ECN 335 Syllabus Intermarket Economic Analysis

Post on: 14 Июнь, 2015 No Comment

Professor Leonard Lardaro

804 Chafee Hall

Over the past twenty years, our economy has evolved substantially as the result of technology, financial innovation, and globalization. This, in turn, has had a major impact on both microeconomic and macroeconomic relationships. While it was once possible to view the US as a closed economy, where international considerations were largely secondary, this is no longer the case. The result of this evolution has been a major change in the analysis of economic activity and the conduct of monetary and fiscal policy. Recent efforts by the US Federal Reserve Bank to coordinate monetary actions with several other central banks are evidence of this. Policies that were once carried out effectively by the US Federal Reserve acting alone don’t necessarily produce the desired outcomes any more. The same is true for fiscal policy.

The tracking of macroeconomic activity has traditionally been based largely on a foundation of macroeconomic theory, analyzing reports that are expected to provide specific signals about likely future changes in macroeconomic activity. Technology, increased globalization, and financial innovation, along with real-time data releases available on the Internet have not only made it possible to go well beyond traditional tracking procedures; the evolving interrelationships among markets require such an extension. More importantly, several key markets, most notably the stock, bond, currency, and commodity markets provide critical information each market day that serves as real-time economic reports. Interrelationships between these markets and the information they provide, which is known as intermarket analysis. is the subject of this course.

In order to provide students with the tools to undertake intermarket analysis, we begin with a review of the fundamental economic tools that are its underlying basis. We start with supply and demand analysis, which illustrates how markets work, what the price mechanism is, and how individual markets restore equilibrium when prices are not at equilibrium levels. We then apply this to a way of analyzing markets (any of those we will be discussing) called technical analysis. A set of handouts and one of the required texts, Stikki Stock Charts . provide the needed background that we will use throughout the semester. We then proceed to a further refinement necessary for a meaningful understanding of the economics of the stock market: elasticity (demand and income), which highlight the sensitivity of various markets to key economic factors such as prices and income, which provides a preliminary examination of microeconomic interdependencies. We conclude the microeconomics review section with a review of the market mechanism — how markets allocate resources without government intervention, linking this to all the microeconomic tools. Following the microeconomic prerequisites, we will analyze the stock market and the foreign exchange (currency) markets.

We then move to a basic overview of macroeconomic theory using the Simple Keynesian Model to illustrate the determinants of output and the multiplier, then move to the Aggregate Demand — Aggregate Supply Model to examine inflation and macroeconomics in the context of changing prices. Along with this will be a brief review of measurement issues (GDP, Inflation, and the Unemployment Rate) and the nature of leading economic indicators. This material is then placed into a further analysis of the stock market (sectors and sector performance) then extended to an analysis of the bond market, which is linked to overall economic activity and inflation, and commodities markets, both directly tied to inflation and inflationary expectations.

Trading with Intermarket Analysis by John Murphy

Atlas of Economic Indicators by W. Carnes and S. Slifer

Stikki Stock Charts

The Murphy text provides a hands-on overview of intermarket analysis, examining how each market works individually then detailing how the various markets fit together in an interrelated framework. It is a somewhat difficult but rewarding text. Expect to return to various chapters several times throughout the semester as your knowledge base is expanded and new trends appear with actual data. The Carnes and Slifer text complements the main text well. It will assist you in applying macroeconomic theory to the real world, while presupposing little theoretical background. Chapters provide well-written explanations (with examples) of key macroeconomic areas, allowing you to gain experience in the application of formal theory to events that are currently taking place. Stikki Stock Charts is a very unique book. It will get you up to speed in reading price charts very quickly, whether for stocks, bonds, commodities, or exchange rates based on technical analysis. You will quickly see the inherent flaws and limitations involved in focusing on closing price only, as the media does.

fidweek.econoday.com/. At the end of Friday, click on Simply Economics (on the left side), and you get a summary of all the indicators for that week. You can also go back to prior weeks to obtain these summaries. This will be very helpful in providing you with background material for your forecast paper (see below).

www.money.com. Please note: a substantial amount of class time will be devoted to group discussions and applications projects as a means of establishing your ability to apply the economic theory covered in lectures and the readings. All of the above sources will be of great help in preparing for these.

en.wikipedia.org/wiki/Main_Page .

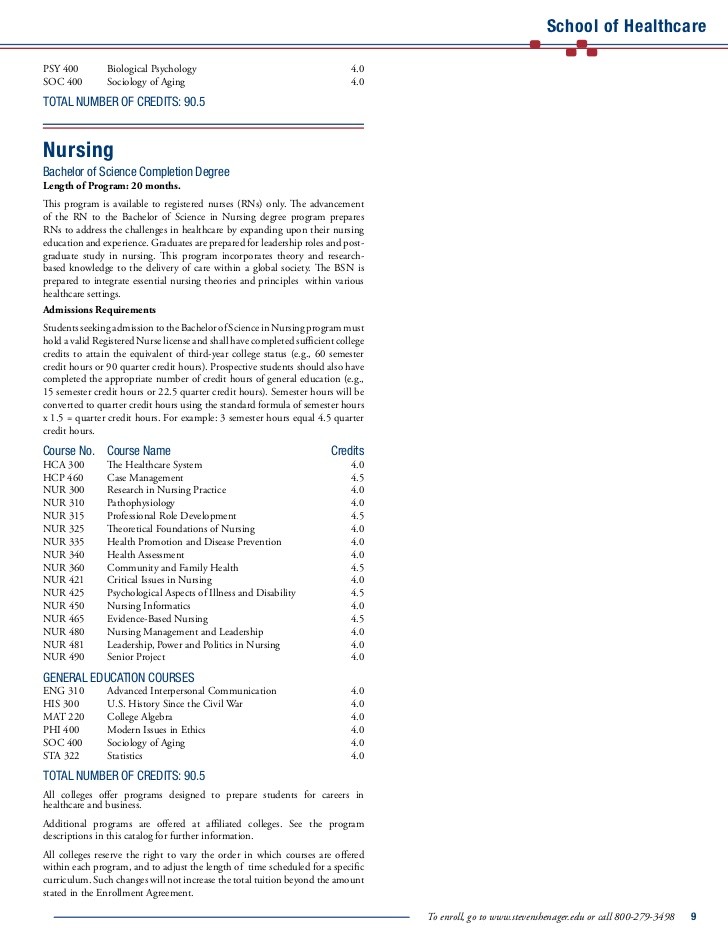

Your grade for this course will be based on the total number of points earned out of 400 possible points from: a midterm exam; two group assignments; course participation; and a final project that consists of a group PowerPoint presentation and an accompanying Newsletter that provide an intermarket forecast of one of the topics below. The midterm exam counts as 150 points, the assignments are 50 points in total. participation, which is substantially affected by attendance , answering questions in class, asking questions, and coming to office hours when you need help. is 40 points, while the final project counts as 160 points. All group members will receive the same grade for the PowerPoint and newsletter, while individuals will be graded separately on the competency of their presentations. Letter grades will be assigned according to the following table: