Emerging Market Debt A Strong Play For Your Portfolio

Post on: 24 Июль, 2015 No Comment

Summary

- Skip the junk-bonds and go to EM debt.

- More and more emerging nations are tapping into credit markets.

- Emerging Market Funds have a lower default risk than junk-bonds.

How Risky are EM?

Two words used almost synonymously are: emerging markets and volatility. In order to invest in emerging markets, one must carefully evaluate investment decisions and asset allocations. One familiar with investing in developed capital markets should note four unique features of emerging market debt: the average returns are higher, the correlation with developed markets is low, returns are less predictable, and volatility is much higher. Lately, geopolitical tensions have been weighing on these emerging market funds creating even more whipsaws than we traditionally see.

Despite the volatility in emerging markets, the smart investors know that they should not only look at markets offering sound opportunities like the US Markets, but also markets that are at risk. Coupled with this fact is the current market environment, we currently live in a world of low interest rates, and many investors are consequently scrambling for yield. In many cases, risks of investing in volatile markets have to be taken to generate yield. Some investors may argue that the current yields in emerging market bond funds (5.1% average) are not reasonable for the credit risks that go hand in hand. However, I will look to dispel some of these fears in my below article.

Why Invest In EM?

I do not disagree that emerging markets have some inherit volatility with them. However, I am not advocating direct investments in particular countries or individual stocks, as this will undoubtedly increase your risk exposure. But rather, I am advocating that investors consider skipping looking at equity markets and junk bonds, and look to emerging market bond funds. As more and more emerging nations tap into credit markets, there will be plenty of room for growth and opportunities to investors.

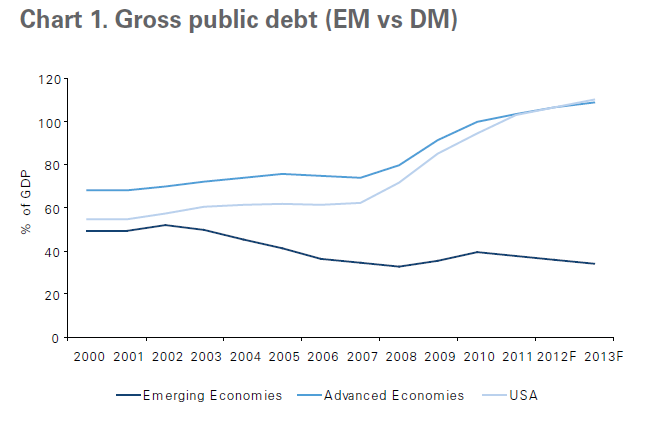

Now much of the risk associated with emerging markets can be tied to headline risks of default. However, although this default risk is not ill-justified, as seen in cases like Argentina, the real truth is that most emerging market debt is near investment grade. What a lot of people don’t realize is that a lot of these countries have strong balance sheets, fiscal responsibility, strong natural resources, and appetizing long-term growth prospects. As well, a lot of these emerging markets don’t have anywhere near the debt-to-equity ratios that their developed market counterparts do.

Essentially, emerging market funds are similar to junk bonds, but have lower default risk. Furthermore, if the dollar resumes its downward trend as seen in recent months, then investors could be poised well to capitalize on this trend in local-currency denominated bonds. I predict that as inflation continues to rise, we will continue to see currency appreciation account for a good amount of additional return on local currency emerging market debt.

Where Should You Invest?

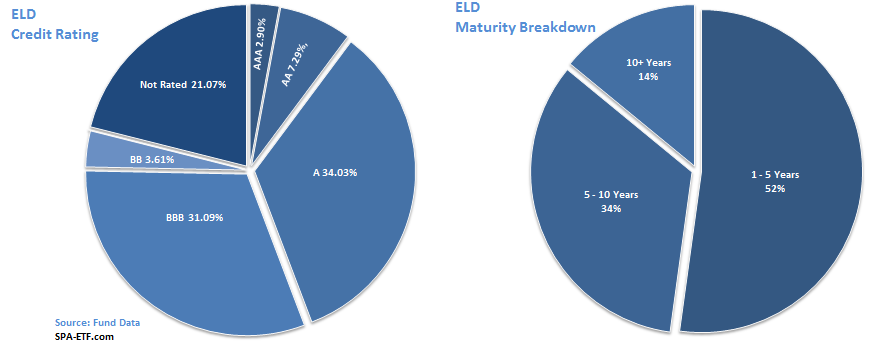

The biggest player in the emerging market ETF space is the iShares JPMorgan USD Emerging Markets Bond ETF (NYEMB ). The primary components of this ETF are Turkey, Russia, and the Philippines. With over $4 billion in assets, a 4.5% yield, and .60% in expenses, this ETF would be a good way to get exposure. Despite the fact that this ETF has seen returns of 10.66% in the past year, there is an additional measure of risk with the value of the USD. Another option for slightly a higher yield with a lower expense ratio (.50%) is the PowerShares Emerging Sovereign Debt (NYPCY ). This fund offers a slightly more concentrated approach with holdings in liquid emerging market US dollar-denominated government bonds.

If you want to get specific with your emerging market funds, you can look at the Emerging Markets Corporate Bond Fund (BATS:CEMB ), which tracks 192 different bonds from companies like the Mexican telecom giant America Movil (NYSE:AMX ) and the Brazilian Energy Company Petrobras (NYSE:PBR ). However, you may feel overwhelmed with all the choices to choose from. For investors that are seeking broad exposure, you might want to look at the Market Vectors Emerging Market Aggregate Bond ETF (NYEMAG ). This ETF tracks all types of EM bonds (high-yield, local currency, dollar-denominated). As well, this ETF yields 4.95% with only .49% in expenses.

Overall

Emerging market bonds offer more yield and less risk than developed market junk bonds. As such, now is the time for investors to consider weighing emerging markets higher. With the potential growth and income that emerging market debt offers, it could be a great play for your portfolio.

Disclosure: The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article.