Dow Dividend Dogs ETF Launches

Post on: 16 Апрель, 2015 No Comment

Feature Stories News:

Dividend hunters seeking exposure to high quality firms may take a look at the new ALPS dividend exchange traded fund that follows the Dogs of the Dow theory.

Dividend ETFs have been very popular over the past year and this is the latest twist on the theme.

According to a press release. the ALPS Sector Dividend Dogs ETF (NYSEArca: SDOG) will follow the Dogs of the Dow Theory on a sector-by-sector basis and try to reflect the performance of the S-Network Sector Dividend Dogs Index, which is comprised of 50 stocks equally weighted from the S&P 500. SDOG has an expense ratio of 0.40%

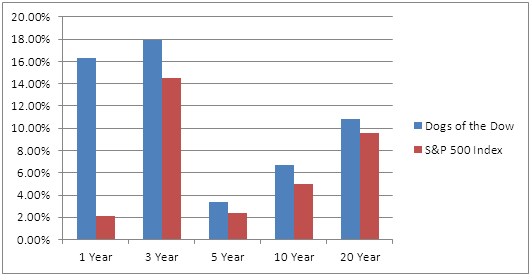

The Dogs of the Dow strategy is based on buying the 10 Dow Jones Industrial Average stocks with the highest dividends at the start of every year.

Since SDOG selects components out of the S&P 500, the chance of troubled and financially distressed companies included in the funds portfolio is greatly diminished. The ETF will equally weight all 10 sectors across the market, include five of the highest yielding stocks in each sector and equally weight each stock them.

By picking the highest yielding stocks, the fund aims to provide potential price appreciation as market forces bring yields back to in line with the performance of the overall market.

Top holdings include Cablevision (NYSE: CVC) 2.2%, RR Donnelley (NasdaqGS: RRD) 2.2%, Frontier Communications (NasdaqGS: FTR) 2.2%, Reynolds American (NYSE: RAI) 2.1% and Lorillard (NYSE: LO) 2.1%.

Sector allocations include telecom services, 10.3%, financials 10.1%, health care 10.0%, industrials 10.0%, consumer staples 10.0%, energy 10.0%, consumer discretionary 9.9%, info tech 9.9%, materials 9.9% and utilities 9.9%.

We Believe SDOG offers investors a product with attractive differentiating factors from other large-cap dividend ETFS including higher yield and sector diversification, Tom Carter, Exeuctive Vice President of ALPS Holdings, said in the press release.

Dividends will be paid on a quarterly basis. [Appraising the Largest Dividend ETF ]

For more information on new product launches, visit our new ETFs category .

Max Chen contributed to this article.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.