Dow Jones S P 500 Bounce Despite Soft Economic Data

Post on: 4 Июль, 2015 No Comment

Recent Posts:

Dow Jones, S&P 500 Bounce Despite Soft Economic Data

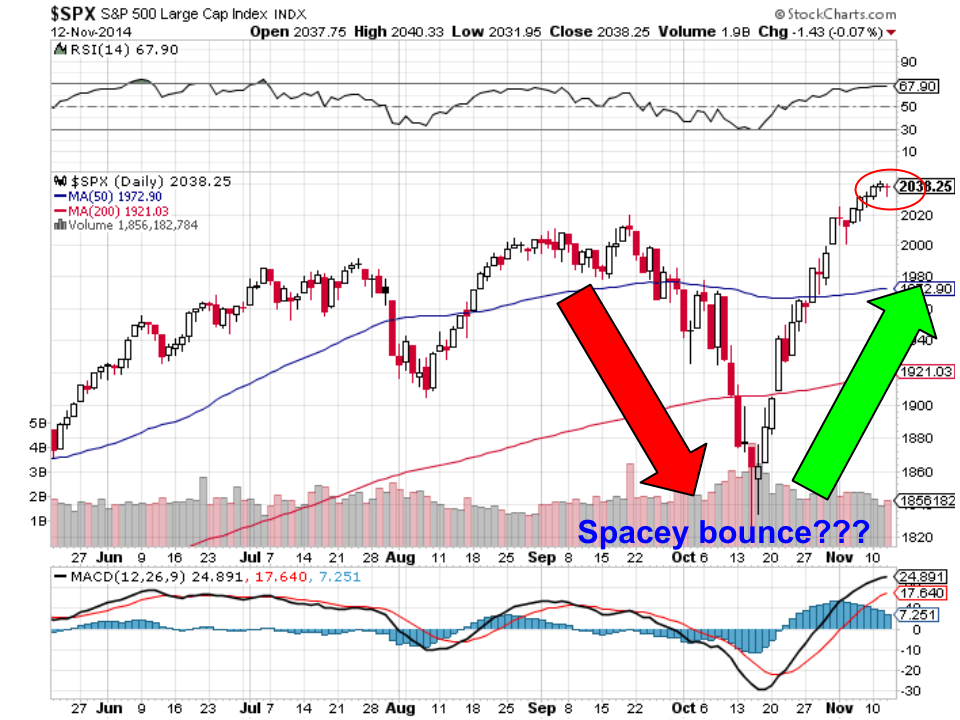

Stocks rebounded strongly on Thursday with the major averages reclaiming their 50-day moving averages thanks to a weak retail sales report and fast declining estimates of Q1 GDP growth.

What, weaker economic data is bullish? In the bizarre world we live in, it is because it increases the changes the Federal Reserve holds off on interest rate hikes this year.

In the end, the Dow Jones Industrial Average gained 1.5%, the S&P 500 gained 1.3%, the Nasdaq gained 0.9% and the Russell 2000 gained 1.7%.

Further evidence that soft economic data and the Fed storyline was the catalyst was provided by a drop in Treasury yields and a weakening of the U.S. dollar.

Retail sales fell for the third consecutive month in February, falling 0.6% on a month-over-month basis vs. the 0.3% increase analysts were expecting. This builds on the 0.8% decline in January and the 0.9% decline in December. And it marks the first time since 2012 that headline retail sales have fallen for three months in a row.

Sales in building materials and gardening were hit hard, suffering the largest monthly drop since April 2012 as lumber futures continue to collapse. That didnt seem to slow Home Depot Inc (NYSE:HD ), which rose 2.7%.

Even removing the impact of lower gas prices and a surprisingly large drop in auto sales, core retail sales still fell at a 0.2% monthly rate. Severe winter weather obviously played a role as consumer confidence remains high, real incomes are growing and the labor market is strong. Its an open question whether the Fed will look through these transitory factors at their policy meeting March 17 and 18.

As a consequence, the Federal Reserve Bank of Atlantas GDPNow real-time estimate has collapsed to just 0.6% for Q1 well off of the 3.9% average of the last three quarters. But this is better than the 2.1% decline suffered in Q1 last year due to the polar vortex.

It wasnt all sunshine and lollipops, however, as breadth remains underwhelming with the number of new lows exceeding the number of new highs on the NYSE as shown above. That suggests the current bout of weakness driven in large part by the consequences of the epic 26% rise in the U.S. dollar since May is far from over.

Intel Corporation (NASDAQ:INTC ) was slammed 4.7% lower after cutting Q1 revenue guidance by about 7% citing weaker-than-expected demand for desktop PCs and lower inventory levels across the PC supply chain. As a result, the March $33 INTC puts I recommended to Edge Pro subscribers back on March 6 are now up more than 361%.

Anthony Mirhaydari is founder of the Edge and Edge Pro investment advisory newsletters.