Duncan Artus portfolio manager Allan Gray

Post on: 12 Июль, 2015 No Comment

On the next SAB/MTN, gold shares, size and more

26 July 2013 00:29

HILTON TARRANT: Welcome to this Market Commentator weekly podcast, our series of interviews with chief investment officers, fund and portfolio managers. Well be interviewing them or the institutions they represent once every two months or once a quarter. We spoke with Ian Liddle, the chief investment officer of Allan Gray three months ago, today were joined by portfolio manager at Allan Gray, Duncan Artus. Duncan, whats occupying your mind at the moment?

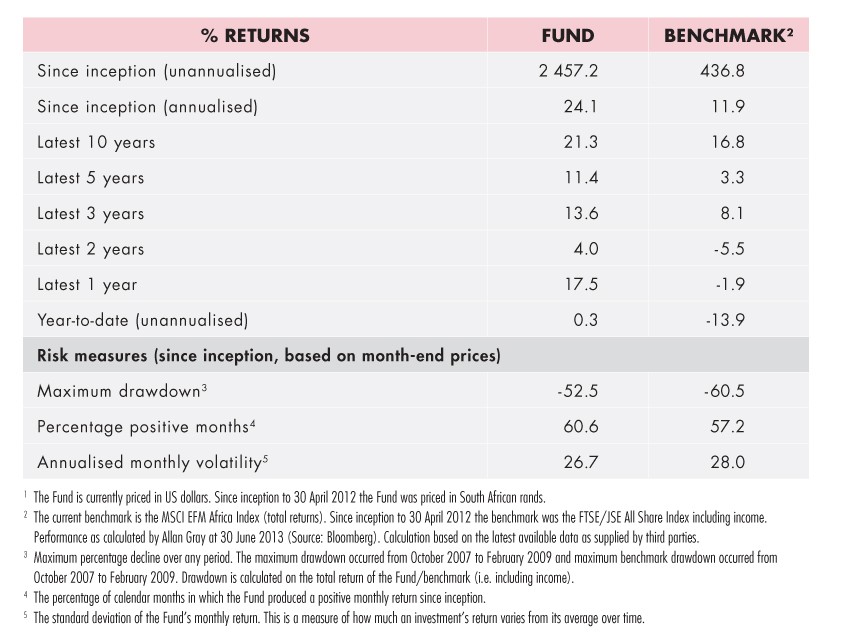

DUNCAN ARTUS: I think, Hilton, whats occupying our minds mostly are perhaps two things, the one would be the asset allocation in our balanced portfolios, that would be in our Allan Gray Balanced Fund and our Stable Fund, where we continue to think share prices are high in South Africa and the prospect for real returns that people have enjoyed over the last decade are unlikely to happen again. I guess the frustrating thing with managing money is you can say something is overvalued and the market can continue to be overvalued for substantial periods of time but we continue to hold a fair amount of cash in our asset allocation funds and a maximum weighting to offshore. So were patiently waiting for a day when we can get South African assets at what we would believe would be attractive valuations and valuations that protect you against risk of loss and we certainly dont think that is the case today. Perhaps the second thing thats occupying certainly my mind, and I think most of the South African asset management industry, would be the wide divergence between the performance of industrial shares, particularly the big dual-listed industrial shares and mining shares, and within mining shares South African deep-level mining shares as we know have really materially underperformed the market and how much of your portfolio you should have, I guess, been changing from the industrial shares into the underperforming resource counters and thats a much harder question to answer than it sounds.

