Effect of Dividends on a Stock

Post on: 4 Май, 2015 No Comment

Return On Investment

The immediate effect of dividends is the possibility of an increased return on investment (ROI). Take any two stocks that have similar performance and the one paying dividends will offer more value than one that does not pay dividends. Many long-term investors capitalize on this by using dividend reinvestment plans (DRIPs) to subsequently purchase additional shares of stock with dividend payments.

Selling Stock

Just as investors must buy a stock before the ex-dividend date to receive a dividend, investors who sell a stock prior to the ex-dividend date are obligated to deliver shares acquired from a dividend payment to the buyer on the payable date. Therefore, investors wishing to avoid this situation must hold the shares through the dividend payment. This makes the ex-dividend date an important time for both buyers and sellers in the market.

Market Perception

The announcement of a dividend payment often affects a stock’s price. When a company increases its dividend payment, this is seen as a sign of strength and often has a bullish impact on the stock price. On the other hand, a lowering of the dividend payment often has a bearish effect on the stock price.

Funds

References

More Like This

How Do Dividends Affect Stock Price?

The Effects of Dividends on the Balance Sheet

How Are Stock Dividends Taxed?

You May Also Like

Dividends and share price are closely related and matter to both companies and their shareholders. Companies try to follow a dividend policy.

Retained earnings refers to the amount of earned income a company keeps to continue its operations. When it makes a profit a.

Treasury stock consists of shares reacquired by the company. These can be retired or reissued. However, they are not considered outstanding stock.

There's an inexpensive method of stock purchase that allows you to buy a smaller amount of shares at an often lower than.

One of the perks of investing in a stock is that you can receive dividends from a company. Dividends are a way.

Because dividends are paid quarterly, companies issue dividends based on their net earnings for the quarter. Although dividends are not guaranteed, investors.

The ability to receive a steady income stream from an investment—particularly a relatively risk free institution like the federal government—is the bellwether.

The payment of a dividend by a corporation has a direct effect on the price of the company's stock. Shares of a.

An investor can consult multiple sources that provide a list of stock prices as well as dividend dates. Some newspapers publish stock.

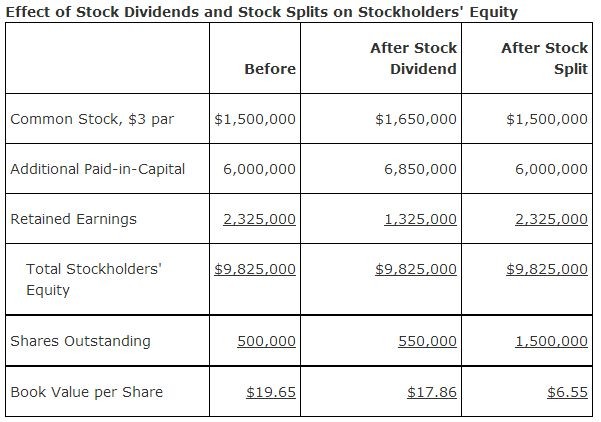

A stock dividend occurs when the company uses the amount of money that would be paid as a cash dividend to purchase.

The ex-dividend date is the date that a stock trades without its dividend. Stocks sold before the ex-dividend date pay the dividend.

Stocks have two ways of paying their investors back, through dividends or share price appreciation. Computing the yield on stock price growth.

There are several dates of importance concerning the sale of stock on the ex-dividend day. This important trade date determines the last.