Earnings per Share (EPS)

Post on: 16 Март, 2015 No Comment

Earnings per Share (EPS) 5.00 / 5 (100.00%) 1 vote

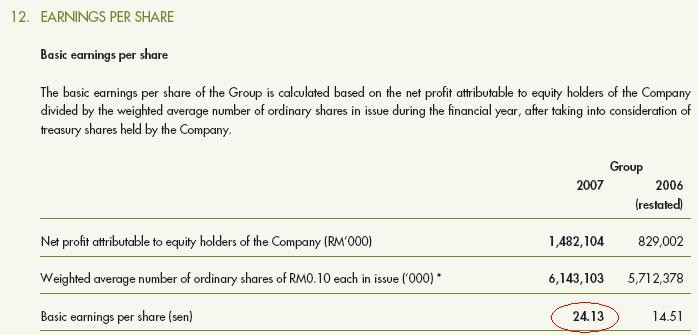

The dividend, or return paid by a company for each of its outstanding shares is what is meant by the term EPS or Earnings Per Share. The easiest way for companies to arrive at this figure is to divide the net profit (profit after tax) by the number of outstanding shares and the result gives the earnings per share. Used in its simplest form, the EPS is the figure most often used by stock market investors to arrive at the value of a share, particularly when contemplating a long term investment in which case the EPS gives a very good indication of the income that should be earned from ownership of that particular stock. The price of the stock compared to the EPS is called the price/earnings ratio or P/E and, calculated from the EPS, and is the most commonly used ratio to determine stock valuations.

Additional Criteria to Arrive at a Valuation of Stocks

The EPS of a company tells you how profitable the company in question is, but there are several variables that should also be considered in order to arrive at a more accurate stock valuation. Among the variables that should be considered is the book value of equity per share – BVPS which gives the value of the assets underpinning each share, as well the debt service covering ratio – DSCR, because should the company not be able to fully service its debt, borrowings might be necessary. This then results in an added burden on the company in terms of the cost of interest, which could lower profits.

Utilizing the EPS for Binary Option Trading

As soon as a company has advised stockholders of the EPS for the preceding period, there is generally movement in the stock price and you need to interpret the financial information provided by the company. There is always an expectation of the EPS figure prior to the company making a public announcement, and it is important to be aware of the forecasts which will have influenced the stock price prior to EPS being released. When the EPS is lower than expectation, you can be reasonably certain that the stock price will retreat in the short term, as investors, having received their dividend, start selling stocks with the perception of a downturn in the company. The time is now ripe for you to place a Put binary options trade, the time lines governed by the speed at which the price is seen to be declining.

In the event of the EPS being higher or even the same as the expectation, the stock price will probably rise as all is perceived to be going well with the company and optimism with regard to a stock usually results in short term gains. This is exactly the right time for placing a Call binary options trade, the time line should again be decided by how rapidly the market is moving.

Earnings per Share (EPS)

The EPS is probably the single most important factor that stock market investor consider when determining the value of a stock and you should follow their lead placing binary options trades in anticipation of how the market investors will react on release of EPS figures.