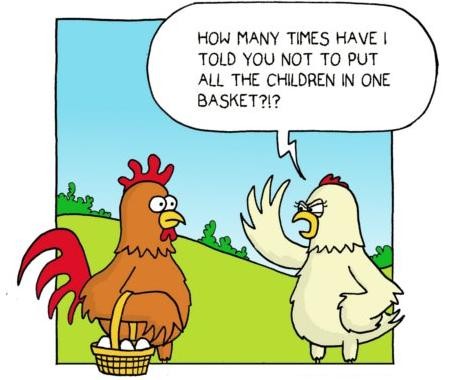

Don’t put all your eggs in one basket

Post on: 17 Июль, 2015 No Comment

’Nimi Akinkugbe

We have all heard the phrase, “Don’t put all your eggs in one basket!” This old maxim describes the concept of asset allocation perfectly. If you put all your savings in one type of investment and that investment fails, you could jeopardise your savings.

Asset allocation refers to how you distribute your money among different asset classes such as cash, bonds, stocks and real estate. This strategy involves reviewing your goals and circumstances, and determining the most appropriate asset mix for you within various classes.

The main purpose of this strategy is to reduce investment risk. History has shown that in general, various types of investments perform differently. While money-market returns tend to be low, your initial investment is relatively safe. Bonds may not be as lucrative, but they offer more stability than stocks as well as a middle ground between cash and stocks in terms of risk and returns. On the other hand, although stocks offer the highest returns among these three classes, they also carry the highest risk. It is thus advisable for an investor’s portfolio to include various categories.

How much should you put where? As you pass through your life cycle, your financial goals will change. Each investor’s approach to asset allocation differs and depends largely upon his or her age, life stage, financial goals and risk tolerance. Generally, the younger you are, the more risk you can afford to take. A twenty-two year old person who is just starting out in the workforce will have a completely different view of risk than a fifty-five-year-old approaching retirement. As you get closer to retirement, it becomes more important to preserve your accumulated wealth.

While stocks and real estate offer attractive returns over the long term, they can suffer significant declines. This makes them somewhat unsuitable for investing money that may be needed within, say, the next two to three years. As one approaches retirement, it is advisable to protect a portfolio from volatility since a large decline in a portfolio could significantly affect one’s planned retirement lifestyle or standard of living.

Here are some useful general rules about asset allocation: any money you need next year should be in cash; money you need in two to three years should be in fixed-income investments; and money you can afford to put away for more than four to five years can be invested in the stock market. This ensures that the cash you may need today is readily available; the money you need in a few years time will be safe from stock market volatility; and money you can afford to put away for several years can be invested in the stock market to take advantage of long term capital appreciation.

A very simplistic old rule-of-thumb is to subtract your age from 100 and invest at least that percentage in stocks. For example, an eighty-year-old might be advised to hold only a small portion of, say, twenty per cent in stocks while leaving the balance in cash. A forty-five-year-old, on the other hand, might have a portfolio that has fifty-five per cent in stocks and the remaining forty-five per cent in bonds and cash. One could argue that this rule of thumb is far too conservative especially as people live longer.

For example, if you are 50-years-old, you could well have over 30 years to invest and should thus have a more balanced mix. This is because if you need to make your money last longer, you will need the extra growth that stocks can provide. With people living longer many advisors recommend that one shouldn’t shy away from stocks altogether even in old age; dividend yielding stocks provide a very important form of retirement income.

Do remember that this is only a rough rule of thumb to illustrate this concept; your asset allocation should be built to suit your own unique circumstance.

In many ways, asset allocation is synonymous with diversification. In addition to diversifying across asset classes or even geographically, you should also diversify within each asset class. There are different types of investments within an asset class. For example, with stocks, instead of investing all your money in only one or two companies, you may choose to invest in different sectors including banking, manufacturing or insurance. By diversifying your investment risk in this way, any losses caused by the downturn in one sector may be offset by a rise in another. However, unless there is a general reversal of the entire market, it is unlikely that all sectors will perform in exactly the same way and decline at the same time. Asset managers generally seek to ensure that no single asset represents more than say five to ten per cent of your total portfolio.

Diversify according to your goals. Based on your various goals, you may require different levels of liquidity. For short-term goals, such as the funding of a family holiday or wedding this year or next, you will require cash to make payments. For the longer-term goals, such as the funding of your children’s education or your retirement, investments in the stock market or real estate will offer better prospects for long-term growth.

Asset allocation is a critical part of the process of building a solid investment portfolio. Indeed, various studies have suggested that asset allocation is a major determinant of long-term investment performance.

Bear in mind that asset allocation does not guarantee profit nor does it protect from losses in a declining market. It is thus important to review your asset allocation strategy periodically and adjust your portfolio as your circumstances and objectives change. This will not only ensure that the portfolio remains reflective of your long-term needs and outlook, but also address your short- and medium-term goals.

Most of us do not have the time or expertise to manage our finances by ourselves. It is thus useful to seek the professional services of a financial advisor who will carefully look at your unique circumstances and design an appropriate portfolio mix for you.