HILTON TARRANT: No, it definitely is, weve been talking about that probably for the better part of the past 12 months and a lot of fund managers scratching their heads specifically around that question. We have seen those that have switched early have, I guess, paid the price when it comes to performance

DUNCAN ARTUS: Yes and I think the thing thats very difficult when you manage money sometimes, particularly if youre a value contrarian manager, which means youre going the opposite of the crowd, is sometimes the crowd is right. I think what can happen and one only has to look ina good example in the US would be General Motors or Sony in Japan or types of shares that have fallen significantly and you look ten years later and theyre down even further because something structural has changed. Whereas if youre buying them on a cyclical basis the news can be bad, profits can be low, the sentiment very poor and you buy the share then and you sell it when its the opposite sometimes that cyclical bottom turns into a structural decline. I think Ian did mention it in the interview with you that I guess every year there is more mounting evidence that the South African mining industry is in structural decline. So you have to do your work very carefully to understand how much of your portfolio you should allocate to those types of shares, where for us its not obviously clear that you should have 30%, 40% of your fund in deep-level mining South African shares at the moment.

HILTON TARRANT: Duncan, is there any compelling reason in the world to want to own shares in a gold mine specifically?

DUNCAN ARTUS: Well, the most compelling reason is price normally, Hilton. We cant predict the future and lots of things can happen and the best defence you have is always to pay a low price. I guess whats tricky with the gold mines is they are difficult companies to value. As you would be aware, weve had an overweight position in the gold mines for a substantial period of time, we sold a fair portion in 2008 in the great financial crisis and we did sell a portion a couple of years ago luckily but its been a mistake obviously to have the residual exposure weve had in the fund. I guess whats tricky for us is the free cash flow, so its very important when people value mining stocks to look not at the accounting earnings but at the free cash flow because you have to spend a substantial amount of money to keep your production at a certain level. Even with spending that significant capex production has actually been falling at most of the gold mines. So it is quite difficult to value but you could wake up in a week and the shares could be up 20%, 30%, given the level of the decline theyve had. I guess its also tricky especially with the more South African-based operations to understand where shareholders rank, I guess, amongst all the stakeholders. It would seem that many of the people are quite determined to put the businesses under significant pressure where they dont actually have the cash flows to reinvest and, therefore, ensure sustainability of the business.

HILTON TARRANT: I guess thats one of the big conundrums when looking specifically at gold shares is in this current environment with low metal prices, high input costs, all sorts of challenges around labour, many of these companies are entering a period where we will see negative free cash flows at least for the foreseeable six or 12 months.

DUNCAN ARTUS: Yes and I think the asset management industry, including ourselves, can take some part of the blame there over the long term, where gold mining companies have had many rights issues over the years and, therefore, have a very low cost of capital. If youre issuing shares on almost an infinite PE it means your interest rate is almost zero if you had to call your cost of equity compare it to interest rate, so youve been incentivised to keep growing production and investing the cash flows knowing your investors are always going to bail you out. I think whats changed over the last couple of years and you would have seen that from the comments of many of the gold mining company management is that its unlikely that shareholders are going to be funding them to the same extent that they have over the past while and you need to generate sustainable cash flows from the operations in order to fund capex going forward.

HILTON TARRANT: Duncan, I want to go back to the Balanced Fund, as you said, at the end of June below average equity exposure, you are at your limit when it comes to foreign exposure, as far as cash is concerned about 16% in money market bank deposits and then your foreign exposure just under 30% obviously due to market movements. If there wasnt an upper limit of 25% on foreign exposure where would you see that number being, would it be significantly higher than what it is?

DUNCAN ARTUS: I think that would be the case, Hilton. I think its something weve been consistently saying over the last number of years and while it may not have worked in the short term it shows you when the rand moved once it happened its too late. I think it really comes down to two things, the one is valuations, especially a year or two ago when we looked at the valuations our sister company, Orbis, were finding and we compared them to the South African similar companies, we found much greater value in the offshore markets and that just makes sense, theyve been flat for almost a decade, whereas our market is up six times. Second of all it comes to the rand and I think weve been saying and perhaps people got tired of us saying it for a while was we thought the rand was reasonably expensive a while back. So were using what we thought was a relatively strong rand to also then buy better valuations and thats why the offshore portion of the portfolio has got the double whammy. Obviously we run the Balanced Fund to be Section 28 complaint but if we were unconstrained it would be significantly higher. Ive seen some studies that suggest 30% would be a neutral level because 30% of your costs are effectively import based but we would probably be well north of 50%, probably closer to 70% offshore if we had an unconstrained fund.

