Dow Jones Industrial Average ETF

Post on: 16 Март, 2015 No Comment

Asset Class ETFs News:

One of the ETF veterans, having debuted back in 1998 and likely having household name status even among non-ETF users is SPDR Dow Jones Industrial Average (NYSEArca: DIA), Expense Ratio 0.16%.

The fund tracks the Dow Jones Industrial Average, which is a price weighted index of thirty U.S. based equity names, and we would hesitate to call this the blue chip index even though many label it as such, thinking that anyone whom suffered through the 2008-2009 crisis would likely agree.

In any case, the DJIA remains a barometer for market observers and is currently top end weighted to IBM (11.21%), CVX (6.45%), MMM (5.60%), CAT (5.42%), and MCD (5.22%).

Interestingly, and something that we have mentioned on several occasions last year, the largest name by market capitalization in the S&P 500 Index, AAPL, is not a Dow component despite periodic rumors that surface about a possible inclusion. The stocks are chosen by editors from The Wall Street Journal. and with AAPL trading in the $400s, many would see a potential add of the stock to the index as a complication (since the index itself is price weighted and not market cap weighted like most indices).

From a sector breakdown, Industrials represent 21.25% of the overall index followed by Technology (15.97%), Consumer Discretionary 11.89%), Energy (11.49%) and Health Care (11.11%).

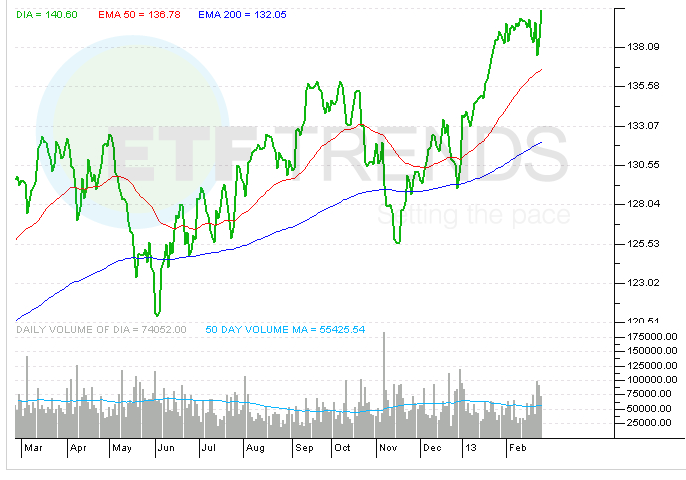

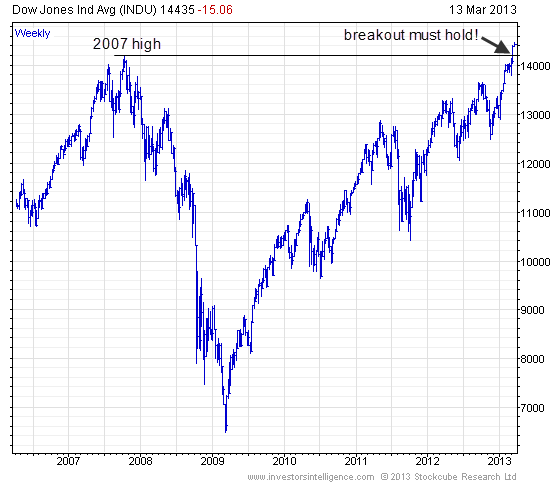

Why are we talking about this fund today? The ETF has seen decent sized redemption activity in recent sessions, ranking among all ETFs in terms of leading in outflows, with nearly $600 million leaving the fund (asset base is approximately $10.7 billion currently), despite trading near its highest levels since October of 2007.

DIA is the fourth largest ETF in the U.S. Large Cap Value Equity space, behind IWD (iShares Russell 1000 Value, Expense Ratio 0.22%), VIG (Vanguard Dividend Appreciation, Expense Ratio 0.13%), and DVY (iShares DJ Select Dividend, Expense Ratio 0.40%), and as one might expect there is overlap present in terms of Dow components appearing in these funds as well.

Yielding 2.38%, DIA also likely continues to hold its popularity in the overall ETF space as portfolio managers, as has been well documented in the media, have been generally very thirsty for yield in their equity allocations and large cap value

names typically fit this bill.

SPDR Dow Jones Industrial Average

For more information on Street One ETF research and ETF trade execution/liquidity services, contact Paul Weisbruch at pweisbruch@streetonefinancial.com.