Dry bulk shipping stocks are down but expect prices to rise Market Realist

Post on: 14 Апрель, 2015 No Comment

Why dry bulk shipping shares will rise after a recent fall (Part 1 of 6)

Dry bulk shipping stocks are down, but expect prices to rise

Dry bulk shipping stocks fall

Last week, from September 9 to 13, dry bulk shipping stocks had underperformed the U.S. market. Large investment banks noted several cautions, and warned that investors should handle the recent rise in share prices of dry bulk companies carefully. Granted, with several companies rising 20% and more since July, the downside risk increases (see the chart below).

Stock movements can be volatile

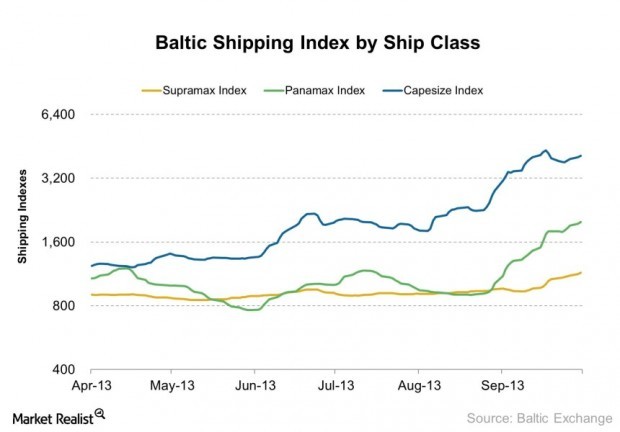

As we explained in last week’s series, we’re going to see some profit sooner or later. Plus, while Capesize rates have risen substantially lately, Panamax and Supramax rates, which make up the largest category of companies’ fleets portfolio, haven’t. The recent fall might scare some people, but investing in stocks can be volatile. Consider Facebook (which went from $35 to

$20, back to $30, down to $24, then surged to a recent price of

$45), Chipotle (which fell 45% last year), and Yelp (which fell

45% before rallying 167%).

Capesize rates will likely fall in early 2014

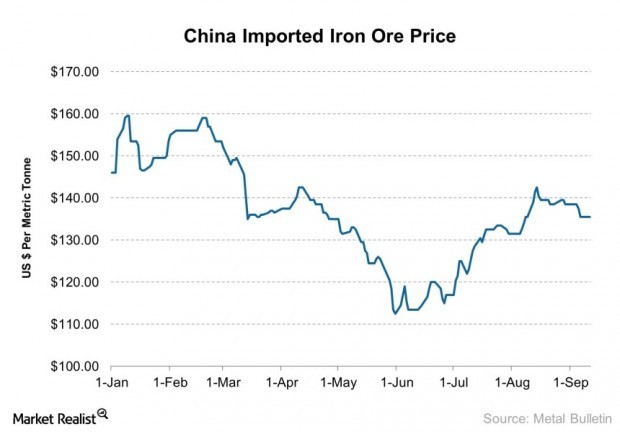

With the first quarter of 2014 looming—typically a weak period for iron ore shipments from countries like Australia and Brazil due to weather problems—shipping rates will likely fall, and the recent rise in rates could be approaching its medium-term peak. With the Baltic Dry Capesize Index hitting close to its late 2011 highs of around 3,500, I don’t know if we’re going to see much higher rates in the short term.

Capesize rates could stay high for a while

At the end of last week, some macro data were published that suggested the shipping industry could see higher Capesize rates for another few weeks. If not, then rates will likely stay at their current peak for a moment and then fall. Will this hurt dry bulk shipping companies’ share prices? There isn’t a straightforward answer. But the recent rally in dry bulk shares more reflects the fact that the market wasn’t expecting such a large jump in Capesize shipping rates. This should also remind investors that even with a slight change in supply and demand dynamics, rates can rise or fall substantially.

Share prices may not fall even if rates fall

Plus, despite the typical fall in the Baltic Dry Index over the past few years, dry bulk shippers didn’t follow. In fact, they’ve risen along with the U.S. market for the past three years. With demand growth expected to outpace supply growth in 2014, we could see the same pattern occur again this year.

The market could have gotten ahead of itself. And this is one reason why short-term trade can be a bit tricky, with many factors (sometimes noises) pulling investors one way and then the other. But as long as supply and demand dynamics tighten, you can expect the share prices of dry bulk companies to rise over the long term. So let’s see whether fundamentals have really changed.