Don’t just do something sit there; Fund managers trade too muc investors can learn not to

Post on: 16 Март, 2015 No Comment

Don’t just do something, sit there; Fund managers trade too much. Retail investors can learn not to

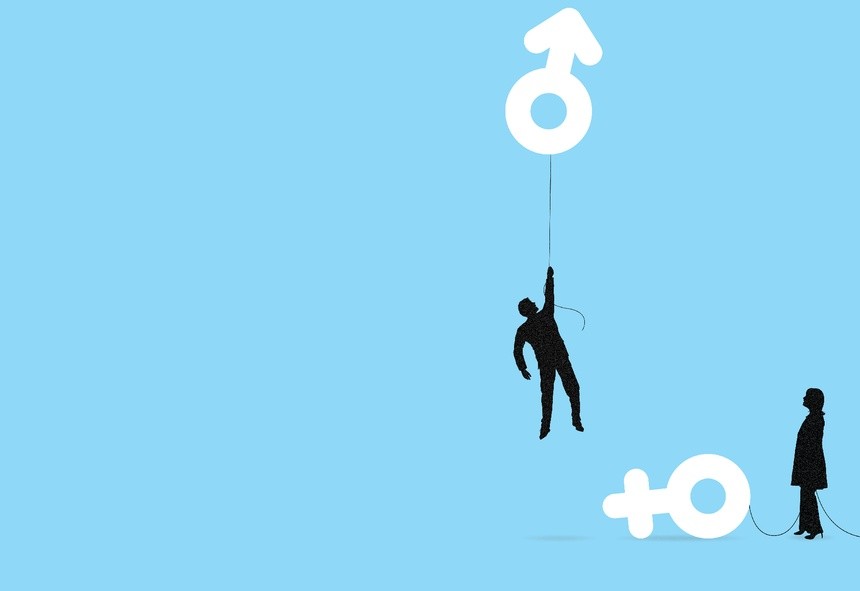

CALL it hyperactivity, call it the temptation to fiddle. Chief executives have a tendency to make acquisitions just to show they are doing something. Similarly, fund managers, sitting at their desks all day, have the urge to trade. Otherwise why go into the office at all?

But these trades inevitably incur costs, and not just in the form of fees disclosed to mutual-fund investors as part of a fund’s total expense ratio. When a large fund sells its stake in a small company, for example, the share price may fall significantly as supply overwhelms demand. A recent paper* in the Financial Analysts Journal (FAJ) found these hidden costs were, on average, higher than the funds’ declared expenses and had a significant negative impact on returns. The academics looked at the record of 1,758 American equity mutual funds between 1995 and 2006. They estimated trading costs by looking at changes in portfolio holdings (which are revealed every quarter), checking the bid-ask spreads for the stocks concerned and making an allowance for the price impact of trades. Relying on portfolio-turnover statistics is not sufficient. Smaller stocks are less liquid than shares in multinationals, and the costs of trading in the small-cap sector are much greater. The paper found that the difference in total expense ratios between small-cap and large-cap funds was just a third of a percentage point (1.39% compared with 1.07%). But the difference in aggregate trading costs, once the price impact was factored in, was much larger, at over two percentage points a year (3.17% versus 0.84%). Higher costs would not matter if the trading decisions of the fund managers were sufficiently astute. But that is not the case. When the academics compared the returns of the funds with their estimated trading costs, the funds with the highest costs had the lowest returns. The return gap between the highest- and lowest-cost quintile was 1.78 percentage points a year.

Although excessive trading has been shown to dent returns, fund managers have become more active, not less, over time. In the 1950s average mutual-fund turnover was 15%; by 2011 it was around 100%. By contrast, a different academic study** shows that private investors do seem to learn the trading lesson.

This study looked at the record of around 11.6m Indian investors between 2004 and 2012. It found that the most experienced investors (ie, those who had their accounts for longer) steadily improved their performance. They were more inclined to own “value” stocks, for example, and less inclined to sell winners and hang on to their losers. They were also less likely to trade frequently; indeed, individual investors who suffered heavy losses when trading frequently seemed to adjust their behaviour and trade less often.

So why do professional fund managers persist in their bad habits? One explanation may be that poorly performing fund managers are fired. The incoming managers then reshape the portfolios to their liking, incurring high trading costs. Poor performance could result in high turnover, rather than the other way round.

A second explanation is that most private investors treat share trading as a hobby, whereas for professionals it is a job. The latter may have more faith in their abilities and suffer from the “illusion of control”, a belief that the more active they are, the better they will do.

A third explanation may simply be that professional managers have little reason to care, because the full cost of their trading activities is not revealed. Clients will discover that hyperactivity leads to underperformance only after they have invested, and that is too late.

One way to get around this shortage of information, the FAJ authors suggest, is to work out a figure for “position-adjusted turnover”. Calculate the average size of a fund’s holdings, compare that with the average holding size of funds in its category (ie, large-cap, small-cap, and so on) and then compare that number with the portfolio turnover. Sure enough, funds that have relatively large positions (which move prices more) and that trade frequently tend to underperform. Those who counsel retail investors, from financial advisers to private bankers, should be looking at this number. And regulators should investigate to see how it might be made more widely available.

* “Shedding Light on ‘Invisible’ Costs: Trading Costs and Mutual Fund Performance”, by Roger Edelen, Richard Evans and Gregory Kadlec, Financial Analysts Journal, Volume 69, Number 1

** “Getting Better. Learning to Invest in an Emerging Stock Market”, by John Y Campbell, Tarun Ramadorai and Benjamin Ranish