Elliott Indicator for MT4

Post on: 16 Март, 2015 No Comment

The Elliott Wave Theory was created by Ralph Nelson Elliott at the end of 1920s. Elliott noticed one interesting thing: in spite of chaotic behavior of stock markets, they all had some common trend repetitive cycles of trading.

Elliott found connection between market cycles and reaction of investors to some influences from outside. I.e. psychology of people at definite period of time influences market behavior. According to Elliotts observations, psychology of masses has upward and downward swings, which are reflected in some repetitive patterns. Elliott named these patterns waves.

Elliott’s theory can be partially compared with the Dow Theory (wave movement of prices). However, Elliott had more capabilities for analysis thanks to fractal nature of markets, so he was able to see much more details. Fractal is a mathematical object with recursiveness property, every part of which is a reduced copy of the whole, i.e. fractal infinitely repeats itself on an ever-smaller scale. Elliott discovered that the structure of stock-trading patterns is similar to the fractal structure.

Wave Patterns as a Base for Market Predictions

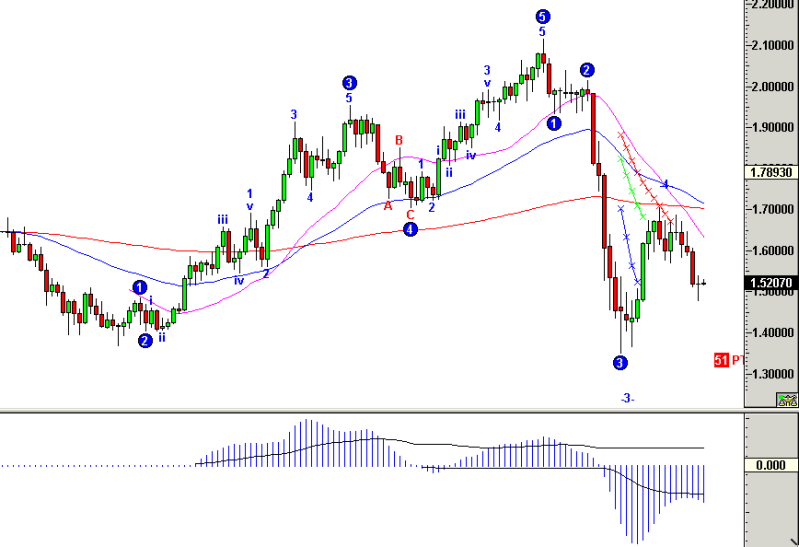

Elliott used wave patterns and their unique features for making in-depth predictions of stock market behavior. Main trend has an impulsive wave, which pattern always includes 5 waves. In turn, each of these 5 waves has a 5-wave structure. Such patterns are repeated ad infinitum. According to the Elliott Wave Principle, such patterns are referred to as different wave degrees.

Every action creates an equal and opposite reaction this simple rule is known to every trader on financial markets, so if price moves up then it will eventually move down and vice versa. Price movement has two patterns: trends and corrections. Trend can be described as the main movement direction of prices, and corrections are price movements against the trend. According to the Elliott Wave Theory, trend is referred to as impulsive wave, and corrections are corrective waves.

Interpretation of the Theory

For better understanding of the Elliott Wave Theory read the following interpretation.

1. Every action creates an equal and opposite reaction.

2. There are 5 waves which go with the stream of the main trend, and there are 3 waves which go against the stream (corrective waves). This is a so-called 5-3 move.

3. The 5-3 move completes a cycle.

4. As a result, the 5-3 move becomes two parts of the following 5-3 wave move.

5. The basic 5-3 pattern continues ad infinitum, but the time span of every new 5-3 wave move can be different.

Lets draw a chart where we depict the basic 5-3 pattern. There will be 8 waves (5 up and 3 down) named 1, 2, 3, 4, 5, A, B and C.

It can be clearly seen that 3 impulsive waves move in the direction of the trend, thats why they have 5 waves within them. �� the other hand, corrective waves move against the trend and include 3 waves.

Raise of Popularity in the 1970s

Thanks to Frost and Prechter, the Elliott Wave Theory became very popular in the 1970s. These two authors wrote The Elliott Wave Principle The Key to Stock Market Profits a book, which became a legend. Many predictions were made in this book concerning the bull market of the 1970s and even Black Monday the crash of 1987.

As a rule, corrective waves consist of 3 price movements, two of which go with the stream of correction trend (A and C) and one goes against the stream (B). For example, waves 2 and 4 in the Picture 3 are corrective waves. The structure of these waves is shown on the Picture 4:

Pay attention to the fact that in spite of waves A and C moving in the direction of the shorter-term, they are still impulsive waves and have 5 waves within them, as you can see in the Picture 4. Impulsive waves and corrective waves form an Elliott wave degree. This wave degree includes trends and countertrends. The patterns of the Elliott Wave Theory are applied both for bull and bear markets.

Categories of Waves

According to the Elliott Wave Theory, there are several categories of waves from the largest to the smallest wave: Grand Supercycle; Supercycle; Cycle; Primary; Intermediate; Minor; Minute; Minuette; Sub-Minuette.

If you want to use the Elliott Wave Theory for real everyday trading, you should do the following:

Find the main wave (Supercycle);