among US household investors is still only 6%.

Shouldn’t the percentage of your equity portfolio invested in emerging markets equities be roughly in line with the proportionate share of emerging-market stocks to total global stock-market capitalization or around 10% to 15% of an investor’s total equity portfolio? It seems natural to expect that the powerful economic growth of emerging markets such as Brazil and China will lead to higher stock market returns than in the slower growing markets such as the U.S. and Europe. So should emerging market equities be a bigger part of your portfolio?

In fact, US household investors may, at least for the moment, be properly weighted in emerging markets. For the following reasons higher potential growth may not justify investing heavily right now in emerging market equities and instead you may want to be gradually increasing your allocation over time:

First, 12% economic growth in a country like India has not necessarily meant 12% market returns. While there is certainly reasonable evidence to support expectations of long-term growth in markets like India, China, Brazil, etc. as reported in this Wall Street Journal article — studies suggest that strong economic growth often does not translate into strong stock returns.

One study, which looked at market returns in 32 nations since the 1970s, concluded that stock gains and economic performance can diverge dramatically. University of Florida finance professor Jay Ritter found, for example, that stocks in Sweden posted a mean return of better than 8% a year from 1970 through 2002, even though GDP grew at an annualized pace of just 1.8%. In contrast, while GDP expanded more than 5% annually in South Korea from 1988 to 2002, the mean stock return was only 0.4% a year. ‘A healthy economy isn’t a guarantee that established companies will attract enough capital and labor to expand sales and earnings stronglypartly because they have to compete with newer ventures for resources,’ Dr. Ritter says.

More basically, since markets are largely efficient, investors have long ago anticipated potential for equities in places like China. Right now, by many measures, it would appear that valuations for US and MSCI Emerging Markets Index on a trailing P/E basis are roughly inline.

Second, even if average annual returns from emerging markets exceed developed markets, emerging markets are still materially more volatile, and this volatility will not just keep you awake at night, it will erode your returns over time through the process of volatility drag. My colleague explains in this article how volatility drag will reduce your returns. Right now, the 3-year standard deviation of emerging market returns is 32.83 versus 24.27 for the S&P500, a difference that translates into roughly a 3% drag on your cumulative return. And while the 60-day volatility on US Large-Cap Equities has now dropped all the way down to 10.99%, the 60-day emerging market volatility actually rose slightly this quarter to 19.55% (see chart below for period ending December 31, 2010):

click to enlarge

Third, emerging market indexes are less efficient investment vehicles which makes a big difference over time for prudent, long-term investors. Most emerging market funds are significantly more expensive than US funds — often hundreds of basis points more. Our firm recommends low cost funds such as iShares MSCI Emerging Market Index (NYSEARCA:EEM ), and Vanguard Emerging Markets (NYSEARCA:VWO ). But even these low-cost funds face higher costs than US equity funds. Compare Vanguard’s VWO at 0.27 expense ratio vs. Vanguards S&P500 Index Fund (NYSEARCA:VOO ) at 0.06%. If you are investing within a fund family such as Fidelity, your choice for emerging markets is an actively managed fund with an annual cost of 1.14% versus Fidelity’s S&P500 Index at only 0.10% (This is why if you really seek more exposure to emerging markets economic growth, a more efficient way to gain exposure is through multinationals traded on US exchanges S&P500 companies derive about 50% of their revenue from abroad, with about a third of that coming from emerging markets).

So higher economic growth may not lead to higher returns on emerging markets equities, volatility drag is likely to erode much of this potential higher return, and higher investment costs are certain to drag the return down even further. In our dynamic asset allocation process, emerging markets allocations are likely to grow along with other equity allocations over the next few years assuming volatility continues to decline. But, right now, it appears that the average American household is not necessarily being naive and xenophobic when they choose to be underweighted in emerging market equities.