Dow Jones Industrial Average

Post on: 16 Март, 2015 No Comment

Treece Blog: The Fed Cannot Prop Stocks Up Forever

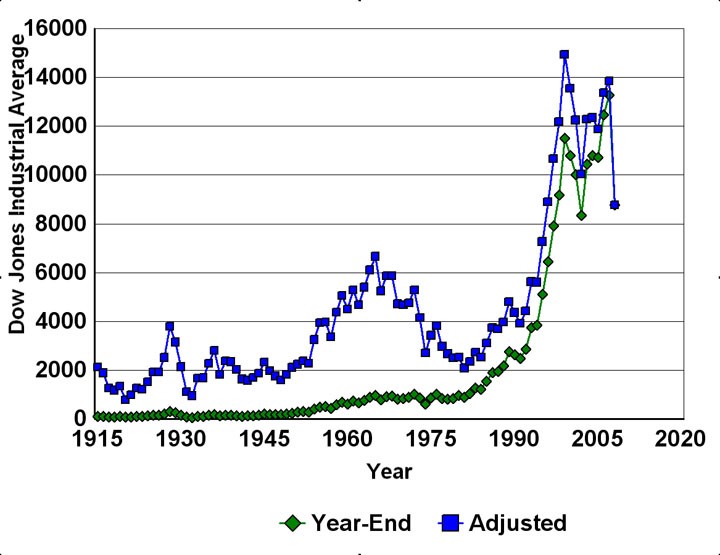

For readers who will recall our piece, “Dow Jones Value All Too Familiar,” we asserted that the Dow Jones Industrial Average (at the time trading just over 16,500) had 3 possible courses given its recent trading history. We asserted that the Dow would hit its short term bottom and rebound to its peak within 4-8 weeks, that market participants would delever driving the Dow to even lower than anticipated levels, or finally that the Dow would establish a trading range and move sideways for the foreseeable future. It seems as though our first scenario is exactly how the market has played out.

Following the Dow’s decline, which sent values below 16,000 on October 15 th and 16 th intraday, the index has rebounded over 7% to just over 17,000 at the time of writing this piece, 1.5% off its all-time high. Our feelings regarding current blue-chip equity valuations (especially in the technology sector) come as no surprise; we believe the market is drastically over-valued. The issue is that global financial markets are unable to seek their own price level.

Equities have been the place to be given the strengthening US Dollar and the low interest rate bond market. Low interest rates have destroyed the earning potential of seniors, forcing them into the stock market, only adding to the whacky valuations that we are witnessing. While we do not fancy ourselves as “End the Fed” types, we have a big problem with any entity, be it governmental or private sector, that attempts to shape the markets, and that is exactly what the Fed is doing.

The Plunge Protection Team, officially known as the Working Group on Financial Markets, is a team that was created in March of 1988 by President Reagan as a response to Black Monday in October of 1987. The mandate of the Plunge Protection Team is to …”enhance the integrity, orderliness and competitiveness of our Nation’s financial markets and maintain investor confidence…” as written in Executive Order 12631. It has been speculated for years that the Plunge Protection Team has provided government funds to purchase stocks and futures specifically to prop up the value of the stock market. While these actions are forbidden, the actions taken by the PTT remain very vague, and it would be painfully unsurprising if they were buying stocks and futures in the open market to stabilize prices.

Their mandate aside, the PTT says one thing in particular about our financial markets, and that is that the Federal Reserve and US Government will do all in their power to prevent another 2008 or 1987 from occurring, even if in the process of protecting the markets they are creating bubbles elsewhere. At some point the law of “Unintended Consequences” rears its ugly head, and if markets could be controlled there would be no such thing as a correction.

Our belief remains steadfast that equities are due for a correction, and when interest rates begin to rise that the bond market will be in for quite a shock. Unfortunately, timing those events is difficult with such forces working against the broader market. The Federal Reserve and US Government need to take a step back and let the market rebalance themselves, if for no other reason than to avoid a more painful correction down the road.

Ben Treece is a 2009 graduate from the University of Miami (Fla.), BBA International Finance and Marketing. He is a partner with Treece Investment Advisory Corp ( www.TreeceInvestments.com ) and licensed with FINRA through Treece Financial Services Corp. The above information is the opinion of Ben Treece and should not be construed as investment advice or used without outside verification.

This entry was posted on Thursday, October 30th, 2014 at 3:08 pm and is filed under Toledo Business Link. Treece Blog .

You can follow any responses to this entry through the RSS 2.0 feed.