Economic recovery S Investing

Post on: 27 Август, 2015 No Comment

Baltic Dry Index chart (Bloomberg)

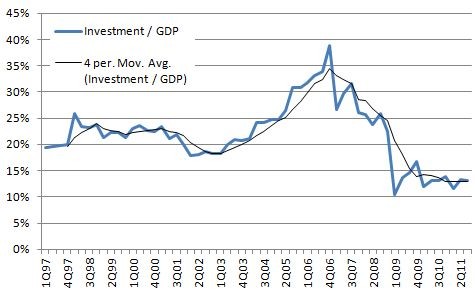

Recently there has been much discussion about an economic recovery. The chairman of the Federal Reserve Bank, Ben Bernanke, indicated the recession was likely over. His recent prognostications, however, leave something to be desired .

Is the economy truly on the verge of recovery? This article presents another measure of economic activity called the Baltic Dry Index. What is the Baltic Dry Index and what effect does it have on the economic crisis and the erstwhile recovery?

The Baltic Dry Index is a figure issued by the London-based Baltic exchange tracking international shipping rates for dry bulk cargoes. By measuring 26 shipping routes, the index provides a measure of the costs of transporting raw materials over the sea. Since the index considers the transport of raw materials that are the components of intermediate or finished goods, it is an excellent barometer of future economic activity. Since it is a measure of shipping activity, it is devoid of any speculative influences and as such can be confidently used to assess economic activity.

The index, however, has the ability to be quite volatile. Part of the reason for the volatility is the inelasticity of worldwide shipping fleets. Since ships tend to take a considerable amount of time to build, any sudden increase in demand in excess of ship supply tends to inflate the index quickly. Likewise, a sudden decrease in demand can hurt the index for the same ship supply reason. It is also not easy to take ships out of circulation. Index swings of 10-20% are commonplace.

In May of 2008, the index reached its high. This was nearly six months after the stock market high in 2007. While there is not a perfect correlation between the stock market (S&P 500) and the index, large moves in one index tend to be reflected in the other.

By December 2008, the index fell 94%, clearly a drop well beyond historical norms. The Baltic index bottomed at the beginning of the year and proceeded to rise slightly and make a top coincident with the stock market bottom of March 2009.

This summer as the stock market continued to rise, the Baltic index peaked in June and has continued down from there. It is strange then that one index is moving opposite of the other (a strong stock market move up versus a gradual slide in the Baltic index) when there is a typical correlation with strong moves. I want to reemphasize that if looking at all historical data, the correlation coefficient may not be near 1.0 (perfect correlation). I have not undertaken that study. I can conclude that one index used to assess economic health (stock market) and another that, at a minimum, indicates international trading activity are so uncorrelated right now.

For those pundits or political leaders pronouncing the end of the recession and an imminent recovery, we should point out a couple of things. First, a downward sliding Baltic Index portends weakened international economic activity. We can confidently assert that global trade is a component of healthy economic recovery. The index does not show recovery. Secondly, stock market gains in the present bear market rally appear concentrated in a small group of stocks. This concentration was highlighted in the September issue of The Sentinel Economic and Financial Newsletter. Even more disturbing about this concentration is the focus on stocks rescued by government bailout efforts that have severely negative earnings.

For those still unconvinced about the dearth of international shipping activity, a story from the London Daily Mail should be revealing. Imagine a fleet of idle ships larger than the combined U.S. and British navies.

The world economy is not on the brink of an economic recovery. Likewise, the U.S. economy is not likely to recover independent of international activity. The excessive supply of shipping capacity is also indicative of the lack of pricing pressure existing in world economies thus dousing fears of an imminent hyperinflation due to the fiscal actions of governments.