HILTON TARRANT: Duncan, in the commentary to the equity fund you point to five industrial shares that have performed exceptionally well on our market over the past decade and its shares that weve been talking about not only with obviously Ian and some of his peers in the industry, its shares we have been talking about for quite a long time, 12, 18 months, SABMiller, MTN, Naspers, British American Tobacco and Richemont, and you give some indication of how these shares have moved in dollar terms. These are extraordinary returns in most cases and I guess the real danger now is will this run be able to continue? Will these five companies and the management at these five companies continue to create value?

DUNCAN ARTUS: I think there are two separate things there, of course, and the one is the companies could continue to create value but the share price could fall significantly. Its not great if you came in as a new CEO into one of these companies now and your share prices has gone up to that extent because effectively the market has already been discounting all the good things youre going to be doing in the future. I think the reason why its so important for South African investors is two-fold, the one is even though offshore markets have done poorly relative to South Africa, our dual-listed stocks, other than one or two, have done spectacularly well. Its not only in South African domestic stocks whether its retailers or food companies, etc done really well, so have the dual-listed stocks offshore and, of course, for most pension funds you have to invest 75% of your money in South Africa and for the equity fund we invest 100% here. So it really comes down to saying the relative valuation of businesses. As we pointed out there, you mentioned the five shares, I think we did a rough calculation and this is a very rough calculation last year the return of the market over the last 12 months would have been about 9% instead of the 20-odd that weve got if we took away the returns of those five shares. I think whats trickier for us, of course, is if we do own some of these shares and rightly so some of our clients ask us and say, well, how can you still have some South African Breweries in your portfolio on a 20 times earnings ratio or how can you still have some British American Tobacco on 16. I guess one of our first answers would be the markets on 17 times earnings in South Africa and I guess the way weve thought about it is if mining battles in South Africa and remember mining contributes most of the foreign exchange to buy our imports, foreigners continue to fund our bond market, is if mining has big problems in South Africa Im of the opinion that so will many of our local industrial stocks, whether it be retailers, telcos, etc, they will come under pressure as well. The one thing that SAB and British American Tobacco add I guess to a South African portfolio is to diversify away from some of that South African risk, which is very common to many of the types of businesses Ive mentioned. I think BAT is about 8% of its profits come from South Africa and SAB around about 17%. So while we would love to buy these shares at half the price they are now, clearly thats not the case and we would expect much lower returns from them going forward but we have to mix and balance a portfolio when were considering the probable outcomes that could happen. We have done, were probably going to write something in our next QC about it, sometimes you can pay up for quality, many, many times you can pay a high PE and still get the same returns from a great company thats able to grow.

HILTON TARRANT: Duncan, what about Naspers, you dont hold that on behalf of your clients or at least its not really a sizeable holding if you do?

DUNCAN ARTUS: So we own about 1.4% of the equity funds in Naspers and Naspers has been a very frustrating share for us, our clients were one of the biggest shareholders for a long period of time in Naspers and we sold out way too early. I guess when you look at it now obviously things have changed quite significantly with Tencent, I think the old Media24 print businesses of Naspers are probably worth around R6 a share out of the 800, so you can see how much the business has changed over the years. Weve always considered pay-TV an excellent business whether in South Africa and the rest of the continent. I guess the thing we got wrong was obviously the continued growth in the value of Tencent and interestingly enough our clients dont actually give us too much pressure about not owning Naspers. A typical response would be, well, Naspers is not an Allan Gray type share but I think thats incorrect, we did lots of work on it and if the value had been there we perhaps should have seen it and we did perhaps two or three separate reports on Tencent trying to understand the competitive position in China and I guess it was one of those shares that the winner takes all, its a network affect. As more people go on Tencent more of their friends join, which means more of their friends join and they really did come to dominate the market there. I think the crucial thing for Naspers shareholders at the moment is to understand the e-commerce strategy, so obviously all the cash flow coming from the pay-TV and from the dividends of Tencent, etc is being reinvested by management, I think almost over R4bn a year at the moment to grow this big e-commerce business and if that works then theres probably further upside in the share, if it doesnt we do remember that Naspers have made a few mistakes in the past like with Open TV, etc and thats really the big call for shareholders now.

