Double short the Dow Jones Industrial Average

Post on: 8 Август, 2015 No Comment

ThomasH. Kee Jr.

Thomas’s Latest Posts

At Stock Traders Daily we trade markets and market-based exchange-traded funds instead of individual stocks because, quite frankly, trading markets is much easier than trading individual stocks.

Not only should you understand where the market is likely to go before you make a decision to trade an individual stock, but in addition to that there is a series of additional variables that must be considered when evaluating individual stocks for trading. Some of those include an understanding of company fundamentals, the actions of institutional shareholders, news events that might influence the share price, the competition, product cycles, and the execution of the business plan, just to name a few. Then of course, you must evaluate the technical trends of the stock itself to determine where to make buy or sell decisions.

Listen, this practice has been something that individual investors embrace, they love trading individual stocks because they can rationalize their buy and sell decisions with a discussion of products, management, or expected announcements, and that serves them well at the dinner table, but when it comes to trading the most efficient way of doing it is to start by eliminating all of the excess variables.

When we trade individual stocks we have a ton of added variables, but after all those are considered we still should evaluate market direction as well, so if we are doing our jobs properly when we trade individual stocks we also should have an idea of where the market will go, and that opens the door for eliminating a long list of unnecessary variables.

When our focus shifts from individual stocks to stock markets and our trading instruments change from individual stocks to market-based ETFs, we essentially eliminate all of the variables except the evaluation of the market itself.

In every respect, traders should streamline their operations because the less noise there is the more efficient they become and the best way to do that is to trade markets and market-based ETFs instead of individual stocks.

Now, I completely understand why individual investors like to trade individual stocks so much. It’s fun to talk about Apple, Facebook, or Tesla, and sometimes it is hard to tell a friend why you bought or sold the market, so by trading markets and market-based ETFs the conversations you might have about investing certainly become more boring, but that should also be a telling sign that everything is more streamlined for you as well.

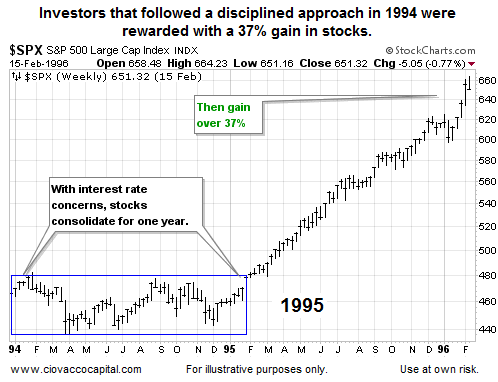

In the year ahead, being nimble and streamlined is going to be very important because the FOMC is no longer printing money and supporting the demand for asset prices like it has been in years past. That means that the year ahead could look much different than the years we have been experiencing recently and if that’s true those traders who streamline their operations are going to do best.

Now, it is not necessarily true that the market is going to fall on its face, and although I have my opinions I am not trying to suggest to any of you that this will happen in this discussion (talk to me privately). The approach I am suggesting is one that reacts to the stock market itself. So if the market wants to continue to increase trading strategies that react to the market, these strategies will be positioned for that increase. Because we are also able to use ETFs to short the market, if the trading signals that surface from our observations of the market suggest decline, our strategies can be positioned to participate on the downside as well.

I am not suggesting that we become one sided, but instead that we become or stay nimble and pay close attention to the market.

Whenever I have this discussion with individual investors the next logical question is, how do I do that, so here is an example of a strategy we use at Stock Traders Daily.

The strategy is called the strategic plan strategy, it is up about 30% year-to-date. Its average return per trade is about 0.92%, and although this strategy is a risk controlled strategy that also shorts the market from time to time using ETFs, it is also keeping pace with the market since its inception, which was January of 2009. These details are important because they proved to you that this approach can work even if the market increases, but the beauty of a strategy like this is that they can also work if the market declines.

This strategy trades the Dow Jones Industrial Average DJIA, +1.47% using the ETFs associated with the Dow Jones Industrials. Specifically, it uses the double long ETF DDM, +2.97% and the double short ETF DXD, -2.83% to take advantage of market cycles. For example, when longer-term support levels are tested in the Dow, buy signals would surface suggesting that we purchase DDM.

However, when short signal surface, based on tests of resistance for example, the short signals would tell us to buy DXD instead. Notice when we short we buy a short ETF and that is important for IRAs.

This example serves as evidence that a trading strategy that’s streamlined can work no matter what happens to the market and although it clearly takes more work than a buy-and-hold strategy, the environment we are likely to see in the coming year will probably favor nimble strategies like this much more than it will buy and hold strategies because the FOMC isn’t there to support asset prices anymore.

For the record, longer-term resistance was tested in the DJIA on Monday, Dec. 29, 2014 and DXD triggered according to rule.

DISCLOSURE: DXD triggered according to rule, but there are also integrated risk controls with this position.