HILTON TARRANT: Duncan, if I run through those five shares again, SABMiller, MTN, Naspers, British American Tobacco and Richemont, probably three maybe four at a stretch of those proper South African companies that have come from a very strong base here and moved offshore very successfully. In the financial services space weve seen a couple of companies try a similar route, I think of something like Old Mutual, Standard Bank to some extent, Investec to some extent, it is important when trying to find these kids of businesses the next MTN, the next Naspers, the next SABMiller, the next British American that you pick the right one.

DUNCAN ARTUS: Yes and thats part of our job, I guess, analysing. I think Old Mutual we were fairly confident when it was trading at R20 before the crisis that it was significantly overvalued because theyd taken a lot of debt and bought asset managers and other businesses at the peak. I think whateven SA Breweries interestingly enough if one had to take a relative performance of South African Breweries relative to the stock market, while it was building its empire it was actually a very poor investment, which is something quite fascinating, and as we know Standard Bank and Investec have battled offshore. I think what we always think about is, I guess, you start with a bit of scepticism because we dont think South Africa is as competitive as offshore, you only have to look at some of failures that youve mentioned and we havent even mentioned some of the retailers in Australia, etc where margins and returns on capital tend to be higher in South Africa than the rest of the world. Its pretty tough if you want to go and compete in Europe or the US, theres lots of competition and people willing to compete at lower returns on capital. I think the hard thing is often it looks, obviously in hindsight, a share like Aspen, our clients were the biggest shareholders when the share was trading below R10 and clearly Stephen Saad and Gus Attridge have done a fantastic job there. But its often very difficult to judge over the short term if that management team is going to be a management team you can back to grow the business significantly. Its easier obviously when youve got a longer-term track record but then obviously everyone prices it in. I guess, from what youve mentioned, are there new ones, we dont see too many in South Africa, which is unfortunately. If you think just about the number of technology stocks you can invest in South Africa is very, very small after Di-Data listed and Datatec is mainly an offshore business with itself. Personally I think it speaks a lot to the South African environment, if you had a very smart idea, if you were the next Mark Shuttleworth would you really want to open the business in South Africa or would you go and open it in America or offshore or somewhere, which is perhaps more friendly to business and youre able to raise more capital, I guess that would be the question I would pose if theres going to be another one of these companies in the future.

HILTON TARRANT: Duncan, have you been buying some of the pure domestic companies, some of the undervalued ones in the past three, four, five, six months?

DUNCAN ARTUS: Well, I guess it depends what you mean by undervalued, I think a lot of them have fallen a fair bit, especially in dollars. I think if you look at something like Foschini, its come from US$18 a share all the way back to $10 a share What I found very interesting over the last month or two is as these companies are reporting and I see AVI gave an update today as well is the second half of their financial year theyve showed a marked slowdown, whether it was Truworths, Shoprite, Anglovaal, perhaps you might see it from something like Tiger Brands as well, I think thats showing you the pressure thats finally coming to bear on the earnings of these companies, which have held up much stronger than we would have thought over the last few years. If you just look at economic growth and the pressures that have come we would have expected margins and returns to come under pressure, which it looks like theyre starting to happen and certainly we have been obviously when shares fall 30%, 40% like one or two of the micro lenders or perhaps some of the retailers we obviously start doing some extra work and start to get ready to see if they are offering value but were not buying them in large quantities, thats not the case at all.

HILTON TARRANT: You sum it up very nicely in the commentary to the Equity Fund at the end of June We South Africans are and have been living beyond our means. It sounds so simple but when you look around you and when you look at some of these earnings reports, as you say, the news on the environment, the macro environment that South African consumers and South Africans find themselves in is starting to finally come through.

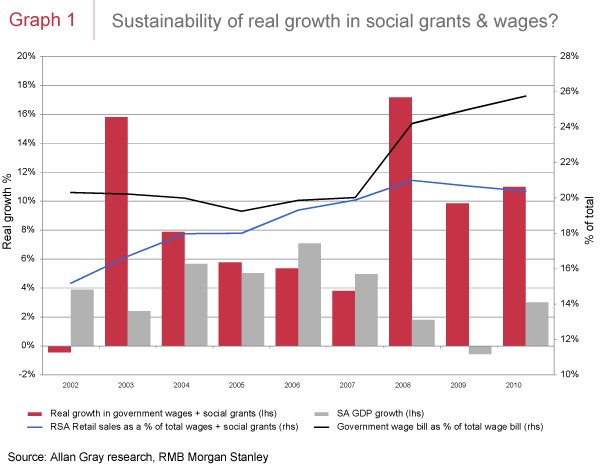

DUNCAN ARTUS: Yes and I think its a virtuous cycle and its very difficult to put this in an Excel model unfortunately. If we look back over the last decade for most of this time the rand has been strengthening, foreign investors have been investing into our country, which has kept the rand strong, which has kept inflation low, which has provided a base to extend credit, which has meant consumption has grown, which has meant foreigners are willing to invest more money in our country and so it is a virtuous cycle. Its only really been interrupted in 2008, 2009 and I guess our concern has been all these things kind of rely on each other and with the rand weaker it should pressure margins. If interest rates had to rise I think its going to be far more difficult for many of these businesses that have done really well over the last decade to produce a similar performance over the next ten. I guess the one thing we think about quite a bit is most of this has happened in a commodity upcycle. So since 1998 to, lets call it, 2008 and commodities have pulled back a bit, this countrygood things happened to it when commodity prices are high. If we had to enter a period from, say, the late 70s or the 80s onwards where I think our exports didnt grow in dollars for well over a decade, its going to be a lot tougher to do business in South Africa. As you know and especially us in the asset management industry know South Africa does have a very low savings rate and in our view savings is what funds productive investment in economy, rather than simple consumption. So we think the next ten years may look slightly different from the last ten.

HILTON TARRANT: Duncan, just to close off with, the size of these two funds, the two big ones, the Balanced Fund at R70bn, the Equity Fund at R33bn as at the end of June. The sizes surely present some unique challenges when it comes to taking positions, start accumulating on behalf of your clients or exiting positions within shares?

DUNCAN ARTUS: So I think the interesting thing when you speak to asset managers about size is, of course, not to look at the unit trust business because we manage our unit trust on exactly the same way we manage our pension fund business. It actually we dont look at the equity fund, we look at all the equities we manage in South Africa and we can express that as a percentage either of the JSE or as the free float of the JSE, etc. In actual fact were actually smaller than we were in 2004 on that basis, so if we had to take the equities Allan Gray manages and we express them as a percentage of the free float in the market were actually smaller, believe it or not. I think one the reasons why that happened is people forget the stock market has gone up seven times. So in absolute billions of terms the universe has grown substantially but sure it is the case so if we went back to 2002 we probably could have had bigger positions in small caps but what we would have looked at is all our analysts are constantly out there looking for the next Aspen or the next EOH, small companies that can grow to be quite significant winners in the portfolio. Instead of having 2%, lets say, in Shoprite you could actually have four 0.5% positions in four attractive small cap shares. The interesting thing about accumulating and selling is generally weve bought too early and sold too late, so there is a strange argument where you could say size may help you sometimes, where you buy in slower and you sell late when the shares have accelerated. But its something we think about and I think most importantly for our clients is roughly well over half our assets are on performance fees, so our business could actually be less profitable at much higher assets under management but at lower performance. So everything in the way our firm is structured is meant to be in the interest of our clients so that the performance of our current clients matters far more than us gaining new assets, which I think is very important. So even if people dont believe what we say theres a financial incentive for the firm to make sure that we concentrate more on the performance of our current clients rather than simply trying to grow assets.

HILTON TARRANT: Duncan Artus is portfolio manager at Allan Gray.